This is a good take on what has driven the decline in inflation or at least it is what I believe. Mike has an explanation on the Phillip Curve within his article. I skipped by it as I felt it was addition to the supply side explanation. Or not needed as a part of the explanation. Supply-Side Expansion Has Driven the Decline in Inflation, Roosevelt Institute, Mike Konczal “After two years of persistently rising prices, inflation has finally decelerated in the first half of 2023. The most recent three-month annualized change in the core Personal Consumption Expenditure Price Index (PCE), which excludes volatile energy and food prices, was 2.9 percent—compared with 4.4 percent a year ago or 4.6 percent in January of this year. The deceleration

Topics:

Bill Haskell considers the following as important: Hot Topics, Journalism, politics, supply side, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

This is a good take on what has driven the decline in inflation or at least it is what I believe. Mike has an explanation on the Phillip Curve within his article. I skipped by it as I felt it was addition to the supply side explanation. Or not needed as a part of the explanation.

Supply-Side Expansion Has Driven the Decline in Inflation, Roosevelt Institute, Mike Konczal

“After two years of persistently rising prices, inflation has finally decelerated in the first half of 2023. The most recent three-month annualized change in the core Personal Consumption Expenditure Price Index (PCE), which excludes volatile energy and food prices, was 2.9 percent—compared with 4.4 percent a year ago or 4.6 percent in January of this year.

The deceleration is even more dramatic when it comes to prices faced by consumers: The most recent equivalent number for the Consumer Price Index (CPI) was 3 percent in July, versus 6.4 percent a year ago. This drastic change isn’t just the result of specific industries or specific measurements. And while there is still a way to go to bring inflation back to a sustained lower range (AB: whatever the FED wants and not balanced in reality),. There could be some reversal in declining inflation, the situation is dramatically better now than it was even six months ago.

The labor market has remained strong as this decline in inflation occurred. The unemployment rate averaged 3.6 percent in 2023, with monthly shifts largely reflecting the positive development of more workers entering the labor force. The employment-to-population ratio of 25-to-54-year-olds has reached levels not seen in two decades. Real GDP growth in the first half of 2023 has stayed at a strong 2.2 percent. Many economists believed that this was not possible, that we couldn’t see substantial deceleration in inflation without an increase in unemployment . . . or even a recession.

So, what accounts for the deceleration in inflation? Though most can just be happy inflation is declining, how that is happening has consequences for understanding this economic moment.”

AB: The following take on this is a good analysis to which I would support. Read on . . .

“The analysis in this brief builds on the work of Shapiro (2022) to find that:

- Inflation has fallen at such a speed that it is no longer in the range predicted by a persistent Phillips Curve model trained on data from the 1970s. Scenarios of entrenched, higher inflation are behind us (AB:.So far)

- The majority of disinflation has been driven by expanding supply rather than decreasing demand. Decomposing price and quantity changes for 123 core PCE items, I find 73 percent of all core items, and 66 percent of services, see prices falling with quantities increasing, a sign of expanding supply.

- Using an arbitrary cutoff point, around a third of items could be described as moving straight down. For overall core categories, a weighted 30 percent move straight down; the remaining is split with 36 percent from supply expanding and 34 percent from demand decreasing.

- Supply expansion driving disinflation is even more true when it comes to categories historically having a strong relationship with demand in the economy. The disinflation we’re seeing is therefore broad and could continue.”

AB: I am not going to touch the Phillips Curve stuff. When I first left Loyola after attaining my MA and supposedly going for my Phd, I could probably give a sound (not excellent rendition of this. Instead I will leave it to those who sleep on this basis nightly. Mike Konczal gives a good take of supply versus demand. This means I agree with him. I will add some to it also.

Supply versus Demand

So, how did this happen? There are generally two explanations mainstream economics uses to describe how inflation could fall while the economy remains strong. The first is that we are expanding the supply of the economy.

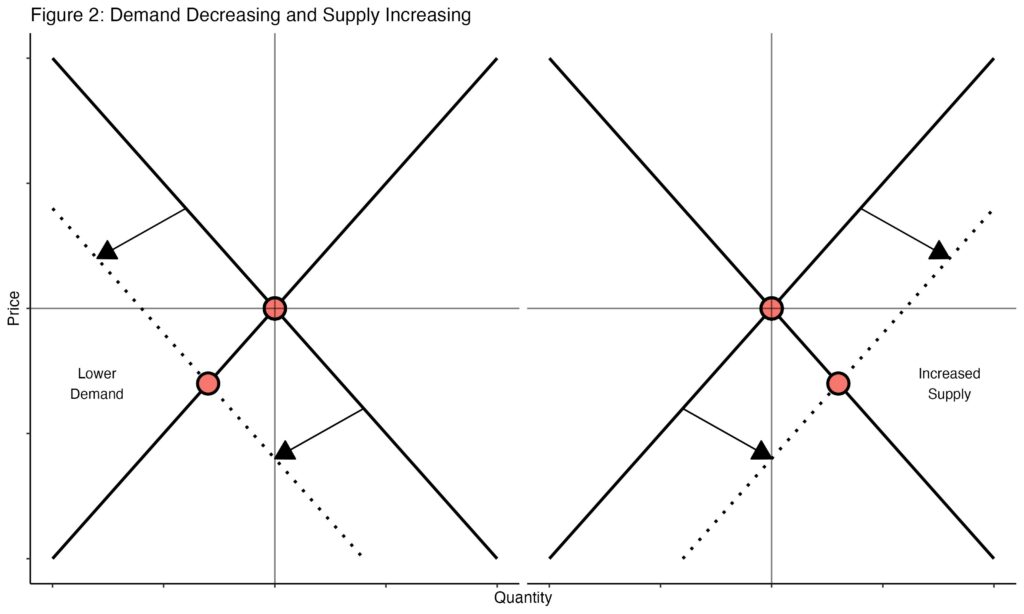

This explanation would say that we are seeing the end of a supply shock and settling of a period of relative price disturbances that characterized the reopening after the deployment of vaccines. Policymakers are also responding to the international economic consequences of Russia’s invasion of Ukraine. Thinking back to an Econ 101 lesson, if increasing supply were the driver of inflation falling, such as in Figure 2, it would result in expanded quantities of items consumed at lower prices.

AB: Guess what? If supply increases and demand is satisfied, Labor requirements decrease. No more OT. This is typical P&IC planning and Materials management which I demonstrated repeatedly at Motorola, Baxter, and Parker Hannifin.

Above Graphs: Supply-Side Expansion Has Driven the Decline in Inflation, Roosevelt Institute, Mike Konczal

AB: Back to Mike Konczal’s Explanation: “The second explanation is we are decreasing demand, but in such a way that just a small decrease in spending has an outsized impact on inflation. (The term used to describe this is “nonlinear” impact—as in, we are on a nonlinear part of the Phillips Curve.) If the economy were too hot in a way that was characterized by nonlinear dynamics, just a little bit of lower demand would cause prices to fall in much higher proportion than any unemployment or slowdown. (AB: In other words there was no need to “whack labor” as Powell wanted. Fix the issue) These kinds of stories would be consistent with lower quantities of items consumed alongside lower prices, or a shift left of an aggregate demand curve.

There is evidence for each. On the supply side, we’ve seen the fall in the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index (GSCPI), which skyrocketed early in the pandemic. The relative proportion of goods and services being purchased is no longer changing and is slightly reverting back to pre-COVID levels. The price level for energy has declined relative to where it was before Russia’s invasion, and commodity markets are stabilizing.

On the demand side, we see nominal wages falling from somewhere between 5 and 6 percent to somewhere between 4 and 5 percent, depending on the measurement. (This is happening even as real wages are increasing, because inflation is falling faster.) These kinds of declines in nominal wages are generally seen only in recessions. Measures of labor market search, like the quits rate and job openings, have fallen substantially. Residential investment, which supports numerous additional industries, has fallen about 14 percent over the past year, while housing inflation slowed.

AB: I am stopping here as this is the explanation, I would have given the current situation and as reason for a return to normal without laying off half the Labor force. The reat of Mike’s article can be found at Roosevelt Institute.