Roosevelt Institute’s Economist Mike Konczal calls this a remarkable recovery. The increase in the number of people working has helped tamp down inflation and has shown the importance of aiming for full employment. Myself? I do not think this was planned by any authority, including the Fed. One belief I do have is there being a contrived supply chain shortage by business leading to increasing need for Labor. I do not recall a positive economic impact after 2008 on Labor other than massive layoffs and high and long unemployment. I do know we were chasing semiconductors for a minimum of two years afterwards. Once supplies increased, prices decreased but this was years later. Perhaps companies and Wall Street being in a perilous situation then, led to

Topics:

Bill Haskell considers the following as important: Economic Recovery 2023, Hot Topics, politics, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

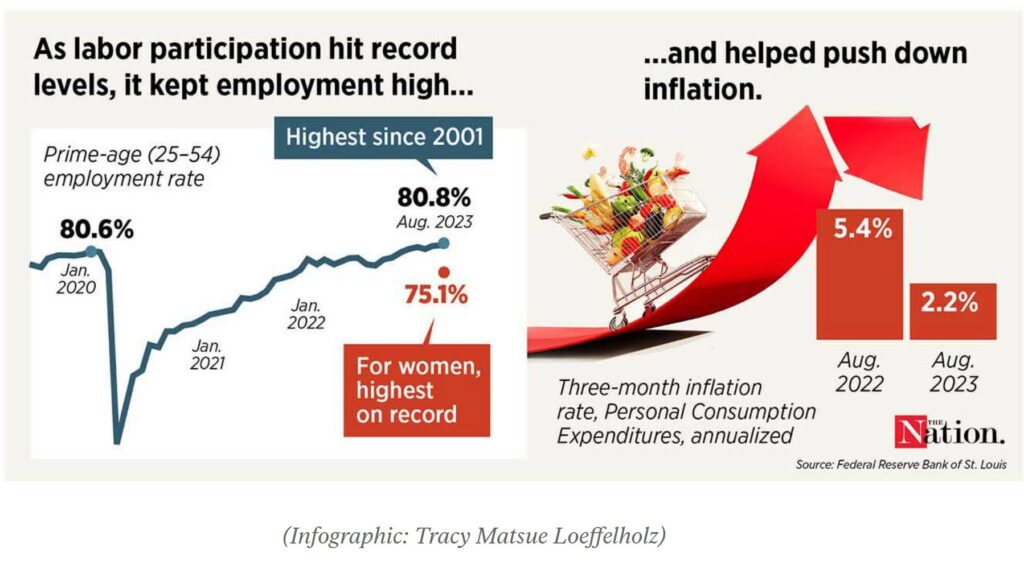

Roosevelt Institute’s Economist Mike Konczal calls this a remarkable recovery. The increase in the number of people working has helped tamp down inflation and has shown the importance of aiming for full employment.

Myself? I do not think this was planned by any authority, including the Fed. One belief I do have is there being a contrived supply chain shortage by business leading to increasing need for Labor. I do not recall a positive economic impact after 2008 on Labor other than massive layoffs and high and long unemployment. I do know we were chasing semiconductors for a minimum of two years afterwards. Once supplies increased, prices decreased but this was years later. Perhaps companies and Wall Street being in a perilous situation then, led to slower economic growth in 2008 and later. In 2021-22 there was governmental stimulus funds for families, childcare, and healthcare. All of which helped create a larger more stable labor pool. And now the funds ended.

What next?

Too Many Economists Thought This Was Impossible, The Nation, Mike Konczal

The charts speak for themselves . . .

There are reasons to be cautiously optimistic about the US economy. While the inflation rate remains higher than before the pandemic, it has fallen during the past six months as supply chains have normalized and the broader economy has worked itself through the chaos of reopening. This occurred even as unemployment remained low and within the mid–3 percent range. Many economists said this would be nearly impossible.

Up and down energy prices, the resumption of student-loan payments, and increasing layoffs could drive down growth. But a wave of productive investments unleashed by last year’s Inflation Reduction Act may be enough to counteract those negative forces. The Fed still has not given up either.

The charts say enough here for a conversation. The link to the article is above, Catch the rest of Mike Konzal’s article at The Nation.

Might There Be A V-Shaped Economic Recovery After All? Angry Bear, Barkley Rosser, June 19, 2020