Housing construction: good news and bad news – by New Deal democrat This morning’s report on housing construction contained both good news and bad news. First, the good news. Both permits (gold in the graph below) and starts (blue) increased, the former by 185,000 on an annualized rate, the latter by 129,000: It is very possible that January’s rate of 1.339 million permits annualized and 1.321 starts will be the low for this cycle. That’s because mortgage interest rates (red, inverted), which along with Treasury yields frequently peak before the Fed finishes hiking interest rates, may very well have done so for this cycle at 7.08% in late October and early November. They declined to 6.09% by early February. As is usual, because permits

Topics:

NewDealdemocrat considers the following as important: Hot Topics, housing construction, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Housing construction: good news and bad news

– by New Deal democrat

This morning’s report on housing construction contained both good news and bad news.

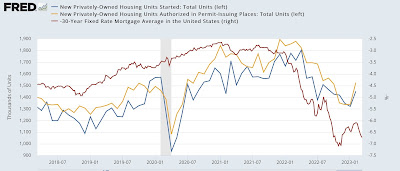

First, the good news. Both permits (gold in the graph below) and starts (blue) increased, the former by 185,000 on an annualized rate, the latter by 129,000:

It is very possible that January’s rate of 1.339 million permits annualized and 1.321 starts will be the low for this cycle. That’s because mortgage interest rates (red, inverted), which along with Treasury yields frequently peak before the Fed finishes hiking interest rates, may very well have done so for this cycle at 7.08% in late October and early November. They declined to 6.09% by early February. As is usual, because permits and starts lag interest rates, the decline in mortgage rates showed up in the increase in permits and starts in this report.

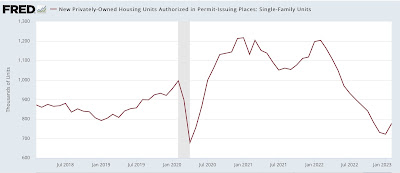

As I have noted many times before, single family permits are the least volatile and most leading of the housing construction data, and these also rose by 55,000 to 777,000 annualized:

So much for the good news. The first bad news is that the decline which has already taken place is still consistent with an oncoming recession.

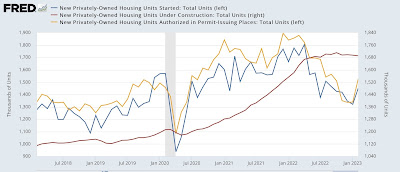

The second, more important piece of bad news is that housing under construction (red in the graph below) was revised lower for December and January, and declined further in February. It is now -1.2% off from its peak:

Since housing under construction is the “real” economic activity, this means that housing is finally putting some downward pressure on the economy as a whole.

It isn’t that significant yet. Typically housing under construction has called more than 10% before a recession has begun. But this month’s report is confirmation that it has begun. Among other things, expect employment in residential construction, which was still increasing albeit by a very small 1,200 jobs in February, to begin to decline in the next few months.

Slight decline in housing construction: the negative actual economic impact has not yet begun, Angry Bear, New Deal democrat