As we rounded out the month of March the USDA has been busy assessing the planted acres around the United States, reported the 31st of March. Much to my prior post, there are not really any surprises as the data has indicated that the planting is mirroring last year…with a few caveats, most namely the switch of 4% moving to soy from corn. Let’s take a look at the estimates from the FBN group and their phone survey they conducted a week or so ago to get a pulse on the planted acres so far and extrapolate on what we can see going into harvest. This is about what I was expecting from a surveyed population of farmers. One thing that does strike my interest is the uptick in soybeans. Given the 0 to ,200 per ton of urea, and other nitrogen

Topics:

Michael Smith considers the following as important: agriculture, commodities, Featured Stories, inflation, Plant2022, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

As we rounded out the month of March the USDA has been busy assessing the planted acres around the United States, reported the 31st of March. Much to my prior post, there are not really any surprises as the data has indicated that the planting is mirroring last year…with a few caveats, most namely the switch of 4% moving to soy from corn.

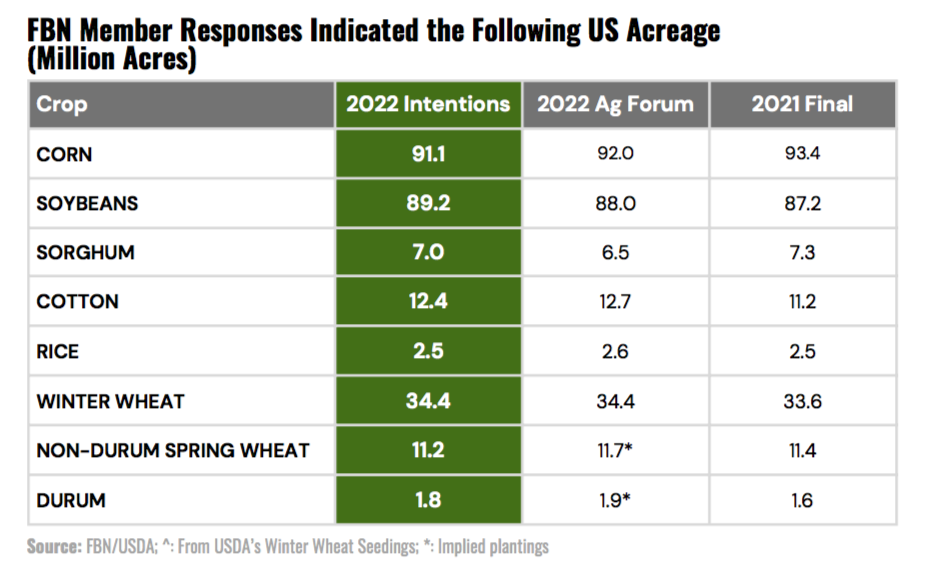

Let’s take a look at the estimates from the FBN group and their phone survey they conducted a week or so ago to get a pulse on the planted acres so far and extrapolate on what we can see going into harvest.

This is about what I was expecting from a surveyed population of farmers. One thing that does strike my interest is the uptick in soybeans. Given the $900 to $1,200 per ton of urea, and other nitrogen sources, which is still a 3x to 5x cost higher than last year. The switch from corn to soy is an interesting one. I don’t think that this is anyway indicative of Joe Machin announcing his indication to restart talks on the Build Back Better legislation. Seeds and inputs were purchased months ago. This could just be a natural swing in specific ag communities going one direction over another based on price trends. The per bushel price for soy is around $16 but could pop, yet both corn and soy are up 22% so far.

All the rest from the estimates are about on par. Wheat, cotton, and the others are more or less same as it ever was and holding true to the survey from the Ag Forum.

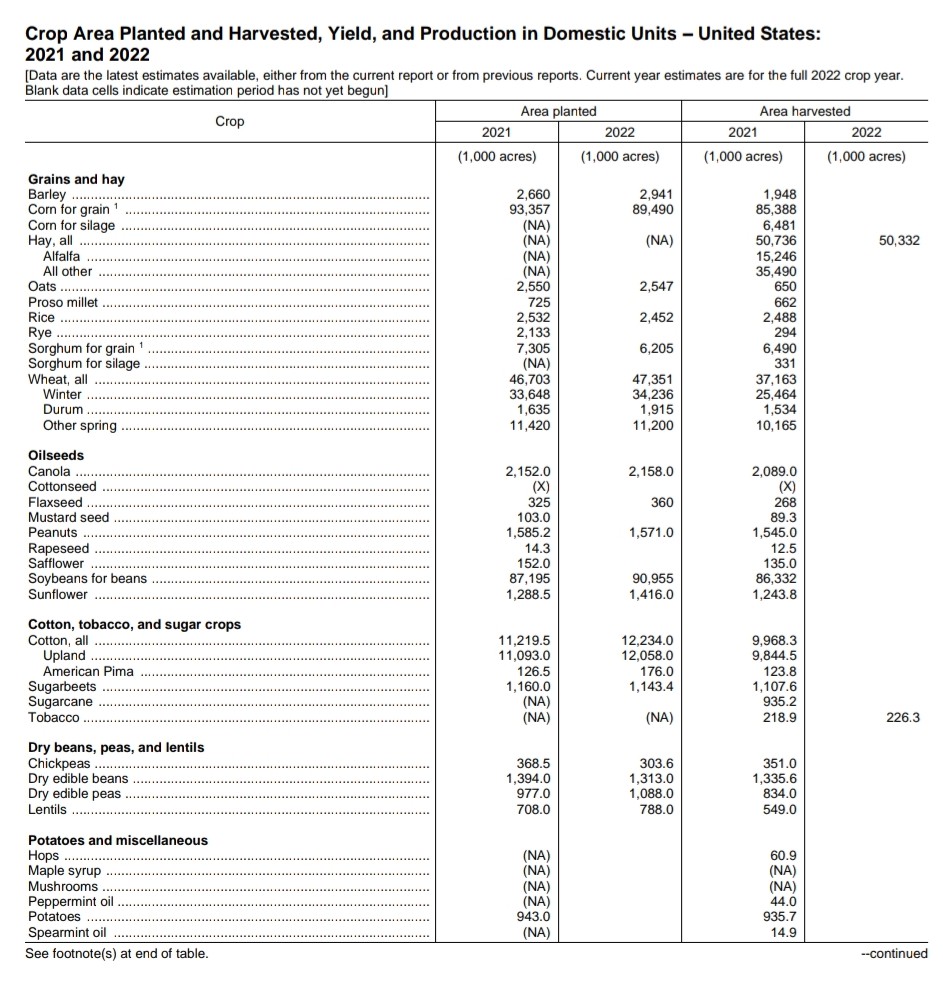

Now let’s review the USDA data just released:

Year over year we are flat from an intentions perspective. The past year 2021 was a record amount of planted acres, and we look to do it again due to high commodity prices. This is actually good news, we need the stability in the markets to tamp down further inflation worries. Current price trends are speculative given the Ukrainian conflict is still ongoing. I currently am of the thought that this will settle as yields come off, and we also have fewer cattle to feed out. More on that from the cattle report.

At 317 million acres planted, we have substantial real estate committed to production again this year. Or as one farmer I talked to recently said, “with prices this high, I’ll plant the ditch”. For context, about 425 million acres is total farmland in the US, with three quarters going to direct croppage and the last quarter to livestock and dairy. Wheat is also trending higher due to expectation of Ukraine’s loss of production. This may or may not be a factor given the resilience of the Ukrainian people. Current logistical issues surrounding Black Sea exports are spooking the wheat market in Chicago.

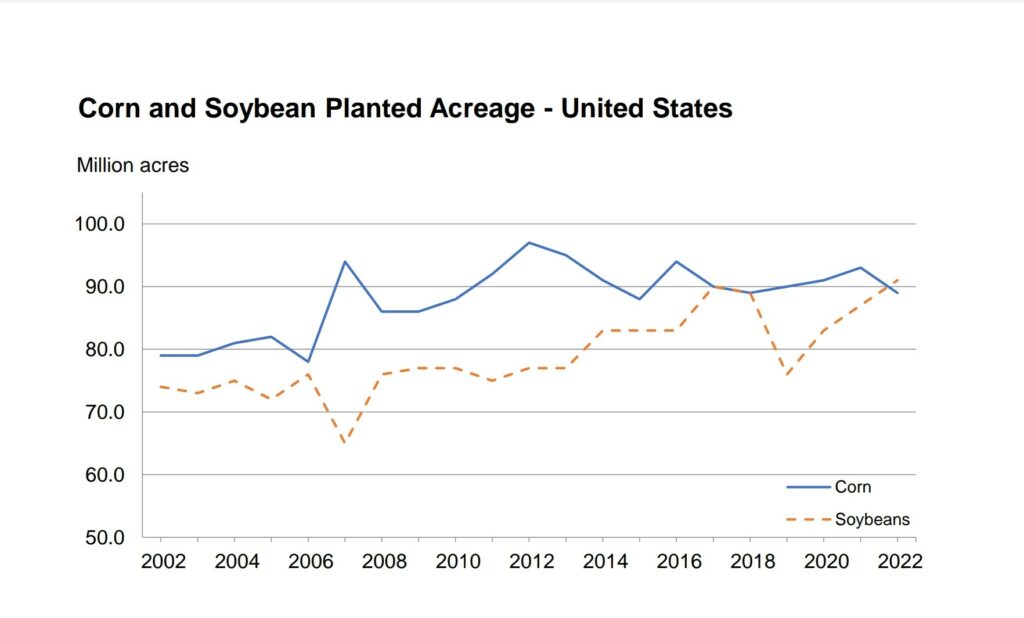

Now about that corn inversion.

Total expected corn plant is down year over year but trending in the averages for the past five years, not that crazy. Total soy expectations, well that’s a little more interesting. There are drought tolerant strains of soy, but without rain, photosynthesis is inefficient and leads to a terrible yield. So that’s out. Specific areas not planting due to weather? Not really, soy is up in multiple states. Fertilizer prices are out of control, so that’s, well, there might be the issue.

For the Western Corn Belt, if anhydrous ammonia was applied in the fall, there is a certain level of commitment to corn. While the added fertilizer nitrogen is not necessarily bad for soybeans, it would be a waste of resources and likely negate any economic advantage of growing soybeans. So, consider any investments made in nitrogen before opting for a direction. The good news is that phosphorus and potassium considerations are generally similar for both corn and soybeans.

This makes sense given that China and Russia were slated to cut off exports, Europe with a gas shortage going into the winter, and the US has no appetite to build additional fertilizer plants due to the $5 billion price tag and the ever changing political winds on fossil fuels. We all say this coming.

This also is a great case for business management. Current commodity prices for corn and soy are $7.44 and $16.05 respectively. I do expect those prices to calm down a bit in the coming months, but we can expect with prices that high at current expected yields, corn will garner $1,004 per acre and soy will come in at $963. However, I do think corn is currently overbought and it should be trading in the mid $6 range, for a per acre price of $877. In other words, they are planting right for the market and planting a lot of it.