This piece is a review on what is happening in increasing manufacturing capacity for computer, electronic, and electrical manufacturing. Where I am, there is increasing builds of facilities for each of those products. That being around the Phoenix area. One facility they have been working on for two years now and it appears to be near the end. Much of this is automated and probably much Labor. Semiconductor is basically growing wafer, populated the slices, and layering. I have oversimplified it so add to it. Unpacking the Boom in U.S. Construction of Manufacturing Facilities U.S. Department of the Treasury The United States has experienced a surge in construction spending for manufacturing facilities. Real manufacturing construction spending

Topics:

Angry Bear considers the following as important: Hot Topics, Manufacturing Facilities, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

This piece is a review on what is happening in increasing manufacturing capacity for computer, electronic, and electrical manufacturing. Where I am, there is increasing builds of facilities for each of those products. That being around the Phoenix area. One facility they have been working on for two years now and it appears to be near the end. Much of this is automated and probably much Labor. Semiconductor is basically growing wafer, populated the slices, and layering. I have oversimplified it so add to it.

Unpacking the Boom in U.S. Construction of Manufacturing Facilities

U.S. Department of the Treasury

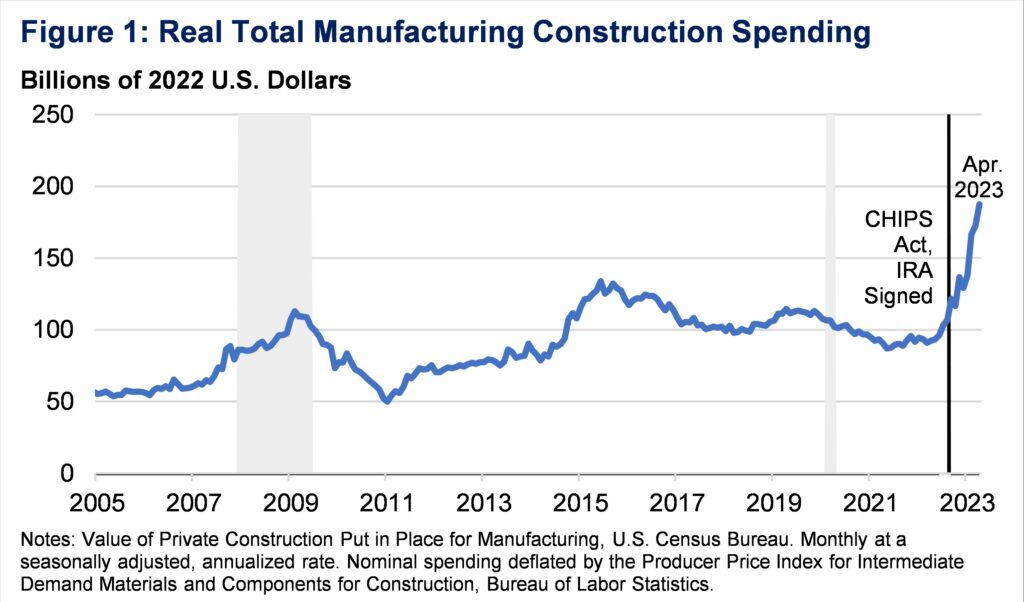

The United States has experienced a surge in construction spending for manufacturing facilities. Real manufacturing construction spending has doubled since the end of 2021 (Figure 1). The surge comes in a supportive policy environment for manufacturing construction: the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and CHIPS Act each provided direct funding and tax incentives for public and private manufacturing construction.

We explore the surge along three key dimensions:

- The boom is principally driven by construction for computer, electronic, and electrical manufacturing—a relatively small share of manufacturing construction over the past few decades, but now a dominant component.

- Manufacturing construction is one element of a broader increase in U.S. non-residential construction spending, alongside new building for public and private infrastructure following the IIJA. The manufacturing surge has not crowded out other types of construction spending, which generally continue to strengthen.

- Finally, we put the trend in international context. While it can be difficult to compare such granular data across countries, the surge appears to be uniquely American and not mirrored in other advanced economies.

Decomposing the Surge

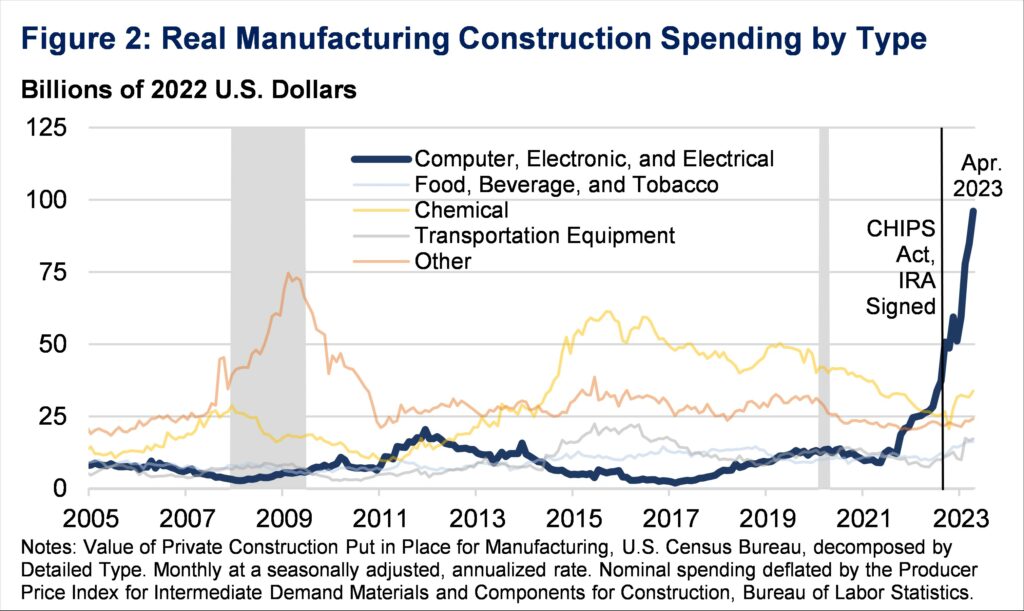

Within real construction spending on manufacturing, most of the growth has been driven by computer, electronics, and electrical manufacturing. Since the beginning of 2022, real spending on construction for that specific type of manufacturing has nearly quadrupled (Figure 2).

The adjustment for price increases is particularly important here. Construction costs have risen quickly in recent years, and therefore nominal spending growth should not be misconstrued as increased physical construction. But by considering deflated measures as we do here, it is clear that the surge is a real one (see Appendix for a more detailed discussion of our choice of deflator).

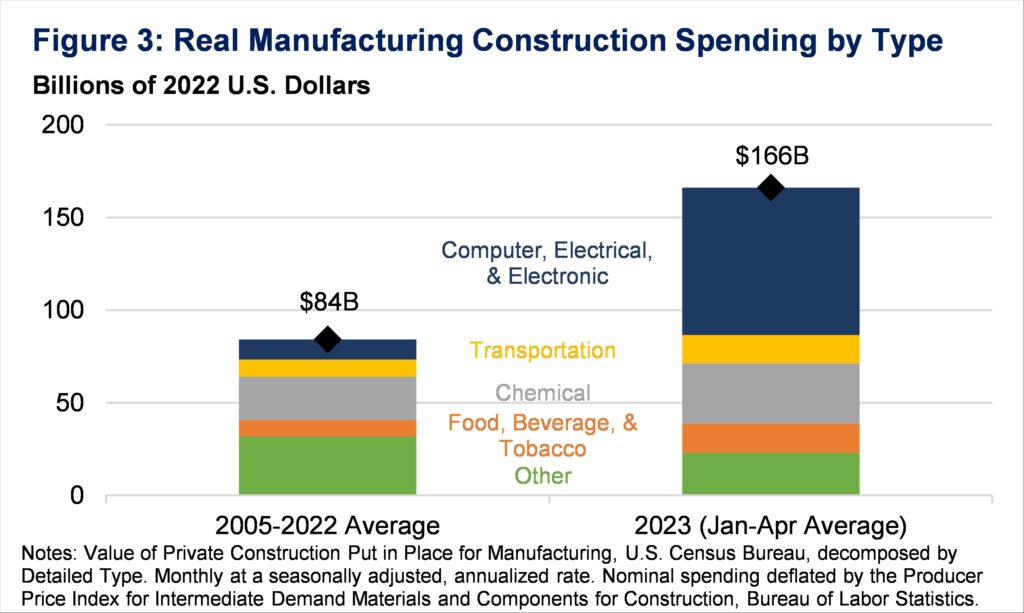

Today, the computer/electronic segment is the dominant component of U.S. manufacturing construction. Importantly, the boom in this segment has not been offset by reduced spending on other manufacturing construction segments, which are largely consistent with long-term levels (Figure 3). In fact, construction for chemical, transportation, and food/beverage manufacturing is also up from 2022, albeit much less than the computer/electronic sector.

This rise in the spending began in the months before the CHIPS Act passed, as many factors beyond policy contribute to construction spending. Still, the legislation has played a critical part in continuing and expanding this trend. In particular, private sector analysts have recognized the connection between the growth in construction for electronics manufacturing and the CHIPS Act. Bank of America notes this rise came “potentially on the back of ongoing construction of semiconductor factories as part of the CHIPS Act.” According to Deutsche Bank Research, 18 new chipmaking facilities will have started construction between 2021 and 2023. The Semiconductor Industry Association reports, over 50 new semiconductor ecosystem projects built in the wake of the CHIPS Act.

The macroeconomic situation, policy implementation, and a range of other conditions will continue to shape construction manufacturing spending in the months and years to come. While today’s striking trend may cool, the CHIPS Act has fostered an ongoing opportunity for investment in this sector.

Broader U.S. Non-Residential Construction Spending

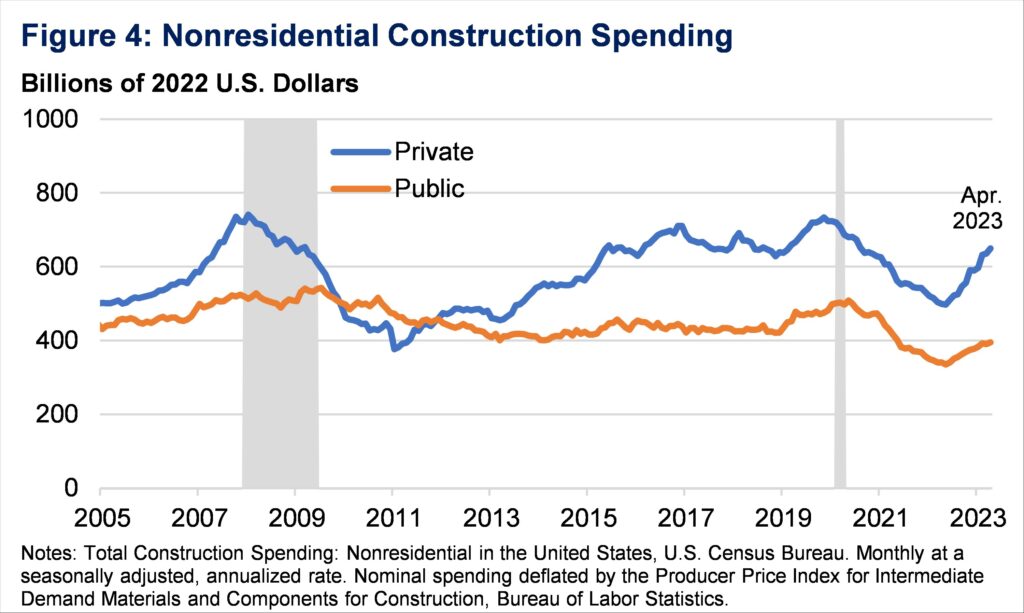

While manufacturing is the most eye-popping component of construction spending, overall real nonresidential construction spending has increased by about 15 percent from November 2021, when the President signed the IIJA, to April 2023. Real public spending, which increased by 7 percent, did not crowd out real private spending, which increased by nearly 20 percent (Figure 4). Moreover, as more IIJA projects come online and break ground, more public and private dollars will go toward our public infrastructure.

Under the hood, specific components of construction spending, beyond manufacturing, have also had substantial increases driven by recent legislation. The IIJA authorized the federal government to distribute new funds to state and local governments for infrastructure needs tied to roads, bridges, public transit, water, and broadband. That funding has started translating to spending.

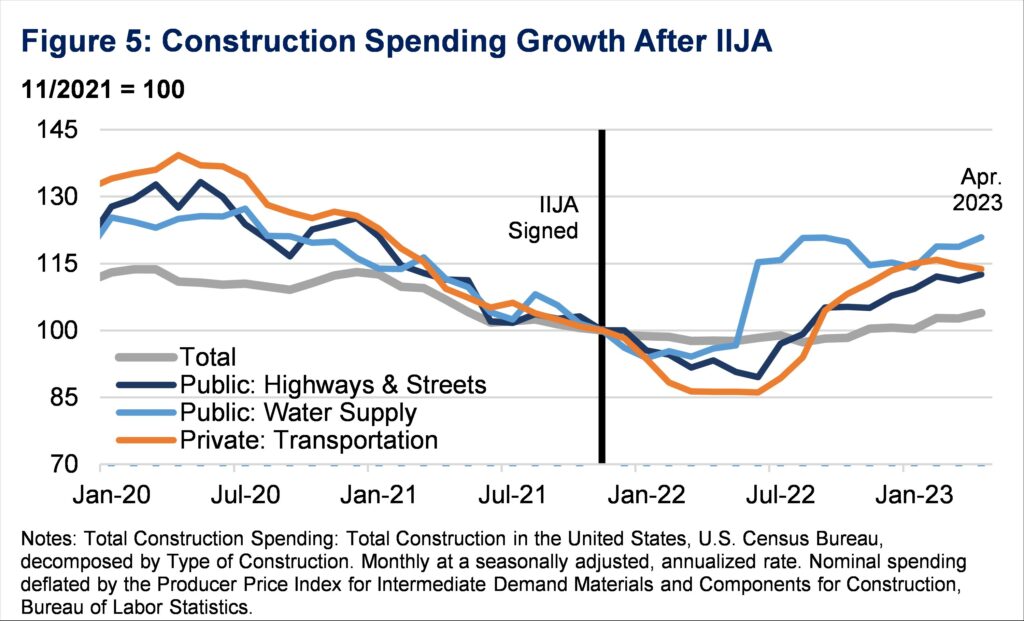

Since the bill’s passage, construction spending on these areas has outpaced total construction spending. For example, total construction spending has increased about 4 percent, while public construction spending on the water supply has increased by over 20 percent (Figure 5). The IIJA delivered more than $50 billion to the EPA to improve the nation’s drinking water, wastewater, and stormwater infrastructure. Public spending on highways and streets has also increased by about 13 percent, as the IIJA funds roads, bridges, and major projects with over $110 billion over five years.

Again, the legislation increased public spending but has not crowded out private spending. Real private spending on transportation construction has grown by nearly 14 percent since the President signed the IIJA. The legislation increased the available Private Activity Bonds (PABs) authority from $15 to $30 billion. PABs, allocated by the Secretary of Transportation, incentivize private sector investment in U.S. transportation infrastructure. Across over 40 projects, the Department of Transportation has approved nearly $17 billion and allocated an additional $2.8 billion in PABs.

Such investments harness government resources to increase productive capacity. This being a central goal of Secretary Yellen’s Modern Supply-Side Economics policy framework. Private manufacturing for semiconductors, with funding from the CHIPS Act, expand the U.S. economy’s footprint in a sector vital for today and tomorrow’s technologies. Increased public expenditure on our infrastructure from the IIJA enables a better functioning, more resilient economy. Tax incentives from the IRA address the historically overlooked market failure of climate change, ushering in a green energy transition that steers the country toward sustainable growth. Each of these projects addresses market failures to increase inputs to production which fuels long-run growth.