The impact of supply constraints on the US economy in 3 easy graphs The two most important purchases ever made by most consumers are (1) their houses, followed by (2) their motor vehicles. Indeed, according to Prof. Edward Leamer‘s forecasting model, ever since the end of World War 2 almost all American recessions have been preceded by, first of all, a decline in new home purchases about 6-7 quarters before, followed by a decline in the purchase of new motor vehicles about 9-12 months before. By all reasonable accounts, the US economy Boomed last year, with real GDP up 5.5%, industrial production up 3.4%, manufacturing up 3.9%, and employment up 4.7%. So one would think that the production of houses and motor vehicles would approach prior

Topics:

NewDealdemocrat considers the following as important: supply chains, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The impact of supply constraints on the US economy in 3 easy graphs

The two most important purchases ever made by most consumers are (1) their houses, followed by (2) their motor vehicles. Indeed, according to Prof. Edward Leamer‘s forecasting model, ever since the end of World War 2 almost all American recessions have been preceded by, first of all, a decline in new home purchases about 6-7 quarters before, followed by a decline in the purchase of new motor vehicles about 9-12 months before.

By all reasonable accounts, the US economy Boomed last year, with real GDP up 5.5%, industrial production up 3.4%, manufacturing up 3.9%, and employment up 4.7%.

So one would think that the production of houses and motor vehicles would approach prior expansion peaks. Well, let’s take a look.

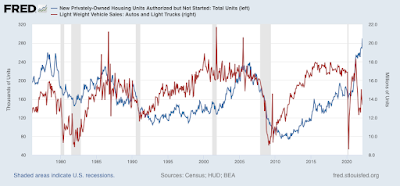

The below graph shows houses where permits have been issued, but construction has not yet started (blue), and sales of cars and light trucks (pickups and SUV’s)(red):

On average over the past 50 years, in any given month the number of new houses where construction has not yet started has averaged about 180,000. The number of new car, pickup, and SUV sales have averaged about 16-17 million during expansion years.

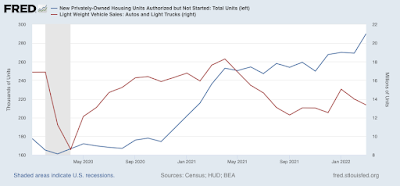

Here’s a close-up from just before the pandemic:

As of one month ago, 300,000 new houses had been authorized but not yet started. Light motor vehicle sales were 13.4 million. That’s 40% more houses than usual, and 25% fewer light vehicles than on average.

In short, supply constraints (e.g., lumber and semiconductors) have seriously impacted the production of the two most important consumer staples.

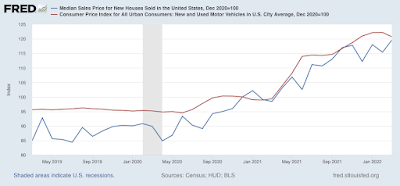

Unsurprisingly, the prices of both have skyrocketed, up about 20% since the end of 2020:

This is a very simple explanation of the most serious economic problem in the US right now.