PPI, without the lagging phantom of Owners Equivalent Rent, declines in August, decelerates YoY – by New Deal democrat What a difference it makes that PPI does not have a concept like “owners equivalent rent!” Overall PPI declined by -0.1%, following a -0.4% reading in July, together the two lowest readings since the pandemic lockdown months: Core PPI increased by 0.5% (blue in the graph below), which while historically high, was the lowest reading in 16 months, excluding last August, in contrast to the continued elevation in core CPI (gold): Notice that core PPI has been decelerating since April. PPI’s primary housing component is residential construction materials. Here are the absolute values in both flavors of that reading:

Topics:

NewDealdemocrat considers the following as important: Featured Stories, housing, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

PPI, without the lagging phantom of Owners Equivalent Rent, declines in August, decelerates YoY

– by New Deal democrat

What a difference it makes that PPI does not have a concept like “owners equivalent rent!”

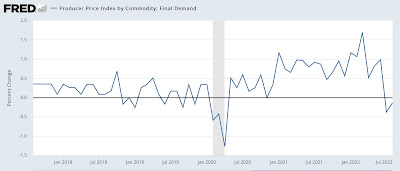

Overall PPI declined by -0.1%, following a -0.4% reading in July, together the two lowest readings since the pandemic lockdown months:

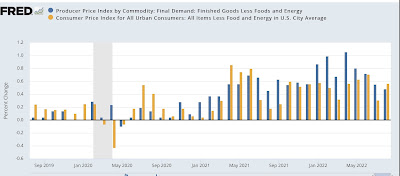

Core PPI increased by 0.5% (blue in the graph below), which while historically high, was the lowest reading in 16 months, excluding last August, in contrast to the continued elevation in core CPI (gold):

Notice that core PPI has been decelerating since April.

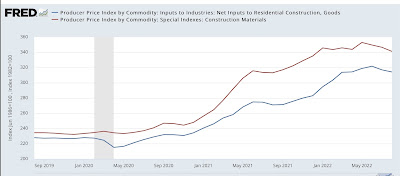

PPI’s primary housing component is residential construction materials. Here are the absolute values in both flavors of that reading:

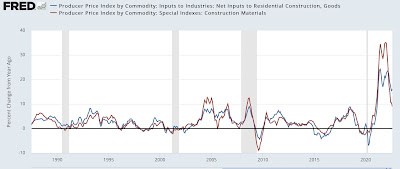

Note that both have declined in the last few months, with construction materials essentially flat all year. Here is what the YoY% changes in each look like:

Both are still very elevated, but at least construction materials are down from the stratosphere to within the range of high readings in the prior 20 years.

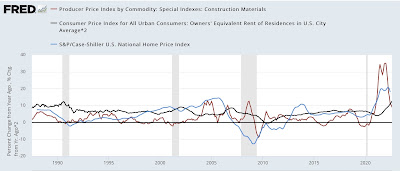

Now let’s compare owners equivalent rent (black) with the Case Shiller housing index (blue) and PPI for residential construction materials (red):

While there is no close historical relationship between the cost of construction materials and the house price index, since the pandemic they have moved in tandem, with both rising sharply and then plateauing almost simultaneously. Since the house price indexes have only been reported through June, we don’t know yet whether they will follow the sharp YoY deceleration already apparent in construction material costs (but I strongly suspect they will).

In other words, there is every reason to believe that both core and overall PPI will continue to slow, even as owners equivalent rent pulls core CPI skyward.

Unfortunately, the lagging phantom of OER will almost certainly cause the Fed to keep stomping on the brakes.