Initial jobless claims: a little soft, but continued expansion signaled – by New Deal democrat I’ll put up an analysis of this morning’s CPI later. In the meantime, initial jobless claims rose 21,000 last week to 248,000. The more important 4 week moving average rose 2,750 to 231,000. With a one week delay, continuing claims declined -8,000 to 1.684 million: On an absolute level, all of this remains very good. The YoY% changes are more important for forecasting purposes. There, for the week initial claims are up 15.9% YoY. However, the 4 week moving average is only up 7.9% – far too low an increase to be consistent with any imminent recession. Continuing claims remain very elevated YoY, up 24.6%: Remember, because YoY claims did not

Topics:

NewDealdemocrat considers the following as important: continuing jobless claims, Hot Topics, New Deal Democratic, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Initial jobless claims: a little soft, but continued expansion signaled

– by New Deal democrat

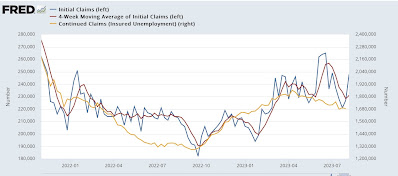

I’ll put up an analysis of this morning’s CPI later. In the meantime, initial jobless claims rose 21,000 last week to 248,000. The more important 4 week moving average rose 2,750 to 231,000. With a one week delay, continuing claims declined -8,000 to 1.684 million:

On an absolute level, all of this remains very good.

The YoY% changes are more important for forecasting purposes. There, for the week initial claims are up 15.9% YoY. However, the 4 week moving average is only up 7.9% – far too low an increase to be consistent with any imminent recession. Continuing claims remain very elevated YoY, up 24.6%:

Remember, because YoY claims did not cross the 12.5% threshold for 2 full months, we re-set the clock. While claims suggest a slight increase in the unemployment rate on the order of 0.2%-0.3% in the next few months, that is not nearly enough to trigger the Sahm Rule.

In short, a little softness, but no recession signaled.

Jobless claims: a good example of why my forecasting discipline demands a confirmed trend, Angry Bear, New Deal democrat