The spending transition from goods to services – by New Deal democrat Today is the last day for a very light economic week of news. One item worth addressing is the relative state of consumer purchases of goods vs. services in this pandemic recovery, because it appears to be unique. Let’s start with the ISM non-manufacturing report, which was released on Tuesday. Unlike the manufacturing report, which bounced back slightly into expansion after two months of slight contraction, the non-manufacturing portions of the economy were still going strong in August, if not at their Boom levels of last year: The overall index level was 56.9, well into expansion and a perfectly normal level over the past 15 years. The new orders index (not shown)

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The spending transition from goods to services

– by New Deal democrat

Today is the last day for a very light economic week of news. One item worth addressing is the relative state of consumer purchases of goods vs. services in this pandemic recovery, because it appears to be unique.

Let’s start with the ISM non-manufacturing report, which was released on Tuesday. Unlike the manufacturing report, which bounced back slightly into expansion after two months of slight contraction, the non-manufacturing portions of the economy were still going strong in August, if not at their Boom levels of last year:

The overall index level was 56.9, well into expansion and a perfectly normal level over the past 15 years. The new orders index (not shown) was 61.8, showing strong expansion.

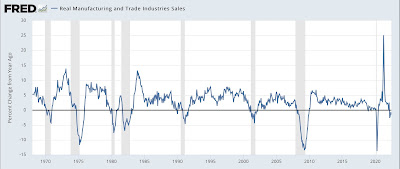

As indicated, the ISM manufacturing index has showed the “goods” sector at a complete stall for the last few months. Worse, the measure of real (inflation-adjusted) manufacturing and trade sales, shows contraction YoY through June for the 4th month in a row:

As you can see, going back 60 years, with the sole exception of 2019 and two months at the end of 1989, this has *always* signaled recession. Not good.

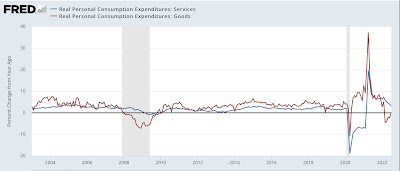

That’s the sales side of the coin. Now, let’s take a look at how this plays out on the other side of the coin, i.e., personal consumption expenditures, for goods and for services.

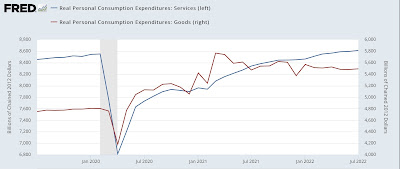

“Real” PCE’s for goods have indeed declined ever since spring 2021; but for services they are still increasing:

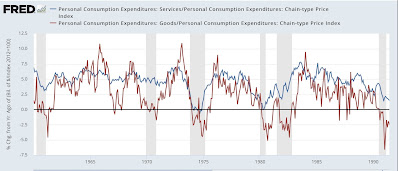

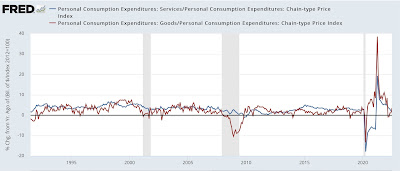

Measured on a YoY basis, similarly to the real sales data, when real expenditures for goods have turned negative, there has usually been a recession (note: I’ve split the data into 2 30 year+ segments for clarity):

The exceptions have been big slowdowns that were not quite recessions, e.g., 1966-67, 1986-87, 1996.

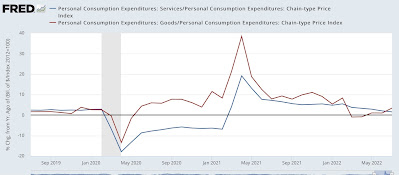

Now here is a close-up on the last 3 years:

Note that the YoY decline only lasted 2 months, and has since rebounded. This is most consistent with a slowdown that is not a recession, or at worst, the 2001’s just-barely-a recession.

The above made use of the PCE price index as a deflator. Since 2002, there has also been a chain deflator. Here’s how that data looks:

The YoY goods downturn was steeper and lasted 4 months, but turned positive in July, while the services measure remained very positive, if declining.

Indeed, when we combine real spending on both goods and services, while we see a deceleration – to be fair, one similar to in 2007 – but no downturn as during the past 2 recessions:

The bottom line here is, that there is merit to the suggestion that what we are primarily seeing is a transition from spending on goods during the teeth of the pandemic (i.e., Amazon deliveries to your door), to spending on services now that restrictions have virtually all been lifted. In other words, not recession, at least not yet.