Real manufacturing and trade sales probably rose to a new record high in February; may have declined in March – by New Deal democrat Real manufacturing and trade sales is one of the 4 monthly coincident indicators most monitored by the NBER to determine whether the economy is in expansion or recession. Because the reporting of this series lags badly (by 2 months), I have developed several placeholders to estimate it on a more timely basis. The first back of the envelope method is a simple averaging of industrial production and real retail sales. The latter is about 1/3rd of the actual measure of real business sales, and the former is a proxy for manufacturers and wholesalers sales (what it leaves out is manufacturers’ inventories and the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Real manufacturing and trade sales probably rose to a new record high in February; may have declined in March

– by New Deal democrat

Real manufacturing and trade sales is one of the 4 monthly coincident indicators most monitored by the NBER to determine whether the economy is in expansion or recession. Because the reporting of this series lags badly (by 2 months), I have developed several placeholders to estimate it on a more timely basis.

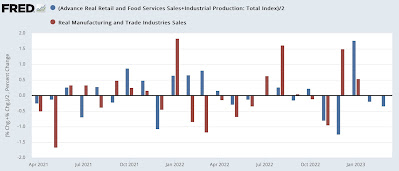

The first back of the envelope method is a simple averaging of industrial production and real retail sales. The latter is about 1/3rd of the actual measure of real business sales, and the former is a proxy for manufacturers and wholesalers sales (what it leaves out is manufacturers’ inventories and the wholesalers’ portion). It isn’t that accurate on a month to month basis, but generally gets the trend right.

Since this morning both real retail sales and industrial production were reported for March, we have our first estimate of March real business sales, suggesting they more likely than not declined, at an estimate of -0.6%. Note that February is also estimated to have declined -0.4% by this method:

The second method, which has been much more accurate on a monthly basis (generally coming in within +/-0.3%) as well as the trend, is to take total business sales (which were reported this morning) and to apply a simple average deflator of the PPI for commodities, intermediate, and finished goods as well as the CPI. Since total sales declined very slightly on a nominal basis (less than -0.1%) for February, but the average deflator was negative, this suggests that real manufacturing and trade sales actually increased in February by +0.2%:

If this holds, it will mean that this important coincident indicator made another new high in February:

But as per the first estimating method above, may have declined in March.

–