Mortgage rates continue to rise; once the backlog in construction is cleared, this will likely kill housing No important economic news today (April 22), but an important negative trend in interest rates is continuing. Mortgage rates are now at 12 year highs. The weekly data from Freddy Mac’s weekly survey shows rates increased to 5.11% as of April 21: This is 2.46% above the low of 2.65% that was set at the end of 2020, and the highest rates since April 2010. It is also only 1.69% below the 6.80% rate that killed the housing bubble in 2006.And according to Mortgage News Daily, as of today rates have increased further to 5.38%. Here’s an update of a graph I ran earlier this week, showing the YoY change in mortgage rates, inverted

Topics:

NewDealdemocrat considers the following as important: Featured Stories, mortgage rates, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Mortgage rates continue to rise; once the backlog in construction is cleared, this will likely kill housing

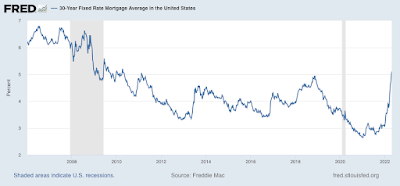

No important economic news today (April 22), but an important negative trend in interest rates is continuing. Mortgage rates are now at 12 year highs.

The weekly data from Freddy Mac’s weekly survey shows rates increased to 5.11% as of April 21:

This is 2.46% above the low of 2.65% that was set at the end of 2020, and the highest rates since April 2010. It is also only 1.69% below the 6.80% rate that killed the housing bubble in 2006.

And according to Mortgage News Daily, as of today rates have increased further to 5.38%.

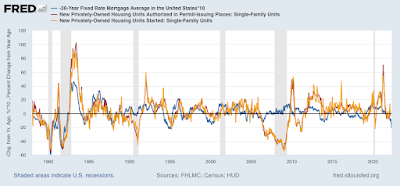

Here’s an update of a graph I ran earlier this week, showing the YoY change in mortgage rates, inverted and *10 for scale, vs. the YoY% change in single family permits (red) and starts (gold):

Unless this situation is reversed quickly, once the backlog in housing starts abates, this is going to absolutely kill the housing market.

Two very important long leading indicators are going to be updated next week: real money supply for March, and corporate profits (via proprietors’ income) for Q1.

Stay tuned.