Producer prices, “sticky” consumer prices – basically, everything except shelter show nearly complete abatement of inflation – by New Deal democrat The producer price index released this morning for November is yet further confirmation that inflation ex-shelter is simply not in the pipeline. Both total and core PPI were unchanged for the month. Both commodities (blue) and finished goods (red) declined by another -0.5%, as shown in the below graph normed to 100 just before the pandemic, and including headline CPI as well (gray): On a YoY basis, commodities are down -3.6%, and finished goods inputs down-0.9%, compared with the 3.1% rise in consumer prices: Some of this difference probably remains producers refusing to pass on price

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Producer prices, “sticky” consumer prices – basically, everything except shelter show nearly complete abatement of inflation

– by New Deal democrat

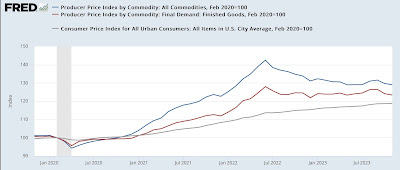

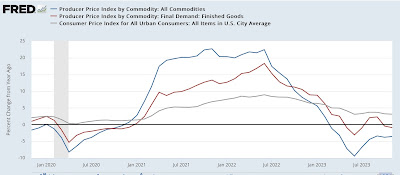

The producer price index released this morning for November is yet further confirmation that inflation ex-shelter is simply not in the pipeline. Both total and core PPI were unchanged for the month. Both commodities (blue) and finished goods (red) declined by another -0.5%, as shown in the below graph normed to 100 just before the pandemic, and including headline CPI as well (gray):

On a YoY basis, commodities are down -3.6%, and finished goods inputs down-0.9%, compared with the 3.1% rise in consumer prices:

Some of this difference probably remains producers refusing to pass on price decreases to consumers, and since consumers still have more income and savings in real terms than they had before the pandemic, consumers are able to pay those increased costs.

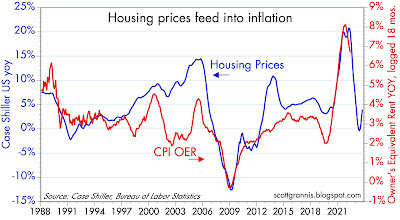

And of course, a big part of the difference is shelter. The idea that the official measure of shelter lags reality seems to have gained increased currency. Steve Liesman of CNBC made a point of it this morning, saying it lagged by 3 Quarters. Meanwhile Scott Grannis (a/k/a Calafia Beach Pundit) put up the below graph with an 18 month lag:

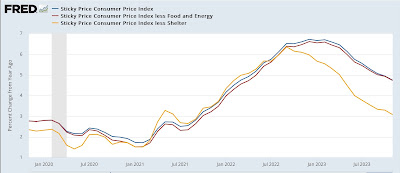

After the official CPI came out yesterday, the Cleveland Fed posted its “sticky price” CPI, which also showed that, absent shelter, even sticky prices are up only 3.1%, vs. both total and core sticky price inflation including shelter, both up 4.7%:

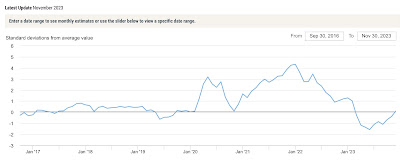

One important question going forward is whether the supply chain has been fully “de-kinked.” The Goldman Sachs Supply Chain Index suggests that it has. Before the pandemic, the average typically varied between 0 and -1 on the index. After the huge pandemic-related increase, it went below -1 earlier this year. In November, for the first time since summer 2022, it went above 0 again:

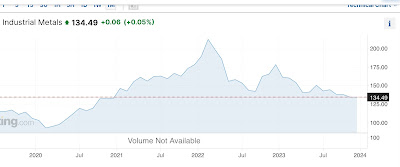

The Bloomberg Industrial Metals Index, which I use because it does not include gas and oil, also peaked in early 2022, and has settled into a flat to slightly declining trend for the last 6 months:

In summary, pressures on producer prices have completely abated. The un-kinking of the pandemic related supply chain seems to have been completed. Consumer price increases ex-shelter also continue to be within a short distance to the Fed’s 2% target. What’s left is shelter, and ironically by constricting the supply of existing houses on the market, the Fed’s increases in that regard have become counterproductive.

Fortunately, as I pointed out yesterday, average and aggregate earnings have exceeded inflation for the past year. I do continue to be concerned that a substantial downturn in actual residential construction is going to materialize in the next few months, with all that it implies as a leading indicator.

Ex-housing, PCE inflation, like CPI inflation, is under the Fed’s 2% target, Angry Bear, New Deal democrat