Driven by frozen inventory, repeat home prices continue to increase, but downward pressure on shelter inflation remains – by New Deal democrat Our last piece of important housing information for the month was released this morning; namely repeat home sale prices as measured by the FHFA and Case Shiller. The former increased by 0.6%, and the latter by 0.3%, continuing their increases since the beginning of this year: On a YoY basis, the FHFA Index is up 6.1%, while the Case Shiller Index is up 3.9%: As repeat sales, by definition these are existing home sales, and the increases in these indexes are similar (on a non-seasonally adjusted basis) to the last year’s record in the NAR data: The story continues to be that many

Topics:

NewDealdemocrat considers the following as important: home prices, Hot Topics, Shelter Inflation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Driven by frozen inventory, repeat home prices continue to increase, but downward pressure on shelter inflation remains

– by New Deal democrat

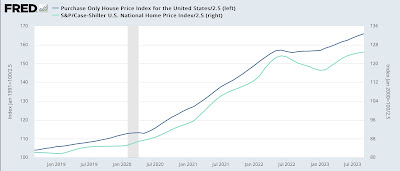

Our last piece of important housing information for the month was released this morning; namely repeat home sale prices as measured by the FHFA and Case Shiller. The former increased by 0.6%, and the latter by 0.3%, continuing their increases since the beginning of this year:

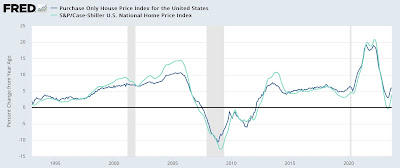

On a YoY basis, the FHFA Index is up 6.1%, while the Case Shiller Index is up 3.9%:

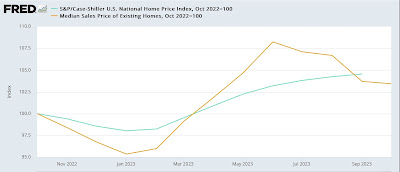

As repeat sales, by definition these are existing home sales, and the increases in these indexes are similar (on a non-seasonally adjusted basis) to the last year’s record in the NAR data:

The story continues to be that many existing homeowners are frozen in place by 3% mortgages. They are not selling and saddling themselves with new 7% or 8% mortgages. So inventory is way down, and buyers, especially entry level buyers, have to compete for that small inventory. This is completely different from the new home market, where homebuilders are using mortgage rebates and other incentives, such as smaller home sizes, to lower the cost to buyers, and so sales have not suffered nearly as much.

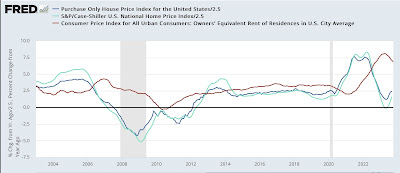

Finally, because sales prices lead the CPI measure for shelter via fictitious Owners’ Equivalent Rent, here is the YoY comparison of each:

The upturn in repeat sales prices will probably have some softening effect on the downward slope of OER in the months ahead, but the expected downward slope remains very much intact.

Two year low in new home prices and turndown in sales show renewed pressure caused by increased mortgage rates, Angry Bear, New Deal democrat