Despite the continued elevation of continued claims, initial claims signal continued expansion – by New Deal democrat I’ll comment on personal income and spending later this morning, but let’s start out with our weekly update on jobless claims. Initial claims rose 7,000 to 218,000, while the 4 week average declined -500 to 220,000. With a one week delay, continuing claims rose 86,000 to 1.927 million, a nearly 2 year high: On the more important (for forecasting purposes) YoY basis, initial claims were up 2.3%, the 4-week average up 3.5%, and continuing claims up 24.0%: The YoY increase in continuing claims has gotten a fair amount of attention recently, because historically that big an increase has always meant a recession is already

Topics:

NewDealdemocrat considers the following as important: Claims, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Despite the continued elevation of continued claims, initial claims signal continued expansion

– by New Deal democrat

I’ll comment on personal income and spending later this morning, but let’s start out with our weekly update on jobless claims.

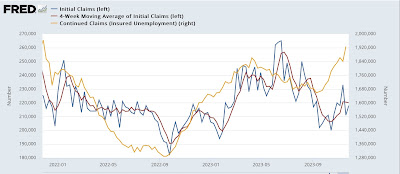

Initial claims rose 7,000 to 218,000, while the 4 week average declined -500 to 220,000. With a one week delay, continuing claims rose 86,000 to 1.927 million, a nearly 2 year high:

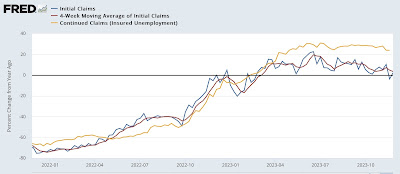

On the more important (for forecasting purposes) YoY basis, initial claims were up 2.3%, the 4-week average up 3.5%, and continuing claims up 24.0%:

The YoY increase in continuing claims has gotten a fair amount of attention recently, because historically that big an increase has always meant a recession is already occurring. While it clearly shows that in at least several sectors of the economy people are not finding jobs very quickly, historically initial claims have led continuing claims. And also notice that the YoY increase in continuing claims has not gotten worse in over half a year – with no recession yet. So, I am discounting that metric unless and until YoY initial claims agree. And with increases less than 5%, initial claims are in no way signaling any imminent recession.

Finally, since initial claims lead the unemployment rate, let’s update our look at the Sahm rule:

Initial claims are forecasting an unemployment rate of 4.0% or below in the next few months (3.5%*1.1), and likely lower than that a little afterward (3.5% or 3.6%*1.05). In short, initial claims are not indicating that the Sahm rule will be triggered in the months ahead.

Initial jobless claims confirm benign employment conditions, Angry Bear, New Deal democrat