FTC and Congress Put PBMs on Notice – AAF (americanactionforum.org) The conclusion of the Congressional Plan Much of this post in a copy and past. However, the conclusion is mostly mine. I am starting out with the conclusions and actions of Congress to which the author claims could result in fewer PBMs and increasing prices. If you look at Figure Two, it becomes rather obvious where the fallout is going to be. The smaller PBMs will not be able to pass along the increasing costs of more regulation. It is possible, there will remain three major PBMs much like the three major distributors of drugs (McKesson, Cardinal, and Amerisource-Bergen). An example? The actual costs and price for insulin were largely due to the distribution from the

Topics:

run75441 considers the following as important: Healthcare, law, PBMs, Pharmaceuticals, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

FTC and Congress Put PBMs on Notice – AAF (americanactionforum.org)

The conclusion of the Congressional Plan

Much of this post in a copy and past. However, the conclusion is mostly mine.

I am starting out with the conclusions and actions of Congress to which the author claims could result in fewer PBMs and increasing prices. If you look at Figure Two, it becomes rather obvious where the fallout is going to be. The smaller PBMs will not be able to pass along the increasing costs of more regulation. It is possible, there will remain three major PBMs much like the three major distributors of drugs (McKesson, Cardinal, and Amerisource-Bergen). An example? The actual costs and price for insulin were largely due to the distribution from the manufacturer to the drug store with multiple intermediators such as PBMs and distributors. It was not just the PBMs. Manufacturers did make money on insulin and other drugs regardless of what is said and even after discounts. Distributors ship what they wish to ship as we found out when West Virginia sued the distributors for millions of opioids going to drug stores in West Virginia,

From 1993-2013, the total increase in pricing was an approximate $50 billion for Insulin. The manufacturer is still king of pricing. The same issue can be seen with EpiPen and Vimovo. More on pricing here: “Here’s What’s Really Driving Healthcare Costs, MedPage Today, F. Perry Wilson. Can the pricing be attributable to the middlemen? Quite possible; but remember, the manufacturer is king. I do not think the author is wrong about Congressional actions will increase costs. Their are other factors. More on this later.

The start of the FTC and Congressional Actions.

The Federal Trade Commission (FTC) and Congress in separate actions collectively put pharmacy benefit managers (PBM) on notice. In June 2022, the FTC launched an investigative study into various PBM practices. Just nine days later, the agency declared increased enforcement against any illegal rebate schemes or bribes paid to PBMs to foreclose on lower-cost drugs.

Meanwhile, the Senate is debating the Pharmacy Benefit Manager Transparency Act of 2023. The Act prohibits certain PBM business practices, imposes new reporting requirements on PBMs, and grants the FTC broad regulatory authority over the industry.

Health plans contract with PBMs to help control drug spending via their purchasing power to negotiate lower prices and rebates. These contracts and the rebates paid to the PBM by drug manufacturers have faced increasing scrutiny from both the FTC and Congress. Consistent with FTC Chair Lina Khan’s “big is bad” approach to enforcement, Khan expressed her desire to investigate “dominant intermediaries,” and described the business model as “extractive.” Khan added that dominant intermediaries can “use [their] critical market position to hike fees, dictate terms, and protect and extend their market power.” The FTC is also concerned that “rebate practices may be driving up the list price of insulin….”

For its part, Congress continues to look for ways to reduce prescription drug prices and brings more transparency to the PBM industry. Senators Charles Grassley and Maria Cantwell, in introducing the legislation, accused PBMs of “unfair and deceptive practices that drive up the cost of prescription drugs at the expense of consumers.”

By leapfrogging the FTC study, the FTC and Congress are acting without fully understanding whether there are problems in the PBM industry needing to be addressed. Preemptively ramping up enforcement and passing new legislation targeting PBMs in isolation risk imposing costly and potentially unnecessary regulatory burdens on a single part of a complex prescription drug supply chain. Such policy can misstep and threaten to reduce competition and ultimately increase patient costs.

Pharmacy Benefit Managers

PBMs are acting on behalf of health plans to manage patient utilization of drugs and process prescription drug claims. More notable activities, and the subject of increasing scrutiny from Congress and the FTC, this includes creating insurance plan formularies, reimbursing pharmacies for prescriptions, and negotiating rebates with drug manufacturers to lower health plans’ costs. The FTC alleges some of these “rebate schemes” could be illegally blocking competition and patients’ access to lower-cost drugs.” In the announcement of the 6(b) study, the FTC stated many of these functions “depend on highly complicated, opaque contractual relationships…” and thus warrant the inquiry.

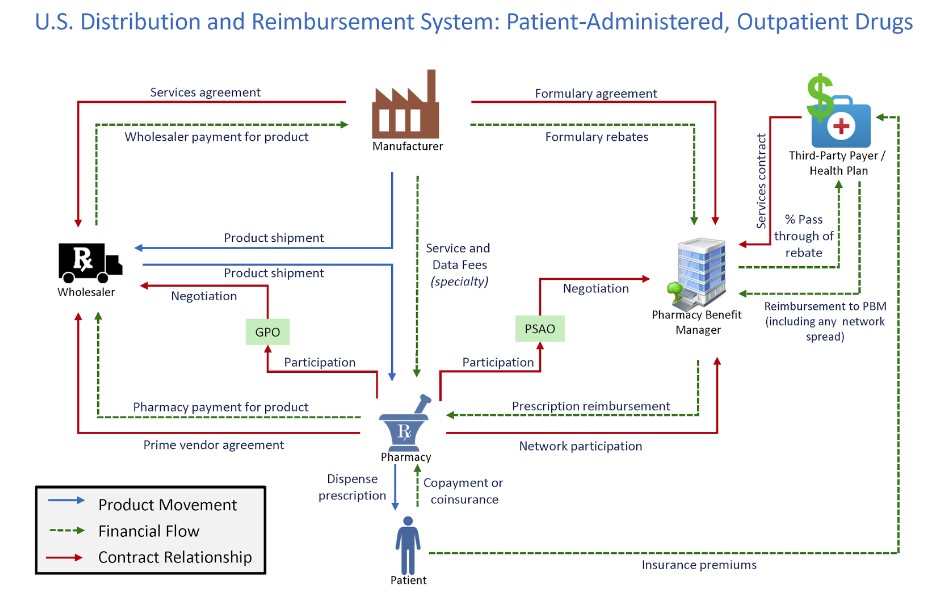

Figure 1 shows how PBMs interact with the rest of the drug supply chain. The graphic includes the product movement, financial flow, and contract relationships in the health care system.

*Source: Drug Channels Institute

The supply chain for pharmaceutical drugs is complex, and PBMs play an important role in lowering the costs for health plans. Research showed that the “U.S. market size [for prescription drugs] is approaching $500 billion annually, with about two-thirds of adults using them and almost 300 million people participating in prescription-drug insurance plans.” Furthermore, 95 percent of all prescriptions at retail pharmacies involve a PBM and 91 percent of drug-plan participants are served by PBMs. The research also found that the estimated net value created by PBM services is $145 billion annually. Additional research from the Government Accountability Office (GAO) specific to Medicare Part D showed that drug price rebates negotiated by PBMs “offset Part D spending by 20% from $145 billion to $116 billion.” The study also showed that PBMs negotiated $18 billion in rebates from Part D-participating manufacturers, retaining less than 1% of these rebates.

The FTC Puts PBMs “On Notice”

The FTC inquiry into the PBM industry required the six largest firms to “provide information and records regarding their business practices.” The study was issued under Section 6(b) of the FTC Act. These studies are generally fact-finding missions conducted “without a specific law enforcement purpose,” and the FTC explained the “inquiry is aimed at shedding light on several practices that have drawn scrutiny in recent years,” including:

- “fees and clawbacks charged to unaffiliated pharmacies;

- methods to steer patients towards pharmacy benefit manager-owned pharmacies;

- potentially unfair audits of independent pharmacies;

- complicated and opaque methods to determine pharmacy reimbursement;

- the prevalence of prior authorizations and other administrative restrictions;

- the use of specialty drug lists and surrounding specialty drug policies; and

- the impact of rebates and fees from drug manufacturers on formulary design and the costs of prescription drugs to payers and patients.”

Just nine days after the FTC announced the fact-finding mission, the agency issued a policy statement declaring a “ramp up [in] enforcement against illegal rebate schemes, bribes to prescription drug middleman that block cheaper drugs,” and put the drug industry “on notice.” Included in the policy statement were business practices ripe for increasing scrutiny, with the topic rebates and fees overlapping with the 6(b) study. The statement made clear that the study’s findings will be used to support future enforcement action.

The FTC’s actions follow the FTC’s recent “big is bad” approach to antitrust enforcement, a departure from nearly 50 years of focusing on consumer welfare.

Figure 2 shows that the three largest PBMs controlled 80 percent of the market in 2021.

Pharmacy Benefit Manager Transparency Act of 2023

Some members of the Senate concur with the FTC. The PBMs contribute to the rising cost of prescription drugs. Rather than waiting for the conclusions of the FTC study to assist in crafting the legislation, Senators Maria Cantwell and Charles Grassley introduced the Pharmacy Benefit Manager Transparency Act of 2023.

The proposed legislation would strap the industry with additional compliance costs. Each year, PBMs would be required to report information to the FTC regarding changes to formularies, reimbursement rates, and clawbacks. Much of these increased costs would likely be passed on down the supply chain, ultimately being paid for by patients. PBMs unable to pass along or absorb these increased compliance costs would be forced out the market, resulting in fewer competitors.

The legislation also directs the GAO to conduct a study addressing rebates, fees, and other sensitive business information with the goal of more industry transparency. The GAO will be required to provide Congress with a report that includes company-level data of the amount of the rebates passed on to patients and payors, the amount of the rebate kept by the PBM, and how PBMs structure their formularies. But the competitiveness of the PBM industry relies on negotiating. And the ability to negotiate relies on confidentiality. Such a requirement would compromise an individual PBMs ability to negotiate with pharmacies and drug manufacturers and could result in higher prices.

The market economy fails when applied to healthcare, Angry Bear, Angry Bear Blog