– by New Deal democrat This is a continuation of my post from yesterday discussing the large divergences between the Household and Establishment jobs surveys. A big current issue with the Household Survey is whether, by relying on Census estimates, it has substantially underestimated population growth, and in particular immigration-driven growth, in the past two years. Here’s a graph from Wolf Street, the source material of which I have verified, that sums it up: In the past two years through May, according to the Census Bureau, the US population has grown by a little over 1%. But according to the Congressional Budget Office, it has grown slightly over 2%. That’s over a 3,000,000 difference! If the Household Survey data were normed to

Topics:

NewDealdemocrat considers the following as important: immigration, population

This could be interesting, too:

Angry Bear writes Immigrants and the Makeup of the US Workforce

Joel Eissenberg writes Annals of “government efficiency”

Eric Kramer writes Somebody better call DOGE . . .

Joel Eissenberg writes Trump takes NYC hostage

– by New Deal democrat

This is a continuation of my post from yesterday discussing the large divergences between the Household and Establishment jobs surveys.

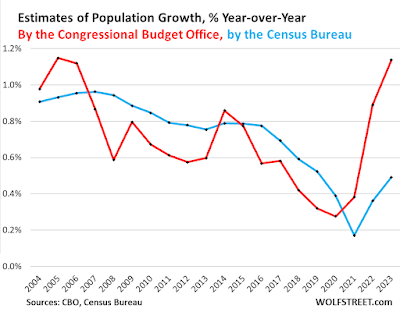

A big current issue with the Household Survey is whether, by relying on Census estimates, it has substantially underestimated population growth, and in particular immigration-driven growth, in the past two years. Here’s a graph from Wolf Street, the source material of which I have verified, that sums it up:

In the past two years through May, according to the Census Bureau, the US population has grown by a little over 1%. But according to the Congressional Budget Office, it has grown slightly over 2%. That’s over a 3,000,000 difference!

If the Household Survey data were normed to the CBO estimates, what would it look like? A couple of basic assumptions should give us a good back-of-the-envelope estimate. Those two assumptions are; (1) the immigration is from Latin America; and (2) it is younger, in the prime working age demographic, plus their children, vs. the native born population.

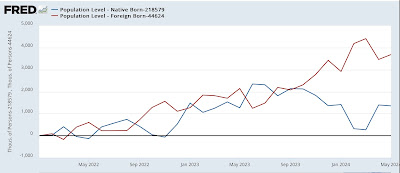

Here’s the difference those two assumptions make. First, here is the difference between growth in the native-born population vs. foreign born population:

The total US population is about 336,000,000. Since the beginning of 2022, the native born population has only grown by less than 1.4 million, or only 0.6%; while the foreign born population has grown by 3.7 million, or 8.3% – and remember, these are the Census Bureau numbers, which the CBO data indicates sharply underestimate immigration during that time.

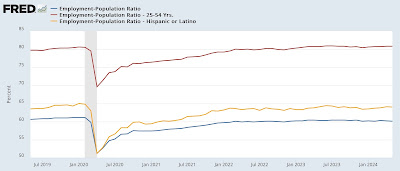

Now, here’s the employment/population ratio for the US population as a whole, vs. the Hispanic or Latino segment (gold), as well as the prime working age component (red) in the past 2+ years:

Now let’s crunch some numbers based on the CBO estimates, and making use of the assumptions above.

Cumulatively since March 2022 the CBO estimates show an additional 1% growth in population, or roughly 3.36 million, vs. the Census Bureau.

Further, the overall employment/population ratio over the past two years is roughly 60%, vs. 64% for the Latin American ethnic group. (I’m being conservative here, assuming working age immigrants have been bringing their children, who obviously are not in the 25-54 demographic).

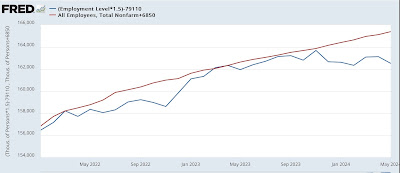

A 64% employment ratio for an additional 3.36 million people generates an additional 2 million+ employees vs. using the Census Bureau estimates.

Now let’s show that in graphs. Through the magic of algebra, here is what the adjusted Household Survey would look like if an additional 2 million jobs were gradually added over the past two years (blue) vs. the Establishment Survey (red):

And here is what the YoY% growth would look like:

There is, as per usual, additional noise, but the adjusted Household Survey would show almost as many jobs as the Establishment Survey through the end of last year, before performing poorly (so far!) this year – but still within the range of noise.

Additionally, with the adjusted Household Survey growing 1.8% YoY in 2023 (vs. 2.0% for the Establishment Survey, it is closer to the QCEW census of 1.5% growth as of its last update.

In short, if the Household Survey has been underestimating prime working age population growth, adjusting for that solves most of the discrepancy with the Establishment Survey. But note that the above analysis only addresses *employment,* and not the unemployment rate. That analysis will be the basis of yet another post.

Demographic Outlook 2024 to 2054 Part 1: Factors Contributing to Population Growth, Angry Bear

Demographic Outlook 2024 to 2054 Part II: Population Used by CBO to Project the Labor Force, Angry Bear

Just Some Census Stats, Angry Bear

US Immigration: How many people are coming to the US and where are they coming from? Angry Bear

The recessionary Household Jobs Survey is not confirmed by other comprehensive hard data, Angry Bear, by New Deal democrat