I rewrote portions of this article and added information from my own experiences in Automotive when new technology is introduced. My experience is not as great when compared to the introduction of EVs. However, it does come close enough to understand what is going on with the industry. Anyways, onwards. As taken from: GM Says EV Demand Is Shrinking. Data Shows a Complex Market, autoweek.com, Emmet White Generally speaking about the market . . . General Motors has officially delayed the Silverado EV for another year due to shrinking demand and engineering challenges. What exactly does this signal for the EV market at large? It remains a complicated market in which to succeed. Automakers like Lucid and Rivian decreased production. And some

Topics:

Bill Haskell considers the following as important: electric vehicles, Ford, GM, Hot Topics, politics, Taxes/regulation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I rewrote portions of this article and added information from my own experiences in Automotive when new technology is introduced. My experience is not as great when compared to the introduction of EVs. However, it does come close enough to understand what is going on with the industry. Anyways, onwards.

As taken from: GM Says EV Demand Is Shrinking. Data Shows a Complex Market, autoweek.com, Emmet White

Generally speaking about the market . . .

- General Motors has officially delayed the Silverado EV for another year due to shrinking demand and engineering challenges. What exactly does this signal for the EV market at large?

- It remains a complicated market in which to succeed. Automakers like Lucid and Rivian decreased production. And some manufacturers continue to reap the benefits of EV adoption trends.

- National and state-by-state figures show positive trends. Analysts warn of an impending plateau. Such an economic environment could leave automakers and their EV investments high and dry for the moment.

I do not find this confusion to be unusual for a new model and technology introduction. Front wheel became more popular in the seventies. Similar issues were experienced. I had a new front wheel drive 1975 Audi Fox. Heading out for Christmas, I bought snow tires for it and they put them on the back.

The Ford’s all-electric F-150 Lightning has been on the open road for over a year. One would think General Motors is eager to engage in an EV pickup segment competition. However, the GM competitor to the Ford F150, the Chevrolet Silverado EV is not ready yet. GM is actually pushing its launch back by a whole year.

Why is GM taking what seems like a drastic action?

A diminished demand for new EVs according to GM and also other engineering challenges. GM says demand is down, necessitating the transfer of 1000 employees to other facilitates from its Orion Assembly plant in Lake Orion, Michigan. Orion is the plant which is currently being retooled for EV production.

GM will phase out its Chevrolet Bolt production later this year at its Orion plant to take on Silverado pick-up later and after assembly lines are rearranged. The original author opines it to be surprising to see a manufacturer delay of a potential flagship EV.

I tend to agree with him. There will be a lot of work to retool the facility to manufacture the Chevrolet Silverado. It should havse started a while ago if GM was to compete with Ford. In any case, GM’s market assessment driven delay is not alone. Ford is temporarily slowing F-150 Lightning production.

Neither automaker is conceding the demand driven production problems being a result of the current United Auto Workers strike, either. Also, it is not just Ford and GM struggling with an EV market lull. Companies such as Lucid Motors produced 30% fewer models this quarter. Ford’s slow down is F-150 Lightning sales dropping 46% in the last three months.

Adjusting production to meet demand is only natural, especially in the years following multiple labor and material crises. The question remains. Is EV demand really dropping sharply? And if consumers are shying away from EVs, where does this leave automakers who are relying on EVs for their future prosperity?

AB: Perhaps automotive has changed since my departure. The car makers built to a yearly forecast, inventoried models, and expect the Tiers to stock parts to meet their orders. You certainly did not build parts far ahead of the automaker weekly or monthly orders. You might get stuck with them. They will adjust short term forecasts.

Looking for Evidence

In order to determine what exactly is going on, Autoweek began looking at state-by-state EV sales data. California is accelerating ahead (not surprising), boasting a 24.3% year-to-date zero-emissions-vehicle sales rate. This is nearly 6% higher than the overall 2022 ZEV sales rate in California. However, California is an easy EV demand target to determine. What about the other states?

A similar trend is occurring in the state of Washington Eighteen percent of new car sales for the first half of 2023 were either fully electric cars or plug-in hybrids. This according to the Seattle Times. For reference, Washington’s EV sales rate hovered around 8%-12% through the first half of 2022 before dramatically ramping up.

If these tax-credit-incentivizing, charging-infrastructure-building state statistics aren’t convincing, it is worth looking at the data on a national level, too. Data from the Department of Energy’s Argonne National Laboratory shows a fairly consistent monthly sales rate for plug-in vehicles this year, save for a small dip between June and July.

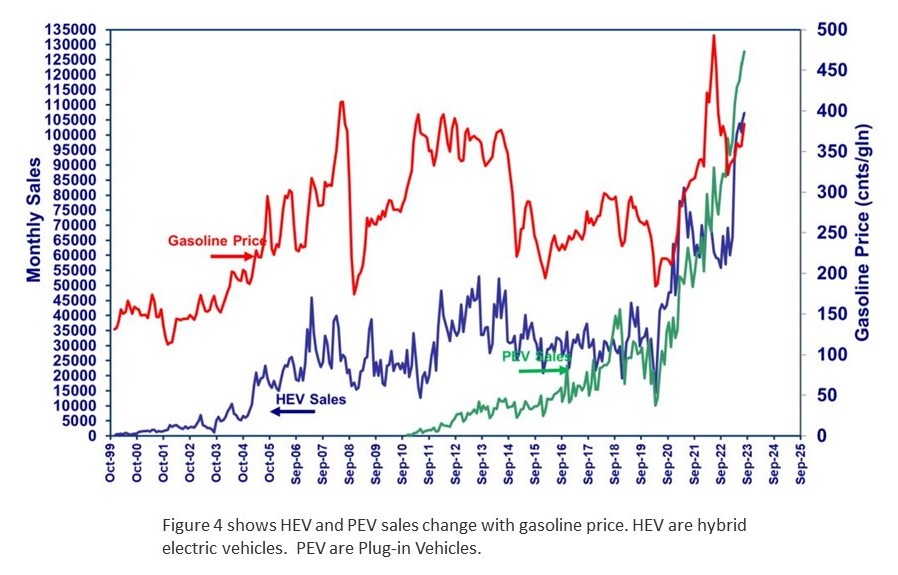

Graph pulled by myself . . .

Light Duty Electric Drive Vehicles Monthly Sales Updates | Argonne National Laboratory (anl.gov)

The graph reveals recent data. I am not certain what GM and Ford sees. There may already be reduced sales at the dealer level.

EV sales rates from manufacturers point to relatively positive trends. Ford reported a 14.8 % quarterly rise in EV sales, with the Mustang Mach-E and E-Transit posting their best sales quarter ever. That accounts for a total EV sales increase of 65% from August to September for Ford. Again, history . . .

It is not just domestic carriers seeing strong EV sales demand. Kia EV6 sales are up 45% year-over-year for the third quarter. Annual Volkswagen ID.4 sales have doubled since 2022. BMW recently set a new quarterly EV sales benchmark in the US. GM says its third-quarter EV sales are up 28% as compared to EV sales earlier this year.

If EV sales are seemingly on the rise, it begs the question of what is behind GM’s decision to take a step back from Silverado EV production. Executive analyst Karl Brauer of iSeeCars‘ sees the move as potentially prudent in the long run. This is made in spite of positive sales trends for individual vehicles and specific statewide trends. Brauer explains. . .

“There seems to be a threshold of around 7%-10% share before EV sales drastically slow down. That’s the situation in California, Oregon, and Washington, where those states have the largest EV share but also the slowest growth in EV share. We are seeing the start of an overall market pushback against electric vehicle sales now that early adopters and environmentalists have their vehicles.”

GM’s slowdown in EV production is actually indicative of caution. The company monitors demand very closely. When considering the lack of profit these vehicles offer, GM’s move actually reads as more calculated than a knee-jerk. Brauer said in an interview with Autoweek . . .

“The profit margins for EVs are much narrower or even non-existent when compared to traditional automobiles. That is when they sell for MSRP. If Ford and GM have to start cutting prices to move these vehicles, the business model rapidly deteriorates. The domestic automakers have never done well when they can’t align production with market demand.”

Of course, pricing plays a big role in the slowdown of EV sales. In fact, the average price of a new EV in the US this August was $53,376, down from $65,688 in August 2022. Factoring in federal and state incentives drops the current going rate into the $45,000 range. However, this still is not affordable for many Americans. No surprise there.

That does not mean US buyers are giving up on EV shopping entirely. Data from Recurrent shows demand for used EVs is up. The used BEV market is outpacing even the most popular new EVs, like Tesla’s Model 3. And the reason behind this is pricing. The average price for a used EV is $27,800, down 32% year-over-year.

Even so, the outlook for automakers in the near future is muddy. Stuck between impending government regulations, challenging engineering costs, and less than a third of dealers signaling confidence in EVs (according to Cox Automotive). Lying in wait may be the safest bet for OEMs. Brauer adds . . .

“There’s this widespread assumption of costs coming down, energy density will go up, and the infrastructure will come together. It paints a great picture, but having an industry move full-speed ahead under those assumptions is extremely risky. And everyone from the automakers to the government regulators knows it, even if they won’t publicly admit it.”

Guess we will have to wait for the GM EV beast to haunt the roads?