House prices stabilize (or even increase!) for existing homes, while prices have been slashed for new homes. What’s going on? – by New Deal democrat Both the Case Shiller and FHFA housing price indexes were reported this morning through May. To quote each in turn: “The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a -0.5% annual decrease in May, down from a loss of -0.1% in the previous month…. “Before seasonal adjustment, [it] posted a 1.2% month-over-month increase in May…. After seasonal adjustment, [it] posted a month-over-month increase of 0.7%.” Meanwhile, according to the FHFA, “U.S. house prices rose in May, up 0.7 percent from April, according to the [ ]

Topics:

NewDealdemocrat considers the following as important: Hot Topics, House Pricing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

House prices stabilize (or even increase!) for existing homes, while prices have been slashed for new homes. What’s going on?

– by New Deal democrat

Both the Case Shiller and FHFA housing price indexes were reported this morning through May. To quote each in turn:

“The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a -0.5% annual decrease in May, down from a loss of -0.1% in the previous month….

“Before seasonal adjustment, [it] posted a 1.2% month-over-month increase in May…. After seasonal adjustment, [it] posted a month-over-month increase of 0.7%.”

Meanwhile, according to the FHFA, “U.S. house prices rose in May, up 0.7 percent from April, according to the [ ] seasonally adjusted monthly House Price Index. House prices rose 2.8 percent from May 2022 to May 2023.”

Wait a minute! With higher interest rates and a decline in permits and starts for new homes, shouldn’t prices reflect that weakness and be declining? Which is a good way to segue to the post I was oriingally going to put up yesterday, about the fundamental bifurcation in the housing market between new and existing homes. I am indebted to Wolf Richter, who covered this very well at this post.

To cut to the chase: the two sectors are behaving very differently because builders have been able to cut prices sharply, while existing homeowners, wedded to 3% mortgages are unable or unwilling to cut prices and absorb a doubling of their monthly payments due to interest rrat3 increases.

In view of this mornings’ data, let’s look at existing homes first. The median price for an existing home, per last Thursday’s report, was only down -1.2% (Realtor.com only allows FRED to show the last year. Meanwhile, as indicated above, YoY prices as reflected in the Case Shiller report were down only -0.5%, and for the FHFA they actually showed an increase of 2.8%:

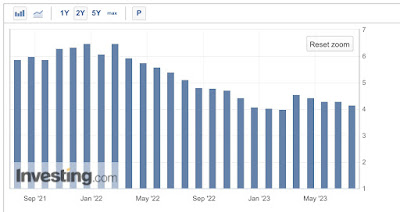

If you’re not going to cut your price, and housing is near record unaffordable levels with a doubling of interest rates from 3% to over 6%, sales are going to suffer pretty drastically. And they have, declining over 35% from peak to new lows as of last Thursday’s report on sales:

Normally I would expect inventory to pick up as a result, but partly because existing owners don’t want to or can’t part with their existing 3% mortgage rates, and partly because of what’s happening with new homes, inventory is at a new record low for June:

Which brings me to new homes. These are more important for the economy, tending to lea it by about 18 months. Here is the exact same graph of new single family home sales over the past 2 years to compare with that for existing home sales as shown above:

These are only down -9% from peak (vs. -36% for existing homes).

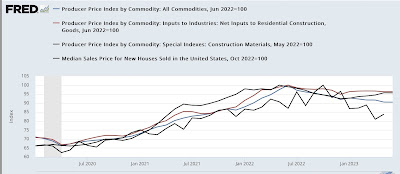

Part of the reason why new house prices spiked was low mortgage rates, but part wa also a sharp increase in commodity prices like for lumber involved in home building. Those peaked in or near June of last year, and are down between 4% and 10% depending on which measure you use. Meanwhile ew home prices followed commondity prices higher, and peaked in October of last year. Since then, the price of the median new home has declined by over 15%! (Shown in black below):

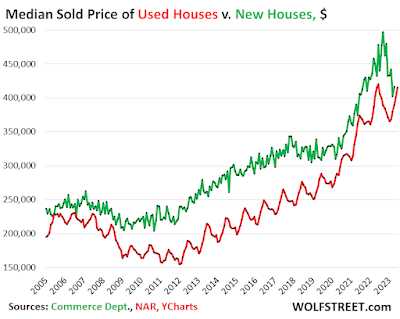

In fact as of the dates of their respective last reports, the median price of a new single family home is only about 0.1% higher than the cost of the median existing home (graph from Wolf Richter):

As you can see from the above graph, typically new homes demand a significant price premium over existing homes – but not now!

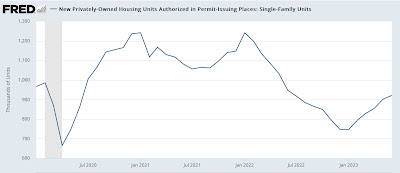

Put this all together, and your can easily imagine that buyers are fleeing existing family homes and flocking to new homes. As a result, these 20% price cuts have resulted in permits for single family homes making up about 40% of their decline from their pre-interest rate hike peaks:

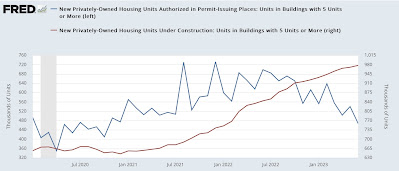

This increase in permits has coincided with a decline to 2.5 year lows in permit for multi-family housing, while the previous surge continues to be reflectedi in the record number of multi-family units under construction:

It is very unlikely that this situation will last very long. Either the prices at which existing hojmes are offered is going to decline, or that for new single family homes is going to increase again. And if it’s the latter, there will be a further decrease in new homes being built.

Housing prices continue to come down – like a feather, Angry Bear, angry bear blog