Real average wages and real aggregate payrolls for December 2022 – by New Deal democrat Now that we know December consumer inflation, we can see how the American working/middle class is “really” doing. Nominally, average wages for nonsupervisory workers increased 0.2%, while prices deflated by -0.1%, meaning that “real” average wages increased 0.3% for the month: While this only returns them to April’s level, and -2.2% below their December 2020 interim peak, they are also 1.5% higher than their pre-pandemic levels, and more importantly 1.3% above their recent June 2022 lows. Essentially all of the volatility in 2022 can be laid at the feet of the huge increase, then huge decrease, in gas prices. Aggregate real payrolls tell us how

Topics:

NewDealdemocrat considers the following as important: politics, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Real average wages and real aggregate payrolls for December 2022

– by New Deal democrat

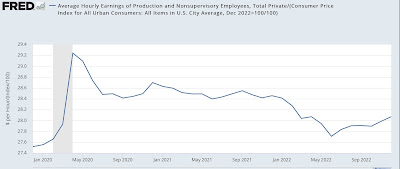

Now that we know December consumer inflation, we can see how the American working/middle class is “really” doing.

Nominally, average wages for nonsupervisory workers increased 0.2%, while prices deflated by -0.1%, meaning that “real” average wages increased 0.3% for the month:

While this only returns them to April’s level, and -2.2% below their December 2020 interim peak, they are also 1.5% higher than their pre-pandemic levels, and more importantly 1.3% above their recent June 2022 lows. Essentially all of the volatility in 2022 can be laid at the feet of the huge increase, then huge decrease, in gas prices.

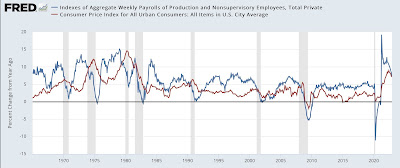

Aggregate real payrolls tell us how much, in full, nonsupervisory workers are earning in “real” terms. As I noted again the other day, in the past whenever YoY inflation has been higher than YoY aggregate payrolls, a recession has either just started or was about to start:

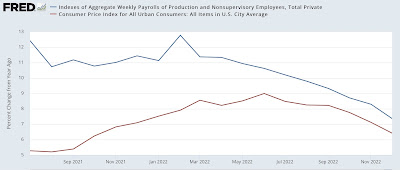

With the addition of December consumer prices, here’s what that graph looks like for the past year and a half:

Since September, YoY aggregate payrolls and YoY consumer inflation have decelerated almost in lockstep, with payrolls growing faster than inflation by 1.0% +/-0.1%. In December it was just below 1.0%.

This is consistent with a very slow expansion.

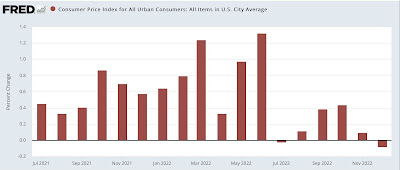

I don’t have any special tools for divining how the net difference between the two will play out over the coming months, but I do suspect that the big decline in gas prices has ended, for seasonal reasons if for nothing else. If over the next 6 months till July 4 gas prices rise seasonally more in keeping with years’ past, let’s say to $3.75/gallon, that will probably give us a monthly inflation rate of about +0.3%. Here’s what that would look like in comparison with the past year and a half:

Between January and June of 2022, consumer prices rose on average just shy of +0.9%/month. A decrease of -0.6%/month to +0.3% would give us YoY CPI of about 3% at mid-year. It’s a decent possibility that aggregate payrolls remain above that number by then, which would mean we probably skirt a recession.

We’ll see.

“Real average and aggregate non-managerial wages for November,” Angry Bear, angry bear blog