This is a portion (1 of 6 observations) of a much longer Employer Healthcare Benefits article which would have been impossible to feature in entirety at AB. If I did so, much of it would probably go unread. I was interested in how much concern employees have about company healthcare insurance costs. In particular, I was looking at what employees thought about their plans and its affordability as show in chart 6. Costs, Inflation and Affordability are still major issues. When you review the percentages for the level of concern, ~58% have a moderate to high level of concern. Broken down, ~20% twenty percent have a high concern and 38% have a moderate concern about monthly costs, affordability, copays, coinsurance, and deductibles. A high enough

Topics:

Angry Bear considers the following as important: Education, Health Affairs, Healthcare, Healthcare insurance companies, Hot Topics, KFF Annual Survey, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

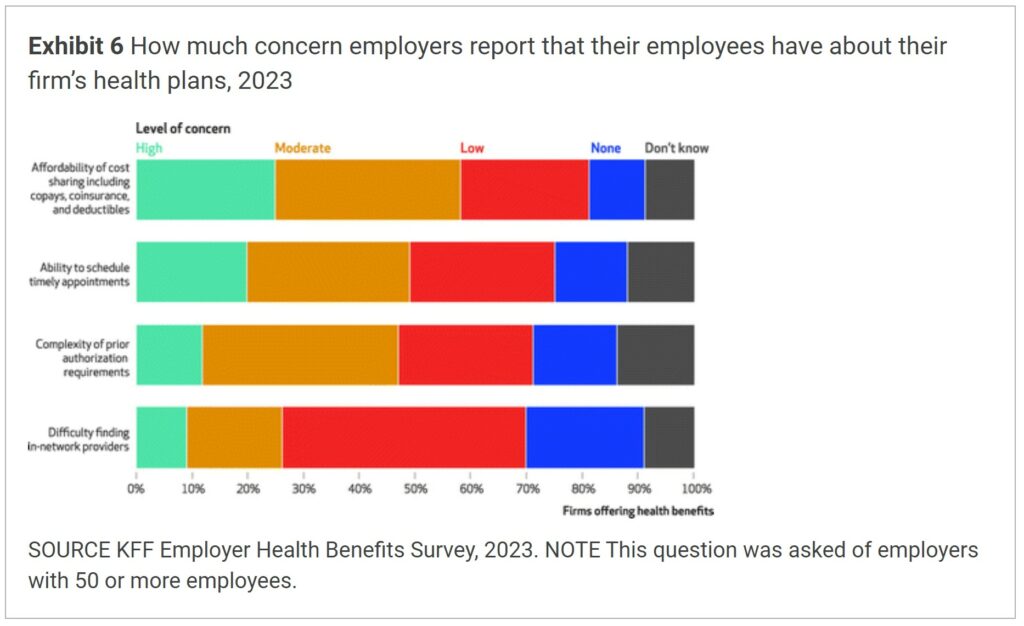

This is a portion (1 of 6 observations) of a much longer Employer Healthcare Benefits article which would have been impossible to feature in entirety at AB. If I did so, much of it would probably go unread. I was interested in how much concern employees have about company healthcare insurance costs. In particular, I was looking at what employees thought about their plans and its affordability as show in chart 6.

Costs, Inflation and Affordability are still major issues.

When you review the percentages for the level of concern, ~58% have a moderate to high level of concern. Broken down, ~20% twenty percent have a high concern and 38% have a moderate concern about monthly costs, affordability, copays, coinsurance, and deductibles. A high enough percentage to consider as a potential issue if prices, etc. continue to rise.

Similar issue, Medicare Plan N (pharma) with United Healthcare-Walgreens is taking a monthly leap of almost 50%. My SS increase will cover the extra $12 with some left over. I am sure there are others who have had their increase all or much of it spent next year. Anyways, onward . . .

A short introduction

Employers with fifty or more workers and offering health benefits were asked how they judged the level of concern their employees had with aspects of the employer’s healthcare insurance plans.

Healthcare Insurance Benefits In 2023: “Premiums Increase with Inflation and Employer Coverage in The Wake of Dobbs,” Health Affairs

Authors; Gary Claxton, Matthew Rae, Anthony Damico, Emma Wager, Aubrey Winger, and Michelle Long

Charts not shown here depict the impact numerical increases.

The average annual premium for workers covered by their own firms was $8,435 for single coverage and $23,968 for family coverage in 2023 (exhibit 1). The average premiums for family coverage increased by $1,505—a 7 percent increase from 2022 (exhibit 2). Both single and family premiums increased faster this year than last year (2 percent versus 7 percent and 1 percent versus 7 percent, respectively).

What I was interested in showing is the level of concern for increasing costs or prices by employees. This is depicted in Exhibit 6 as shown below. Some and not a lot of detail after the exhibit.

Summary of Findings on this One Issue

The Kaiser Employer Health Benefits 2023 survey reveals premiums for single and family coverage were both increasing 7% in 2023. This is up from their levels in 2022, consistent with inflation (5.8%), and wage growth (5.2%) for the year. The latter percentage is drawn from the same source New Deal democrat uses to discuss, the Average Earnings of Production and Non-Supervisory Employees.

Historically, premiums have risen faster than inflation and wages. During the past five years the cumulative increases have been similar. This is in part due to the decline in use of health services during the COVID-19 pandemic, as well as the end of a prolonged period of very low inflation. Therefore, there is no way to know whether this a transient trend or a new pattern in the costs of care. During the past ten years, the average family premium has risen 47%, compared with growth in inflation of 30%, and wage growth of 42%. Dependent upon how high your income can be, a 47% increase in cost could have an impact.

Employer Health Benefits Survey 2023 Annual Survey – Summary of Findings, kff.org, Similar chart to what is shown by Health Affairs is portrayed as Chart H shown on Page 10 of 14 in the Summary of Findings. Health Affairs used the KFF report for their well-done abbreviated version as shown above.