Updating some important coincident indicators – by New Deal democrat We returned to no more significant monthly data today. So here are some important coincident indicators I’ve been particularly following. Redbook consumer purchases only increased 4.3% YoY last week, the lowest number in almost 2 years. The 4 week average also declined to 4.7%, also a 2 year low: This strongly suggests that the January retail sales report, which will be published next week, will be negative again in real inflation-adjusted terms, implying a further weakening of YoY employment gains in the months ahead. The American Staffing Index also had its second negative YoY reading in a row: This tends to correlate with temporary jobs in the nonfarm payrolls

Topics:

NewDealdemocrat considers the following as important: New Deal Democrat, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Updating some important coincident indicators

– by New Deal democrat

We returned to no more significant monthly data today. So here are some important coincident indicators I’ve been particularly following.

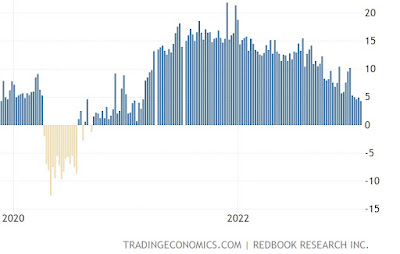

Redbook consumer purchases only increased 4.3% YoY last week, the lowest number in almost 2 years. The 4 week average also declined to 4.7%, also a 2 year low:

This strongly suggests that the January retail sales report, which will be published next week, will be negative again in real inflation-adjusted terms, implying a further weakening of YoY employment gains in the months ahead.

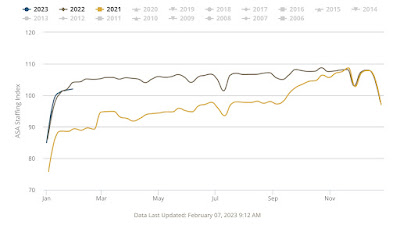

The American Staffing Index also had its second negative YoY reading in a row:

This tends to correlate with temporary jobs in the nonfarm payrolls report, and argues the YoY comparison there, which just turned negative there, will worsen in the next monthly jobs report.

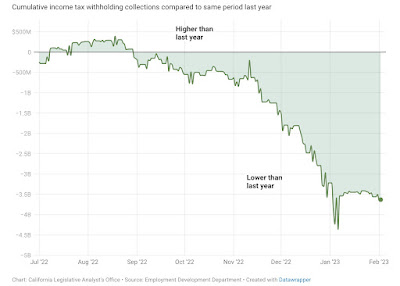

On the other hand, withholding tax payments, which were up 5.4% YoY in January, are also higher 5.4% YoY for the first week of February. Here’s an up to date chart from the California Treasurer’s Office (CA being 12% of the US population), showing the stabilization in payments in January:

Finally, here’s the Lewis-Martens-Stock Weekly Economic Index:

This index so far has stubbornly refused to turn negative (which is after all a good thing).

Three most quickly reported measures of coincident indicators – all of which are close to turning negative, Angry Bear, New Deal democrat.