CPI less shelter up only 0.7% in last 11 months (0.8% annualized rate) – by New Deal democrat Let me cut to the chase right from the outset: except for the very lagging measures of shelter; motor vehicle parts, repairs and insurance; and to a lesser and waning extent, food; consumer inflation is now well-contained and close to the Fed’s target rate. First, let’s look at the headlines, with the monthly and YoY rates of change: Total CPI up 0.1% m/m and 4.0% YoY (lowest since April 2021) Core CPI up 0.4% m/m and 5.3% YoY (lowest since November 2021) CPI less shelter up +0.1% and 2.2% YoY (lowest since February 2021) Core CPI less shelter up +0.3% and 3.4% YoY Energy down -1.2% m/m and down -11.7% YoY Food up +0.2% m/m and up

Topics:

NewDealdemocrat considers the following as important: Hot Topics, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

CPI less shelter up only 0.7% in last 11 months (0.8% annualized rate)

– by New Deal democrat

Let me cut to the chase right from the outset: except for the very lagging measures of shelter; motor vehicle parts, repairs and insurance; and to a lesser and waning extent, food; consumer inflation is now well-contained and close to the Fed’s target rate.

First, let’s look at the headlines, with the monthly and YoY rates of change:

Total CPI up 0.1% m/m and 4.0% YoY (lowest since April 2021)

Core CPI up 0.4% m/m and 5.3% YoY (lowest since November 2021)

CPI less shelter up +0.1% and 2.2% YoY (lowest since February 2021)

Core CPI less shelter up +0.3% and 3.4% YoY

Energy down -1.2% m/m and down -11.7% YoY

Food up +0.2% m/m and up 6.7% YoY (lowest since December 2021)

New cars up +0.2% m/m and 4.7% YoY (lowest since May 2021)

Transportation services (parts, insurance, repairs): up +0.8% and up +10.3% YoY (vs. October 2022 peak of 15.3%)

Owners Equivalent Rent up 0.6% m/m and 8.0% YoY (down -0.1% from all time YoY high)

This is the same pattern as we saw last month ago, just even more amplified: “Lowest since…” for almost everything *except* shelter, which is close to its all-time YoY high set one month ago.

And let me further headline that fact right here: CPI less shelter since last June is only up 0.7%:

That’s an annualized rate of 0.8%.

Keep in mind that shelter component of official inflation, which is 1/3rd of the total, and 40% of the “core” measure, badly lags the real data – as in, by a year or more.

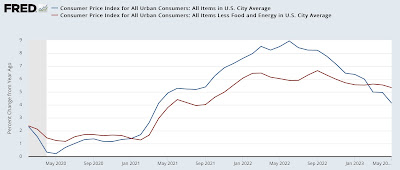

Next, here is the YoY% change in headline inflation (blue), core inflation (red), and inflation ex-shelter (gold)

Both have been in decelerating trends since last June (headline and ex-shelter) or last September (core).

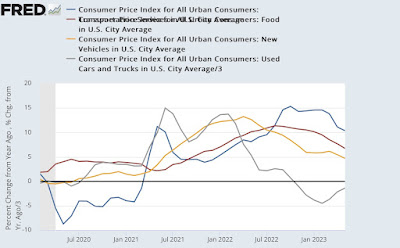

Here are the other big drivers of inflation for the past several years outside of shelter: food (blue), new vehicles (gold), used vehicles (gray), and transportation services (red, /4 for scale!):

All of these are well off their highs, and used vehicles have been negative YoY for a number of months. Aside from food, which is weighted at 13.4% of the total, transportation services are only 5.9%, and new and used vehicles combined only 7.0%.

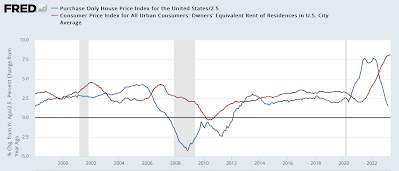

Next, because of the importance of shelter to my analysis, here is an updated long term YoY graph of the big culprit, Owner’s Equivalent Rent (blue), which increased another 0.5% in April, with the FHFA house price index (red, /2.5 for scale), which has been declining since last June and was up 4.0% as of its last reading for February:

Exactly as I have been saying for the past 18 months, house prices dragged OER higher and with it the CPI indexes, with about a 12 month delay. House prices on a YoY basis plateaued for a year between late spring 2021 and mid year 2022, and now OER has finally plateaued as well. The only remaining issue is how long it will remain at that plateau before it follows house prices back down.

Finally, here is “sticky” core inflation ex-shelter:

Even this measure is declining, although less than a “non-sticky” index would be.

As noted above, the FHFA index is only up 3.6% YoY as of March. If it has continued to decline in the 2 months since then at the same rate, it is only up about 2.0% YoY currently, vs. 8.0% for OER. If the FHFA index were substituted for OER, then total YoY CPI for May would only be 2.7%. Core inflation would only be up 3.5%. Neither of these warrants continued restrictive interest rate policy.

In summary, properly measured inflation is no longer a significant issue. Even if OER is a valid way to measure housing inflation, because of the serious lag the Fed should be relying on house prices, and at very least pause.

House prices may have bottomed, YoY price increases (leading inflation) have declined, Angry Bear, New Deal democrat.

Have We Whipped Inflation Now? Angry Bear, Dean Baker, CEPR.