Despite a few soft spots, consumer income and spending continued to power ahead in October – by New Deal democrat The monthly personal income and spending report is along with the jobs report, one of the two most important coincident metrics for the entire economy, because it is a fairly comprehensive look at the consumer sector. In October both nominal and real personal income and spending increased 0.2%. Since the beginning of the pandemic, real income is up 5.8%, and real spending is up 9.7% (thank you, COVID stimulus payments!): Both of these have consistently risen since the peak in gas prices in June 2022. There are several slightly leading components in this report. The first is the personal savings rate, which tends to

Topics:

NewDealdemocrat considers the following as important: consumers, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Despite a few soft spots, consumer income and spending continued to power ahead in October

– by New Deal democrat

The monthly personal income and spending report is along with the jobs report, one of the two most important coincident metrics for the entire economy, because it is a fairly comprehensive look at the consumer sector.

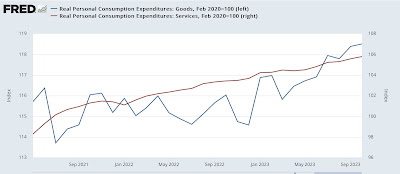

In October both nominal and real personal income and spending increased 0.2%. Since the beginning of the pandemic, real income is up 5.8%, and real spending is up 9.7% (thank you, COVID stimulus payments!):

Both of these have consistently risen since the peak in gas prices in June 2022.

There are several slightly leading components in this report. The first is the personal savings rate, which tends to decrease as confident consumers spend during expansions, and increase just before recessions as consumers begin to pull in their horns. In October the savings rate increased 0.1% to 3.8%, but is down 1.5% from its level in May (the biggest part of the explanation for the blockbuster Q3 GDP report), and remains at low levels only seen in 2005-07 and in 2021 just after the stimulus payments (below graph subtracts -3.8% to show current level at the zero line):

There is no sign of consumers pulling in their horns here.

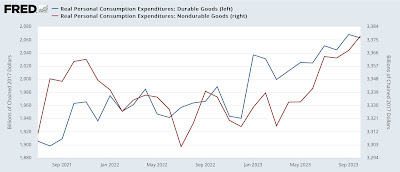

Secondly, while real spending on services has historically continued to rise even through recessions, real spending on goods, and especially durable goods, tends to decline beforehand. The below graph, again normed to 100 just before the pandemic, shows that both have continued to rise through October, up 0.1% and 0.2% respectively:

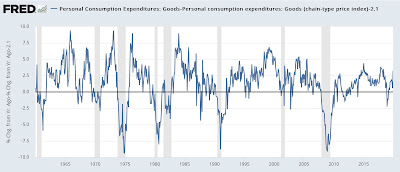

Real spending on goods has increased sharply earlier this year, but being up 2.1% on a 12 month basis is equivalent to YoY comparisons in past slowdowns as well as recessions (graph below subtracts 2.1% to show current level at the zero line):

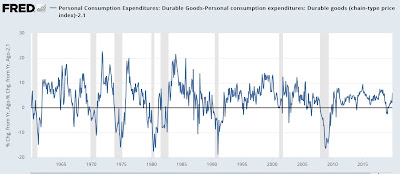

We can break down goods spending further between durable and non-durable goods, since the former tend to turn first. Indeed, real durables spending did decline -0.3% for the month, while non-durables spending increased 0.3%:

This shows that the relative slowdown in the recent few months has been centered on durable goods. Non-durables spending has increased sharply. Again, current YoY spending on durable goods is equivalent to both slowdowns and recessions historically:

One important word of caution: spending on goods and durables in particular may have been influenced by the autoworkers’ strike, so take with a grain of salt this month.

There are two other coincident metrics that are paid particular attention to by the NBER. The first is real personal income ex-government transfer payments. This also increased 0.3%, and is up 2.3% YoY:

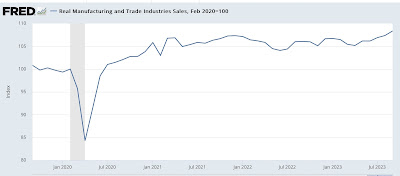

The second is real manufacturing and trade sales. This increased a sharp 0.9% in September, and is up 3.4% YoY. This has a great deal to do with consumer disinflation and some outright producer prices deflation (note it has also generally increased since June 2022):

To sum up: although there were a few soft spots (spending on durables, a slight increase in savings), consumers generally continued to power ahead in October, fueled by continuing increases, even after inflation, in income.

Real personal income and spending, Angry Bear, New Deal democrat