Real aggregate payrolls and recessions – by New Deal democrat One of my favorite indicators for the overall economic health of the American working and middle classes is real aggregate payrolls for non-supervisory workers. This is kind of self-explanatory. Rather than measure hourly wages, this is the *total* amount of wages paid to non-supervisory workers, adjusted for inflation. It tends not to be noisy, i.e., there is a lot of signal compared with noise. And its growth, or lack thereof, is a good short leading indicator for recessions. Since I didn’t update this earlier in the week when inflation was reported, let’s take a look at it now. Here is the long term view for the past 55+ years: During that time period, real aggregate

Topics:

NewDealdemocrat considers the following as important: Hot Topics, non-supervisory workers, real aggregate payroll, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Real aggregate payrolls and recessions

– by New Deal democrat

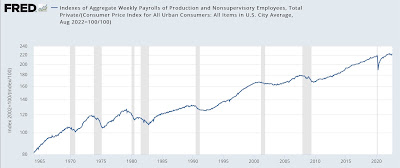

One of my favorite indicators for the overall economic health of the American working and middle classes is real aggregate payrolls for non-supervisory workers. This is kind of self-explanatory. Rather than measure hourly wages, this is the *total* amount of wages paid to non-supervisory workers, adjusted for inflation. It tends not to be noisy, i.e., there is a lot of signal compared with noise. And its growth, or lack thereof, is a good short leading indicator for recessions. Since I didn’t update this earlier in the week when inflation was reported, let’s take a look at it now.

Here is the long term view for the past 55+ years:

During that time period, real aggregate payrolls for non-supervisory workers tends to sharply slow down, and even roll over, 6-12 months before the onset of recessions, with the possible exception of the 2020 pandemic.

Here is the close-up view of the last 18 months:

The sharp slowdown began in September 2021, 12 months ago.

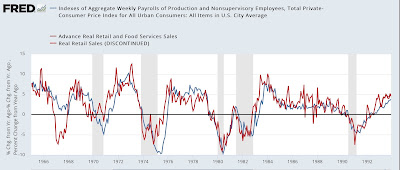

Looking at the YoY% change in the data gives us further insight:

With the sole exception of one month in 1992, and the 2002-03 “jobless recovery,” real aggregate payrolls have been declining, and been negative YoY *only* during recessions, and *always* during each recession, although they may not turn negative until several months into the recession. In short, they are an excellent coincident marker for recessions.

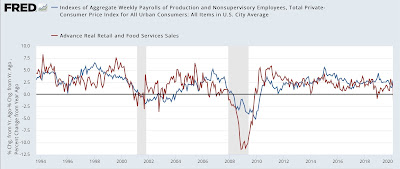

Here is the close-up view since May 2021:

Real aggregate payrolls have shown decelerating growth at the rate of -0.3%/month during that time. *If* that rate were to continue, they would be negative by the beginning of next year, almost certainly signifying recession.

Finally, let’s compare real aggregate payrolls with another of my favorite markers of consumer health, real retail sales. Below I’ve split the series into 2 periods so that the trends are easier to see:

Real retail sales have either shortly led or else been coincident with real aggregate payrolls for over the past half century, but are somewhat more volatile, with more false positive recession signals (see, e.g., 1966).

Here is the comparison for the past 15 months:

Real retail sales turned slightly negative YoY this spring, before recovering slightly.

In summary, although the decline in gas prices in the past 3 months has been very helpful, the consumer remains in a really dicey situation. Any further deterioration is likely to signal either that a recession is nearly imminent, or that one has already begun.