Doing my usual internet walkabout and looking for things which may be interesting to present at AB. Rental Housing costs and Mortgage costs are important in trying to find reasonable housing. A reader does not have to travel far to pick up on this topic. Angry Bear’s features New Deal democrat, who also covers similar topics every day. You can also read Bill McBride (Calculated Risk) comments on similar topics. At one time, Bill wrote at Angry Bear also. Anyway, on to the topic. The article states, “Annual rent growth ticked up in October for the first time since the pandemic peak in early 2022.” This comes on top of increasing single used and new home pricing which has been an issue for a while. Quite literally, we were priced out of the

Topics:

Angry Bear considers the following as important: Hot Topics, US EConomics, Zillow Observed Rent Index

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Doing my usual internet walkabout and looking for things which may be interesting to present at AB. Rental Housing costs and Mortgage costs are important in trying to find reasonable housing. A reader does not have to travel far to pick up on this topic. Angry Bear’s features New Deal democrat, who also covers similar topics every day. You can also read Bill McBride (Calculated Risk) comments on similar topics. At one time, Bill wrote at Angry Bear also.

Anyway, on to the topic. The article states, “Annual rent growth ticked up in October for the first time since the pandemic peak in early 2022.”

This comes on top of increasing single used and new home pricing which has been an issue for a while. Quite literally, we were priced out of the market (2021) even after offering $10 thousand over list price(s). People out bid us by more, offered cash deals, or etc. We finally were offered a new home and had 24 hours to accept it. It was said our realtor placed our name in a raffle. I am also a Vietnam veteran. This builder made it a practice to give new homes away to veterans and widows of veterans. It fit our needs and we took it.

Increasing rents make it difficult for new couples, low-income families, and the elderly to find housing. The homes exist where I am now, but are not at affordable prices due to high interest rates. Seeing an increase on rents could be problematic in the longer term.

Rent Growth Finally Reaccelerates After Nearly Two-Year Slowdown (October 2023 Rent Report) – Zillow Research, November 8, 2023

As reviewed by Zillow Reseach:

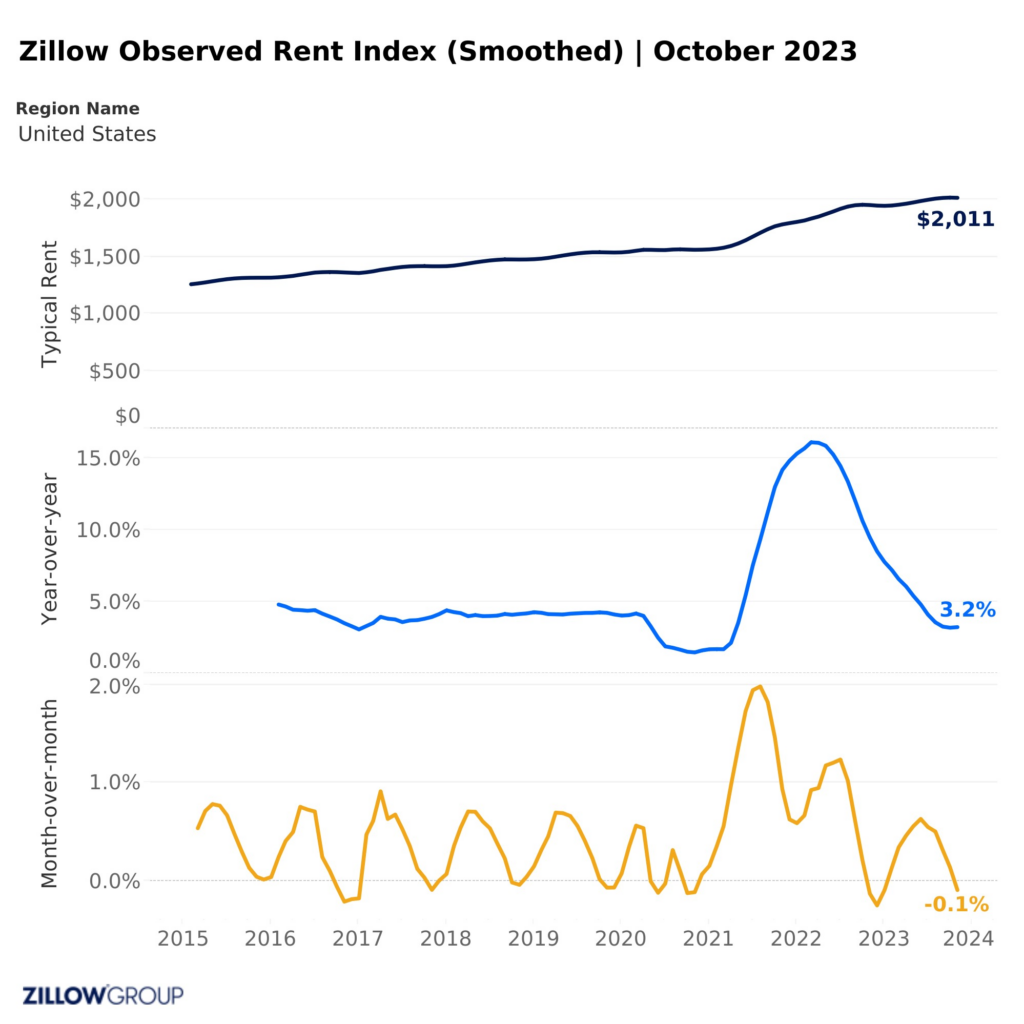

The nearly two-year-long slowdown in rent growth may finally have come to an end in October. After slowing in every month since a record-high 16.1% in February 2022, the annual change in typical U.S. asking rent increased in October, according to the Zillow Observed Rent Index (ZORI). ZORI increased in October by 3.23% from a year ago, slightly faster than September’s 3.19% annual change, and now sits at $2,011.

It remains to be seen whether this is the beginning of a recovery in annual rent growth back toward longer-term averages, or more of a stabilization. Indeed, despite the uptick in annual appreciation, typical U.S. asking rent fell slightly in October from September, ticking down by less than one-tenth of a percent, in line with usual monthly changes in pre-pandemic Octobers.

The consistent cooling of annual rent growth had largely been driven by an onslaught of new multifamily construction. The overwhelming majority of which are built for rent – coming on the market and accepting new tenants. This dynamic remains in place and should continue well into 2024. While homebuilder confidence has waned and fewer new multifamily housing projects have recently begun construction compared to prior months, a record-high number of multifamily homes remain under construction and are likely to become available homes for rent once building is complete. This added supply is likely to nudge rental vacancy rates upward and help dampen asking rent prices for multifamily units in the months to come. (To enlarge, click on the picture).

October’s uptick in annual rent growth may be an indication the affordability benefits of renting – relative to buying – a home are stoking demand for rental housing. In much of the country, monthly rent payments are cheaper than the mortgage payment associated with the purchase of a home thanks, in large part, to the substantial increase in mortgage rates over the past year. For several years prior to the pandemic, the opposite was true. The affordability benefits renting now provides has made it an attractive – if not necessary – option for many households seeking their next home. With a return to pre-pandemic home purchase affordability remaining unlikely, this rental market advantage should persist in the months ahead, buoying demand for rentals as a result.

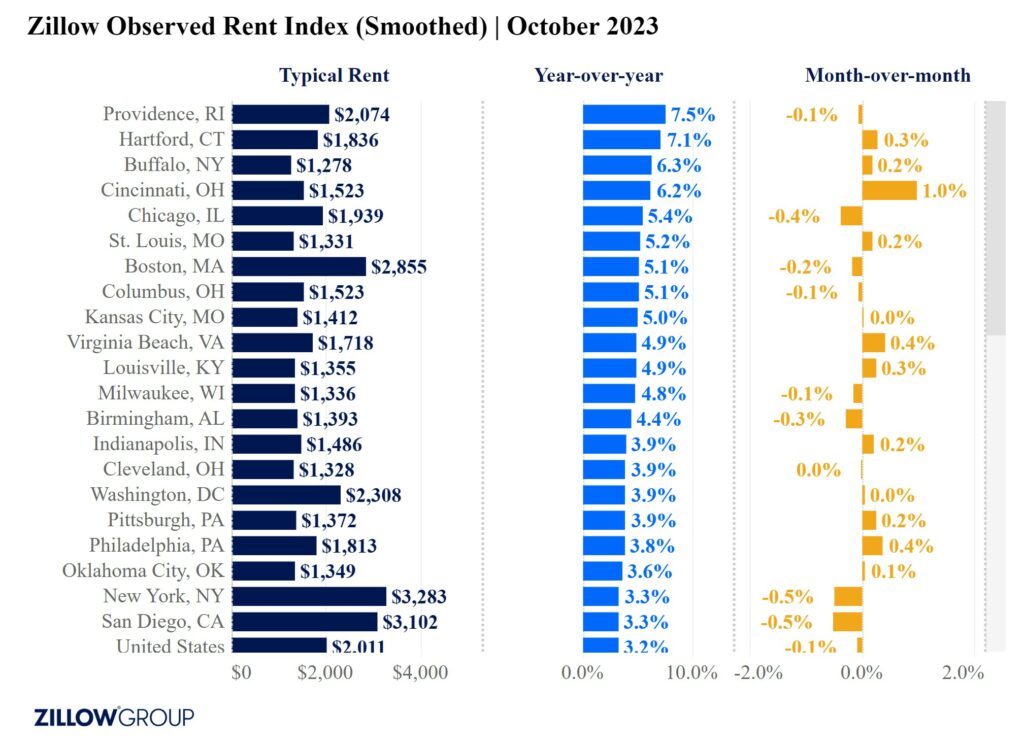

Rent growth is strongest in the Northeast and Midwest

Annual rent appreciation remains strongest in smaller markets in the Northeast and Midwest, while markets out West saw the weakest year-over-year growth, and even declines in a few markets:

- Rents have risen the most over the past year in Providence (+7.5), Hartford (+7.1), Buffalo (+6.3%), Cincinnati (+6.2%) and Chicago (+5.4%).

- Rents fell over the past year in Austin (-2.8%), San Francisco (-0.2%) and Portland (-0.1%).

CPI rent inflation likely to continue to decelerate

Annual rent inflation in the Consumer Price Index (CPI) continued to decelerate in September, the latest reading available at time of writing. Deceleration should continue to be the case for at least the near-term.

It takes time for changes in asking rents to be ingested by monthly inflation readings, so the housing-specific components of CPI and the Fed’s preferred gauge (the Personal Consumption Expenditure price index) should continue to decline as they account for ZORI’s annual decelerations seen earlier this year. (To enlarge, click on the picture)

Also: Orphe Divounguy, senior macroeconomist at Zillow Home Loans . . .

“Mortgage rates decreased this week (November 22, 2023) on softer than expected consumer price inflation and leading economic indicators pointing to a slowdown in economic activity. As a result, bond markets began pricing in rate cuts midway through 2024 despite Federal Open Market Committee (FOMC) minutes suggesting a policy reversal is not likely at least until core inflation returns to the Federal Reserve’s target.”

It is not all doom and gloom as politicians are spouting. It appears the economy is actually improving as New Deal democrat believes and as followed up by Zillow.