Q2 GDP indicates continued good expansion now, but more storm clouds gathered ahead – by New Deal democrat Now let’s deal with this morning’s big news: real GDP improved at a perfectly respectable 0.6% over the first Quarter of this year: This works out to a 2.4% annualized rate. Although it continues the slowdown from the white hot 2021 numbers, it would be average for the economy since the turn of the Millenium. As per my usual practice, though, I want to focus on those parts of the report which tell us where the economy is likely headed: real private residential investment (a proxy for housing) and proprietors income (a placeholder for corporate profits, which won’t be reported for another month). And the bottom line is, both were

Topics:

NewDealdemocrat considers the following as important: GDP, New Deal Democrat, private residential, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Q2 GDP indicates continued good expansion now, but more storm clouds gathered ahead

– by New Deal democrat

Now let’s deal with this morning’s big news: real GDP improved at a perfectly respectable 0.6% over the first Quarter of this year:

This works out to a 2.4% annualized rate. Although it continues the slowdown from the white hot 2021 numbers, it would be average for the economy since the turn of the Millenium.

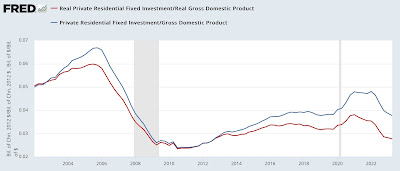

As per my usual practice, though, I want to focus on those parts of the report which tell us where the economy is likely headed: real private residential investment (a proxy for housing) and proprietors income (a placeholder for corporate profits, which won’t be reported for another month).

And the bottom line is, both were negative – housing for at least the 5th Quarter in a row..

Professor Edward Leamer gave a famous lecture almost 20 years ago showing that nominally, housing as a share of GDP turned down on average 7 quarters before a recession began. As indicated above, that metric (blue in the graph below) has now been down for 5 quarters. Measured in real terms (red), it has been considerably longer than that:

Taken strictly by itself, this metric argues that the most likely time for the onset of a recession is autumn (Q4) of this year.

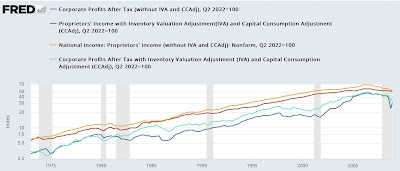

The second long leading indicator, according to a lengthy history discussed several decades ago by Prof. Geoffrey Moore, is corporate profits deflated by unit labor costs. We con’t have unit labor costs yet for Q2, but these have been rising sharply in this expansion. And corporate profits themselves won’t be reported for one more month. So I make use of the placeholder of proprietors’ income, which typically turns either several quarters later than, or simultaneously with, corporate profits.

Here’s their historical record:

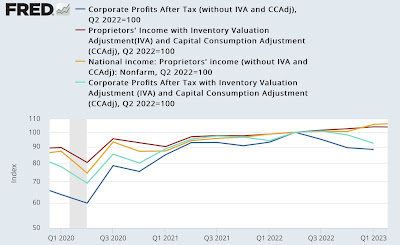

And here’s what they look like so far in this post-pandemic expansion:

Corporate profits turned down in Q2 or Q3 of last year, depending on how you measure. Proprietors’ income, as reported this morning, declined -0.3% in Q2, after peaking nominally in Q1.

Finally, let me take a look at a very important coincident indicator, real personal consumption expenditures. The monthly numbers, especially for services, have continued to rise sharply YoY. For the first two months of Q2, they are only up 0.2% from Q1, and will be updated tomorrow.

But the GDP report shows that real PCE’s rose 0.4% in Q2, suggesting that tomorrow’s personal consumption report is going to be very positive:

While there’s lots more that can be discussed, today’s preliminary GDP report for Q2 indicates an economy that continued to perform very well, but is going to come under increasing pressure in the quarters just ahead. In short, we’re not in recession now, but one continues to look like it is on the table for the very near future.

June housing report: a tale a two diametrically opposed sectors, Angry Bear, New Deal democrat.