I am interested in inflation expectations (acting like a macroeconomist for a change). In particular I am thinking about something Brad DeLong just tweeted. He says his subjective probability of sustained inflation due to expected inflation causing current inflation is still just 40% Why “.only a 40% chance …? Because bond markets expect the Fed to get inflation down to 2% not in the short run of next year but in the medium run of three years from now and after. Workers and bosses won’t raise their prices anticipatorily unless they expect… 6/118 Brad DeLong @delong·Apr 9…inflation to continue. And I do not see how workers and bosses can expect inflation to continue while bond traders remain un-spooked. Bond traders are more sensitive to

Topics:

Robert Waldmann considers the following as important: Hot Topics, Michigan Surveys of Consumers, politics, TIPS, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I am interested in inflation expectations (acting like a macroeconomist for a change). In particular I am thinking about something Brad DeLong just tweeted. He says his subjective probability of sustained inflation due to expected inflation causing current inflation is still just 40%

Why “.only a 40% chance …? Because bond markets expect the Fed to get inflation down to 2% not in the short run of next year but in the medium run of three years from now and after. Workers and bosses won’t raise their prices anticipatorily unless they expect… 6/118 Brad DeLong @delong·…inflation to continue. And I do not see how workers and bosses can expect inflation to continue while bond traders remain un-spooked. Bond traders are more sensitive to fears of inflation than workers and bosses. So they are the canaries in the coal mine here. And they… 7/

…have not yet keeled over.”

I agree that usually and in general bond traders think more about future inflation than workers and bosses do. I also agree that they tend to be jumpy and sensitive to fears. However, I also thought two other things that made me wonder. First workers and bosses are paying a whole lot of attention to inflation right now. It is an issue that regular people talk about a lot. This makes a difference. The other thing is that ordinary consumers pay a whole lot of attention to the prices of food and energy (especially gasoline). OJ Blanchard noted that ordinary people’s inflation expectations as reported in the University of Michigan Survey depend critically on food and energy inflation. In contrast, professional forecasters use core inflation — that is inflation except for food and energy. The Michigan expectations depend on headline inflation minus core inflation.

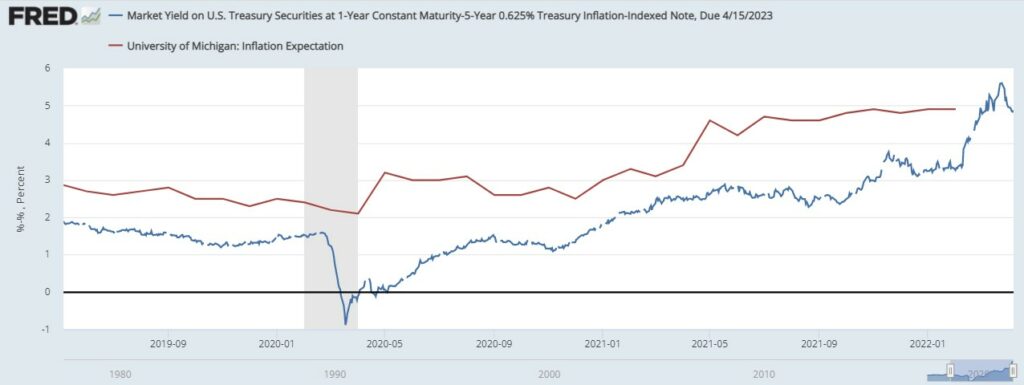

I am interested in comparing bond traders expectations as revealed by TIPS breakevens and ordinary people’s expectations from the Michigan Survey. To explain the terms TIPS are treasury inflation protected secutities which pay coupons and face value indexed to the consumer price index. The breakeven inflation rate is the difference between the nominal interest rate on regular treasury securities and the real interest rate paid on TIPS.

FRED gives one year ahead expectations. It also gives 1 year constant maturity nominal interest rates. It doesn’t give one year constant maturity TIPS, but there happens to be a TIPS which matures April 15 2023, so there is the one year return. The 1 year constant maturity nominal treasury rate is 1.78%, the TIPS yields -3.088 % so the breaken is 4.868%.

In constrast, the latest one year expected inflation rate from the Michigan survey is 4.9%.

That is a pretty remarkable coincidence. The canaries seems to be singing along with the regular people surveyed by the Univesity of Michigan team.

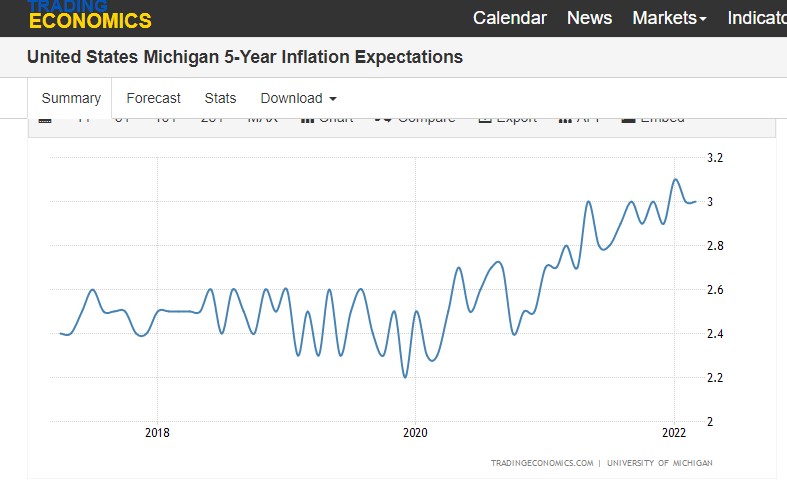

I also wonder if ordinary people overestimate the persistence of inflation. The Michigan survey 5 year expected inflation rate is currently 3%.

The 5 year TIPS breakeven is easier to calculate. It is 3.26%. Again very similar