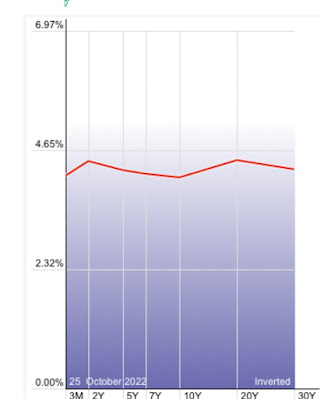

The Treasury yield curve has now almost totally inverted – by New Deal democrat One of the few leading indicators not flashing red for recession has been the short end of the Treasury yield curve, which has been relentlessly positive – until now. While the 10 year minus 2 year Treasury spread has been negative for months, the 10 year minus 3 month had remained positive. But twice in the last two weeks the 3 month Treasury has yielded more than the 10 year Treasury: The highest yielding Treasury is the 1 year maturity. Further, the 6 month Treasury is now yielding more than the 2 year. In other words, almost the entire Treasury yield curve is now inverted: The curve remains positive from the Fed funds rate out till 1 year. That’s the

Topics:

NewDealdemocrat considers the following as important: NDd, politics, treasury yield curve, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

The Treasury yield curve has now almost totally inverted

– by New Deal democrat

One of the few leading indicators not flashing red for recession has been the short end of the Treasury yield curve, which has been relentlessly positive – until now.

While the 10 year minus 2 year Treasury spread has been negative for months, the 10 year minus 3 month had remained positive. But twice in the last two weeks the 3 month Treasury has yielded more than the 10 year Treasury:

The highest yielding Treasury is the 1 year maturity. Further, the 6 month Treasury is now yielding more than the 2 year. In other words, almost the entire Treasury yield curve is now inverted:

The curve remains positive from the Fed funds rate out till 1 year. That’s the only part of the curve that hasn’t inverted yet.

That leaves about the only major indicator that hasn’t rolled over yet is corporate profits, which have been more or less flat, but haven’t really turned down.

“The US Treasury yield curve is on the verge of inverting,” Angry Bear