Income tax withholding payments stumble again – by New Deal democrat The important data this week will include new home sales tomorrow, Q1 GDP and initial jobless claims on Thursday, and most importantly of all (imo) real personal income and spending, along with real manufacturing and trade sales on Friday. In the meantime, today let me take another look at a significant coincident indicator, income tax withholding payments, because the situation has changed in the past week. Tax withholding payments have for years been employed as a proxy for jobs. Unfortunately, there’s no monthly or quarterly data published on FRED. The best representation is annual data from 1947 to 2020. Below I show the YoY% change in that annual data, adjusted for

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Income Tax Withholding, Taxes/regulation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Income tax withholding payments stumble again

– by New Deal democrat

The important data this week will include new home sales tomorrow, Q1 GDP and initial jobless claims on Thursday, and most importantly of all (imo) real personal income and spending, along with real manufacturing and trade sales on Friday.

In the meantime, today let me take another look at a significant coincident indicator, income tax withholding payments, because the situation has changed in the past week.

Tax withholding payments have for years been employed as a proxy for jobs. Unfortunately, there’s no monthly or quarterly data published on FRED. The best representation is annual data from 1947 to 2020. Below I show the YoY% change in that annual data, adjusted for inflation, compared with the YoY% change (*3 for scale) in monthly nonfarm payrolls:

Because of a quirk in FRED graphing, it appears that jobs lag tax payments, but that’s just a byproduct of comparing monthly vs. annual data. Had I used annual payroll averages, the peaks and troughs would match exactly (but the jobs data would be less fine-grained). The bottom line is that, while the two haven’t matched exactly, especially in the 1980s, typically the increases and decreases move in tandem.

Turning to the present, last week I cited to the California Department of Revenue, showing that tax payments in that State had declined steeply compared with the prior fiscal year during the last four months of 2022, before stabilizing during the first three months of this year.

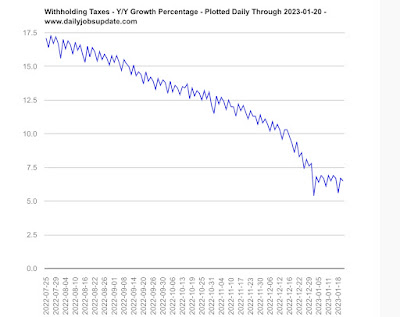

For the nation as a whole Matt Trivisonno has the YoY data, measuring the entire 365 day total of tax withholding vs. the entire previous 365 days, and has a public graph with a 3 month delay. Here’s his latest:

Like the California graph, it shows a steep deceleration during 2022, which had been as high as +21% YoY in March, down to only about +6% by the end of December. Thereafter through January, the YoY data stabilizes.

Indeed, by my own calculations, for the first three months of fiscal 2023 ending December 31, withholding tax payments were only up +1.2% YoY. But for Q2 they rebounded sharply, up +5.4% YoY.

But in the last 10 days they have stumbled. For the first 14 withholding days in April, payments are down -3.4%, $189.7 Billion vs. $196.3 Billion one year ago. For the last 4 weeks as a whole, withholding payments are down -5.0%, $270.2 Billion vs. $284.5 Billion.

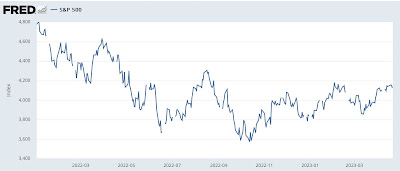

What is notable about that, in addition to including the April 18 deadline for payment of taxes this year, is that the CA Department of Revenue had suggested that the late 2022 stumble was due to stock market declines meaning that stock options hadn’t vested.

Well, since last October the stock market has rallied, and last week was very close to an 8 month high:

Only a short term shortfall at this point, and of course it could reverse by the end of the month, but if stock options are vesting and withholding payments are still down, even before accounting for inflation, that suggests renewed trouble in the jobs market.