Positive real retail sales in August, but YoY flatness continues – by New Deal democrat Retail sales, probably my favorite monthly economic datapoint, increased 0.3% in August. Since consumer prices rose 0.1%, real retail sales rose 0.2%: That’s certainly good news. Now here’s the bad news: July’s retail sales were revised downward by -0.4%, so that real retail sales, reported last month as +0.1%, are now shown down by a little less than -0.4%. Thus as shown above real retail sales are still -1.1% below their April peak. Ex-autos, retail sales were down -0.3%, and unchanged ex-autos and ex-gas, reversing July’s initially reported gains – which in the case of autos were revised down sharply to -0.4%. As I note almost every

Topics:

NewDealdemocrat considers the following as important: August 2022 Retail Sales, Hot Topics, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Positive real retail sales in August, but YoY flatness continues

– by New Deal democrat

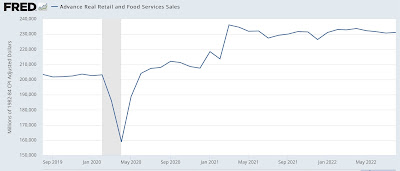

Retail sales, probably my favorite monthly economic datapoint, increased 0.3% in August. Since consumer prices rose 0.1%, real retail sales rose 0.2%:

That’s certainly good news. Now here’s the bad news: July’s retail sales were revised downward by -0.4%, so that real retail sales, reported last month as +0.1%, are now shown down by a little less than -0.4%.

Thus as shown above real retail sales are still -1.1% below their April peak.

Ex-autos, retail sales were down -0.3%, and unchanged ex-autos and ex-gas, reversing July’s initially reported gains – which in the case of autos were revised down sharply to -0.4%.

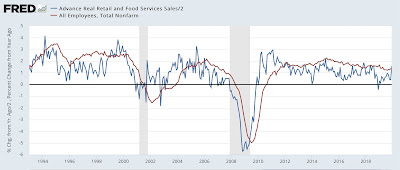

As I note almost every month, real retail sales (/2) are a good short leading indicator for employment. Here’s the long term view from 1993-2019:

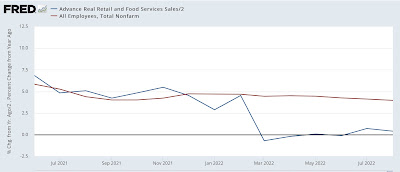

While real retail sales were down YoY for several months, this month they are up 0.8% YoY, the second positive yearly comparison in a row. Here is the updated above comparison with payrolls since June 2021:

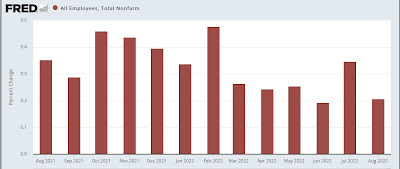

Retail sales continue to forecast a deceleration in monthly payroll gains. Here’s the monthly % change in payrolls for the past year:

Last autumn’s Booming payroll gains are a thing of the past. Payrolls gains averaging 0.2% (about 300,000) or less are what we should expect for the rest of this year.