One of the last of the positive short leading indicators rolls over – by New Deal democrat The only economic release today of any significance was the ISM non-manufacturing index, which tracks services. It is only about 25 years old, and is not a leading indicator the way its sibling manufacturing index is, but for the record in March it showed slight expansion at 51.2. Here is its entire history: Its new orders subindex came in at 52.2. Lest you think that it sounds an “all-clear,” in December 2007, the first month of the Great Recession, the index came in at 54.4, and new orders at 53.9. The history is, services decline only after goods. Goods lead into the recession, then services join. In that vein, yesterday we got confirmation that

Topics:

NewDealdemocrat considers the following as important: politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

One of the last of the positive short leading indicators rolls over

– by New Deal democrat

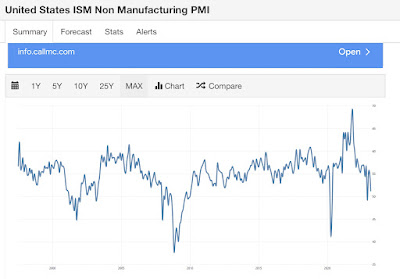

The only economic release today of any significance was the ISM non-manufacturing index, which tracks services. It is only about 25 years old, and is not a leading indicator the way its sibling manufacturing index is, but for the record in March it showed slight expansion at 51.2. Here is its entire history:

Its new orders subindex came in at 52.2. Lest you think that it sounds an “all-clear,” in December 2007, the first month of the Great Recession, the index came in at 54.4, and new orders at 53.9. The history is, services decline only after goods. Goods lead into the recession, then services join.

In that vein, yesterday we got confirmation that one of the last short leading indicators which had not turned down, has finally unequivocally done so. Durable goods orders (blue) and consumer durable goods orders (red) both declined for the second month in a row. Meanwhile capital goods orders less defense and aircraft (gold) also declined slightly, and remain below their high from last August, having trended essentially sideways since then:

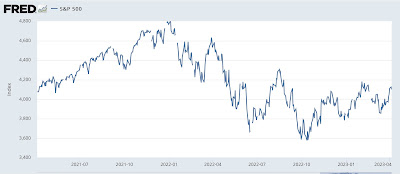

At this point there is not a single short leading indicator – including even initial jobless claims – that has not retreated from their best level. Aside from jobless claims, the only other short leading indicator showing signs of life is stock prices as measured by the S&P 500. These made a new 3 month high in early February, and haven’t made a new 3 month low since last October, so for the short term count as a positive:

But if they fail to make a new 3 month high by early May, they too will retreat to a neutral. And of course, they remain below their all-time high from January 2022.

Finally, here is what the other 3 big coincident monthly indicators aside from payrolls look like, normed to 100 as of last October:

Real personal income less government transfers looks like it may have made a peak as well. Real manufacturing and trade sales jumped in January, but with a -0.8% decline in its real retail sales component in February, manufacturing and wholesale sales will have to jump in February in order to avoid a decline in that as well.

Not only do I continue to believe that a recession is near at hand, but there is a non-trivial possibility that, after revisions are all in, the NBER will determine that a cycle peak occurred in January, nonfarm payrolls notwithstanding.