[embedded content] WSJ. President Biden’s unprecedented release of oil from the U.S. petroleum reserves in 2022 turned the White House into an unusually active player in the volatile crude market. The flood of emergency supplies helped arrest surging oil prices after Russia invaded Ukraine and pulled billions of dollars into the Energy Department’s coffers in the process. Oil prices have sputtered since and allowed officials who sold high to start replenishing U.S. stockpiles on the cheap. The question that will echo from Washington to Wall Street in 2024 is how the Biden administration might finish off a trade many investors would envy. The Energy Department says it has already snapped up about 13.8 million barrels of crude, with accelerating

Topics:

Bill Haskell considers the following as important: Hot Topics, politics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

WSJ. President Biden’s unprecedented release of oil from the U.S. petroleum reserves in 2022 turned the White House into an unusually active player in the volatile crude market. The flood of emergency supplies helped arrest surging oil prices after Russia invaded Ukraine and pulled billions of dollars into the Energy Department’s coffers in the process.

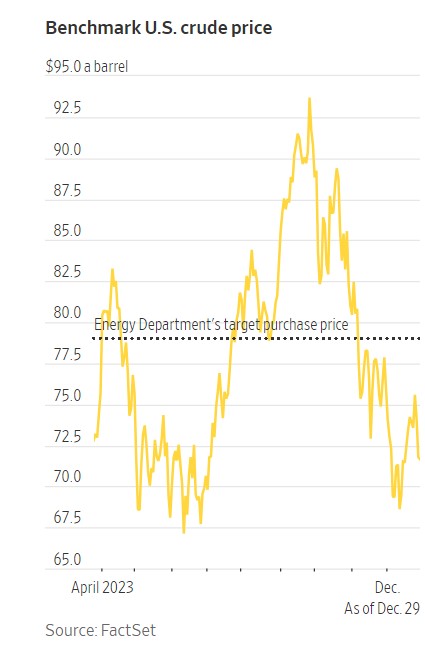

Oil prices have sputtered since and allowed officials who sold high to start replenishing U.S. stockpiles on the cheap. The question that will echo from Washington to Wall Street in 2024 is how the Biden administration might finish off a trade many investors would envy.

The Energy Department says it has already snapped up about 13.8 million barrels of crude, with accelerating deals in recent weeks signaling the agency could move more aggressively in 2024.

At an average price of $75.63 a barrel, the purchases so far total a nearly $270 million theoretical discount from 2022’s average sale price of $95 a barrel.

The Energy Department will have about $3.45 billion left to buy more oil after those deliveries are complete, a spokeswoman said. That is enough cash for tens of millions more barrels of crude.

The Biden administration’s opportunity to build on its gains could slip away if prices rise. Benchmark U.S. crude changed hands Friday at $71.65 a barrel, well below the administration’s asking price of $79 or lower, even as fallout from the Israel-Hamas war threatens tankers in one of the world’s most important shipping lanes.

Any major ramp-up in deals would come with challenges. It could strain the country’s ability to release emergency supplies, because storage sites can’t accept crude at the same time. The facilities, some of which are currently undergoing maintenance, are also limited in how much they can receive each month.