October industrial and manufacturing production tank – but it’s all about the UAW strike – by New Deal democrat Industrial production historically has been the King of Coincident Indicators, turning up and down coincident with the onset and end of recessions in the past. But there are signs that has changed in the past 20+ years since China was admitted to normal trade relationships with the US. Because manufacturing is a much smaller share of domestic economic activity, and employment, downturns which before 2000 would always have meant recession probably do not do so now. Which is a particularly apt introduction this month, because in October industrial production declined -0.6%, and there was a -0.2% revision to September. Manufacturing

Topics:

NewDealdemocrat considers the following as important: manufacturing, NewDealdemocrat, UAW, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

October industrial and manufacturing production tank – but it’s all about the UAW strike

– by New Deal democrat

Industrial production historically has been the King of Coincident Indicators, turning up and down coincident with the onset and end of recessions in the past. But there are signs that has changed in the past 20+ years since China was admitted to normal trade relationships with the US. Because manufacturing is a much smaller share of domestic economic activity, and employment, downturns which before 2000 would always have meant recession probably do not do so now.

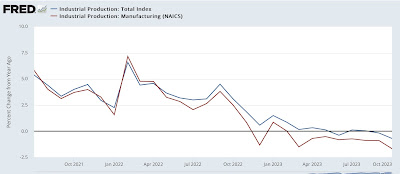

Which is a particularly apt introduction this month, because in October industrial production declined -0.6%, and there was a -0.2% revision to September. Manufacturing production declined -0.7%, and September was revised down by -0.1%. The below graph norms both measures to 100 as of their peaks last autumn:

Production is down -0.8% from its peak, and manufacturing down -1.7%.

BUT, let’s put a spotlight on the very important role that the UAW strike played in this month’s number. Indeed, the Fed’s release itself notes that “the index for manufacturing excluding motor vehicles and parts edged up 0.1%.” Obviously the total index would have been much better as well, although whether it would be positive or not I cannot say at this point.

On a YoY basis, production is down 0.7%, and manufacturing down -1.7%:

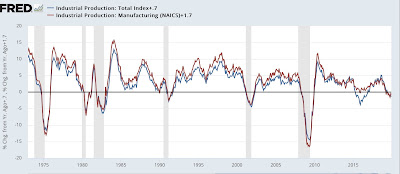

Before 2000, these types of declines would always have meant a recession was upon us, and indeed underway, as shown in the below graph which norms the current YoY comparisons to zero:

But we had equivalent, and worse, declines in 2015-16 and 2019, all without recessions. This doesn’t mean that production is no longer relevant, just that it is going to take sharper declines to signal recessions – and we’re not there, particularly in light of the role played by the UAW strike.

The motor vehicle industry has been an important reason why past pattens haven’t necessarily been relevant here. Chip shortages curtailed production until earlier this year. Motor vehicle production hit an all-time high in July, but there was a-10.0% decline in October:

On a YoY basis (not shown), motor vehicle production is down -6.6%. In the past 50 years, there have been occasional bad months like this without signaling anything worse. The big decline last month was almost certainly all about the strike, and probably so were the earlier occasions.

The bottom line this month is to take it with a particularly large helping of salt. Absent the strike, there is no way of knowing whether the uptrend in production since June of last year is attenuating or not. We’ll have to wait one more month to see how the post-strike landscape compares.