Positive production print points to continued economic expansion in May The usual suspects are out, claiming that a recession has either already started or is imminent. Well, the big reason I call industrial production the King of Coincident Indicators is because empirically is the one whose peaks and troughs coincide most definitively with NBER recession dates. And unless there is a significant downward revision, in May the King of Coincident Indicators proclaimed: no recession yet. Total production rose 0.2%, while manufacturing declined -0.1%. April’s overall number was also revised higher, from 1.1% to 1.4%, while manufacturing remained at +0.8%. The former made yet another new record high: On a YoY basis, total production is up 5.8%,

Topics:

NewDealdemocrat considers the following as important: Economic Expansion May 2022, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Positive production print points to continued economic expansion in May

The usual suspects are out, claiming that a recession has either already started or is imminent. Well, the big reason I call industrial production the King of Coincident Indicators is because empirically is the one whose peaks and troughs coincide most definitively with NBER recession dates. And unless there is a significant downward revision, in May the King of Coincident Indicators proclaimed: no recession yet.

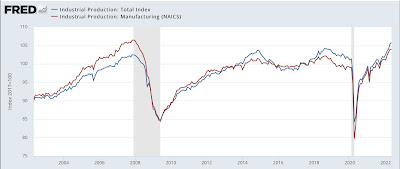

Total production rose 0.2%, while manufacturing declined -0.1%. April’s overall number was also revised higher, from 1.1% to 1.4%, while manufacturing remained at +0.8%. The former made yet another new record high:

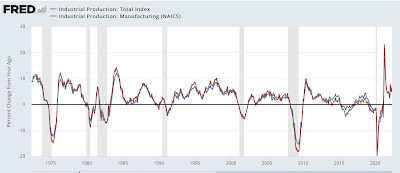

On a YoY basis, total production is up 5.8%, while manufacturing is up 4.9%. Compared with the last 40 years, and particularly the last 20, this remains pretty good growth:

A recession *could* start from these YoY numbers (see 1990 and 2007), but usually, YoY production is decelerating pretty rapidly before a recession actually begins.

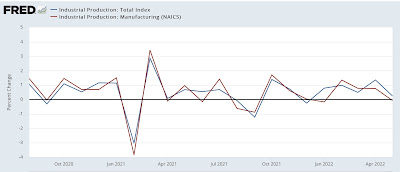

A close-up of the monthly changes since the depth of the pandemic recession shows that May was weak, like many other data for the month, but not indicative of any significant trend change yet:

With an employment gain of nearly 400,000, and (again, unless revised lower next month) a positive print on production, overall the economy continued to move forward in May.