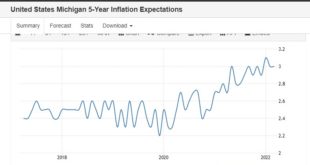

I am interested in inflation expectations (acting like a macroeconomist for a change). In particular I am thinking about something Brad DeLong just tweeted. He says his subjective probability of sustained inflation due to expected inflation causing current inflation is still just 40% Why “.only a 40% chance …? Because bond markets expect the Fed to get inflation down to 2% not in the short run of next year but in the medium run of three...

Read More »Brian Romanchuk — Brief TIPS Market Comment

The U.S. inflation-linked bond (TIPS) market is in an interesting position right now. Inflation protection seems cheap, but the question always remains: is it cheap for a reason? Unfortunately, I am not able to answer that question, I am going to just briefly outline the debate…. Bond Economics Brief TIPS Market CommentBrian Romanchuk

Read More » Heterodox

Heterodox