On the road, and missing all the fun on Wall Street . . . I’m still on the road, and there is no important economic statistic to report, but I will make a brief market comment. YoY stocks are now down 10%. Except for the very bad 1982 and 2008 recessions, and the 2000 Nasdaq bubble and the 1987 crash (which were prolonged bear markets), that has typically been close to their YoY lows: And with rare exception that level has only been hit about midway through a recession. The only time buying a broad basket of stocks at this price reduction has not been amply rewarded within after 2-3 years is during the 1929-32 Great Contraction. < Sigh > I miss the days when I could read triumphalist diaries by DOOOMers at Daily Kos, who were

Topics:

NewDealdemocrat considers the following as important: bear markets, Hot Topics, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

On the road, and missing all the fun on Wall Street . . .

I’m still on the road, and there is no important economic statistic to report, but I will make a brief market comment.

YoY stocks are now down 10%. Except for the very bad 1982 and 2008 recessions, and the 2000 Nasdaq bubble and the 1987 crash (which were prolonged bear markets), that has typically been close to their YoY lows:

And with rare exception that level has only been hit about midway through a recession.

The only time buying a broad basket of stocks at this price reduction has not been amply rewarded within after 2-3 years is during the 1929-32 Great Contraction.

< Sigh > I miss the days when I could read triumphalist diaries by DOOOMers at Daily Kos, who were infallible contrary indicators, and be sure that the bottom was in.

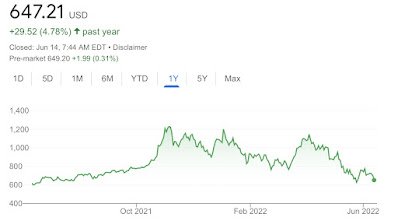

On the other hand, here’s a 12 month graph of Tesla, recently valued at a level equal to if not exceeding the entire rest of the auto industry:

That’s a pretty severe price reduction. Until you zoom out to the 5 year perspective:

Is there any reason for Tesla still to be selling at 10x its price only 2 years ago?

And further, is there any reason for Bitcoin to exist at all?:

On the bright side, a lot of know-it-all smart mouthed 30 year olds are going to STFU.