Manufacturing and construction have the most positive reports all year – by New Deal democrat As usual, the monthly data starts out with reports on the two most important production sectors of the economy, namely manufacturing (for September) and construction (for August). For a change, the news was mainly positive. Let’s start with manufacturing. The ISM’s diffusion index, where any value below 50 indicates contraction, came in negative for the 11th month in a row for the total index, and the 13th month in a row for new orders (not shown): How is that consistent with the news being “mainly positive?” Because both numbers were the highest this year, with the total improving +1.2 to 49.0, and new orders improving +2.4 to 49.2. The ISM

Topics:

NewDealdemocrat considers the following as important: Hot Topics, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Manufacturing and construction have the most positive reports all year

– by New Deal democrat

As usual, the monthly data starts out with reports on the two most important production sectors of the economy, namely manufacturing (for September) and construction (for August). For a change, the news was mainly positive.

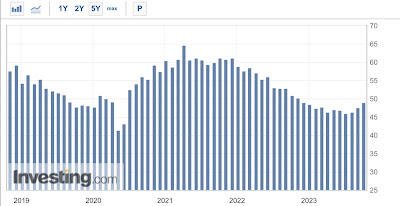

Let’s start with manufacturing. The ISM’s diffusion index, where any value below 50 indicates contraction, came in negative for the 11th month in a row for the total index, and the 13th month in a row for new orders (not shown):

How is that consistent with the news being “mainly positive?” Because both numbers were the highest this year, with the total improving +1.2 to 49.0, and new orders improving +2.4 to 49.2. The ISM itself indicates that numbers above 48 typically are *not* associated with recessions.

In other words, across all sectors manufacturing may still be contracting, but only slightly. And because this is a diffusion index, and vehicle manufacturing has been improving this year, the news has probably been better on a $ weighted basis than based on this diffusion.

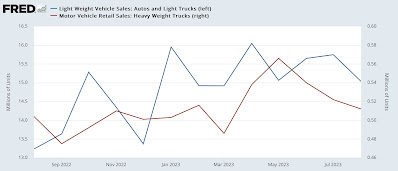

If there is a fly in the ointment here, it is in the aforesaid vehicle manufacturing. Data for sales of passenger vehicles and heavy trucks are both reported with a 4 week delay, meaning we got August’s report last Friday.

And here, we see that both sectors turned down in August. In particular, heavy weight truck sales have been declining since May:

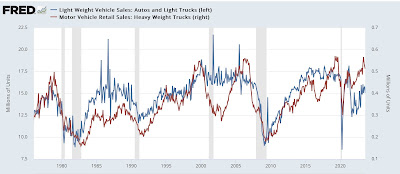

The possible peak in heavy truck sales is most important because historically heavy truck sales turn down first – and decisively – in advance of recessions:

In general, a downturn from peak of more than -10% in heavy truck sales has been signal rather than noise. We’re not quite there, but it’s getting close.

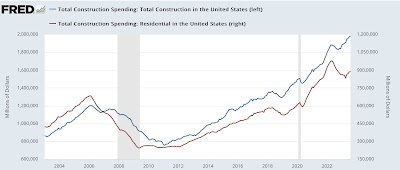

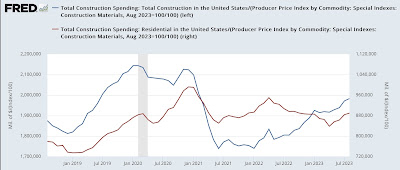

Now let’s look at the other leading sector of construction. Here the news was totally positive, as both total and residential construction improved on both a nominal and real basis. Nominally total construction spending made another all-time high, while residential construction spending was the higher since last October:

Since the cost of construction materials actually declined -0.1% in August, in real terms the results were even slightly better, although total construction spending has not surpassed its post-pandemic peak:

In sum, while there are several soft spots warranting caution, this was the most positive set of manufacturing and construction reports so far this year.

Manufacturing and construction reports give very mixed signals to start Second Half 2023 data, Angry Bear, New Deal democrat