Pharma companies providing pharmaceuticals exclusive to them have vast amounts of control in availability and or pricing. Either can result in increased costs to the patient. Economist Timothy Taylor reviews one particular instance with Teva Pharmaceuticals. Collaboration with other companies to control pricing appears to be Teva’s Director of Strategic Customer Marketing Nisha Patel’s strong suits. by Timothy Taylor Conversable Economist Imagine in the market for generic drugs, a group of companies form a cartel to raise prices on the products controlled by their group. Other companies were not involved. What pattern might you expect to see for the prices of drugs controlled by the cartel, or not controlled by the cartel. Amanda Starc and

Topics:

Angry Bear considers the following as important: Healthcare, law, Pharamaceuticals, Teva, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Joel Eissenberg writes How Tesla makes money

Pharma companies providing pharmaceuticals exclusive to them have vast amounts of control in availability and or pricing. Either can result in increased costs to the patient. Economist Timothy Taylor reviews one particular instance with Teva Pharmaceuticals. Collaboration with other companies to control pricing appears to be Teva’s Director of Strategic Customer Marketing Nisha Patel’s strong suits.

by Timothy Taylor

Imagine in the market for generic drugs, a group of companies form a cartel to raise prices on the products controlled by their group. Other companies were not involved. What pattern might you expect to see for the prices of drugs controlled by the cartel, or not controlled by the cartel. Amanda Starc and Thomas G. Wollmann carry out such an analysis in “Does Entry Remedy Collusion: Evidence from the Generic Prescription Drug Cartel“ (NBER Working Paper 29886, April 2023).

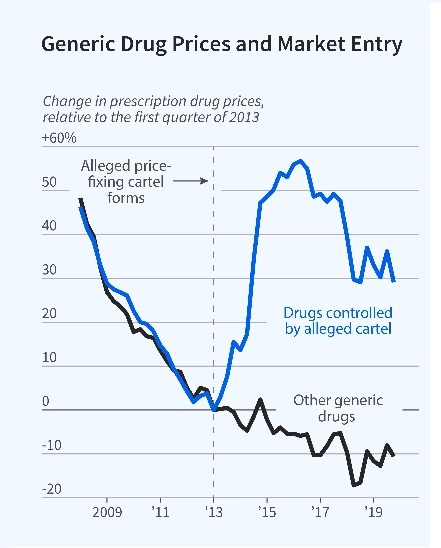

The blue line (Chart below) shows prices of generic drugs where supply was controlled by the firms in the cartel. The black line shows prices of generic drug where supply is not controlled by the cartel. As you can see, price changes for these two groups of generic drugs track each other closely before 2013. But after 2013, prices for the group of drugs not controlled by the cartel continues on its downward trajectory, while prices for the group of drugs controlled by the cartel suddenly rise and then maintain a higher level.

Of course, one graph doesn’t prove that a cartel was actually formed or was successful in raising prices. It’s theoretically possible that a sudden surge of increased demand or reduced supply caused prices for all the drugs controlled by the supposed cartel to leap up in this way at just the time that an employee at Teva Pharmaceuticals started coordinating efforts across a number of firms to keep prices high. But as circumstantial evidence goes, it does raise one’s eyebrows.

Some antitrust cases are resolved all at once, with a well-publicized court finding or a legal settlement. But in other cases, the resolution trickles out over time in a series of announcements, one company at a time. That’s what seems to be happening in the ongoing antitrust case about the prices of a number of generic drugs. Last summer, Teva Pharmaceuticals and Glenmark Pharmaceuticals became the sixth and seventh companies to announce consent agreements with the antitrust authorities at the US Department of Justice. Teva, which is especially central to this case, agreed to a criminal penalty of $225 million to settle the case, along with divesting a certain cholesterol drug and other penalties.

What exactly did Teva do? It’s hard to know what happened behind the scenes, and part of the reason that a company signs a consent decree is to avoid acknowledging the full extent of what happened. But we at least know the accusations that were laid out in US District Court in 2019.

The complaint starts out by alleging that there has been a long-standing pattern in the generic drug industry of firms agreeing (at least tacitly) to divide up the market and not to compete too hard with each other. I can’t speak to the truth of this allegation, and the evidence above shows that prices of generic drug were falling steadily up through 2013. Thus, the heart of the case is not the allegations about a long-standing lack of competition, but events that started in 2013. Here, I’ll quote the allegations of the complaint about the actions of Nisha Patel at Teva Pharmaceuticals in 2013 (starting around p. 158 of the complaint):

565. In April 2013, Teva took a major step toward implementing more significant price increases by hiring Defendant Nisha Patel as its Director of Strategic Customer Marketing. In that position, her job responsibilities included, among other things: (1) serving as the interface between the marketing (pricing) department and the sales force teams to develop customer programs; (2) establishing pricing strategies for new product launches and in-line product opportunities; and (3) overseeing the customer bid process and product pricing administration at Teva.

566. Most importantly, she was responsible for – in her own words – “product selection, price increase implementation, and other price optimization activities for a product portfolio of over 1,000 products.” In that role, Patel had 9-10 direct reports in the pricing department at Teva. One of Patel’s primary job goals was to effectuate price increases. This was a significant factor in her performance evaluations and bonus calculations and, as discussed more fully below, Patel was rewarded handsomely by Teva for doing it.

567. Prior to joining Teva, Defendant Patel had worked for eight years at a large drug wholesaler, ABC, working her way up to Director of Global Generic Sourcing. During her time at ABC, Patel had routine interaction with representatives from every major generic drug manufacturer and developed and maintained relationships with many of the most important sales and marketing executives at Teva’s competitors.

568. Teva hired Defendant Patel specifically to identify potential generic drugs for which Teva could raise prices, and then utilize her relationships to effectuate those price increases.

571. When she joined Teva, Defendant Patel’s highest priority was identifying drugs where Teva could effectively raise price without competition. On May 1, 2013, Defendant Patel began creating an initial spreadsheet with a list of “Price Increase Candidates.” As part of her process of identifying candidates for price increases, Patel started to look very closely at Teva’s relationships with its competitors, and also her own relationships with individuals at those competitors. In a separate tab of the same “Price Increase Candidates” spreadsheet, Patel began ranking Teva’s “Quality of Competition” by assigning companies into several categories, including “Strong Leader/Follower,” “Lag Follower,” “Borderline” and “Stallers.”

572. Patel understood – and stressed internally at Teva – that “price increases tend to stick and markets settle quickly when suppliers increase within a short time frame.” Thus, it was very important for Patel to identify those competitors who were willing to share information about their price increases in advance, so that Teva would be prepared to follow quickly. Conversely, it was important for Patel to be able to inform Teva’s competitors of Teva’s increase plans so those competitors could also follow quickly. Either way, significant coordination would be required for price increases to be successful – and quality competitors were those who were more willing to coordinate.

573. As she was creating the list, Defendant Patel was talking to competitors to determine their willingness to increase prices and, therefore, where they should be ranked on the scale.

574. It is important to note that Defendant Patel had several different ways of communicating with competitors. Throughout this Complaint, you will see references to various phone calls and text messages that she was exchanging with competitors. But she also communicated with competitors in various other ways, including but not limited to instant messaging through social media platforms such as Linkedin and Facebook; encrypted messaging through platforms like WhatsApp; and in-person communications. Although the Plaintiff States have been able to obtain some of these communications, many of them have been destroyed by Patel.

575. Through her communications with her competitors, Defendant Patel learned more about their planned price increases and entered into agreements for Teva to follow them. …

576. By May 6, 2013, Patel had completed her initial ranking of fifty-six (56) different manufacturers in the generic drug market by their “quality.” Defendant Patel defined “quality” by her assessment of the “strength” of a competitor as a leader or follower for price increases. Ranking was done numerically, from a +3 ranking for the “highest quality” competitor to a -3 ranking for the “lowest quality” competitor. …

577. Defendant Patel created a formula, which heavily weighted those numerical ratings assigned to each competitor based on their “quality,” combined with a numerical score based on the number of competitors in the market and certain other factors including whether Teva would be leading or following the price increase. According to her formula, the best possible candidate for a price increase (aside from a drug where Teva was exclusive) would be a drug where there was only one other competitor in the market, which would be leading an increase, and where the competitor was the highest “quality.” Conversely, a Teva price increase in drug market with several “low quality” competitors would not be a good candidate due to the potential that low quality competitors might not follow Teva’s price increase and instead use the opportunity to steal Teva’s market share.

578. Notably, the companies with the highest rankings at this time were companies with whom Patel and other executives within Teva had significant relationships.

The legal complaint runs to several hundred pages, documenting contacts between firms with agreements to raise prices, or not to underbid on contracts. Taking it all into account, the legal complaint alleges:

At the zenith of this collusive activity involving Teva, during a 19-month period beginning in July 2013 and continuing through January 2015, Teva significantly raised prices on approximately 112 different generic drugs. Of those 112 different drugs, Teva colluded with its “High Quality” competitors on at least 86 of them (the others were largely in markets where Teva was exclusive). The size of the price increases varied, but a number of them were well over 1,000%.

Again, it’s worth remembering that these allegations are one side. But when it comes to the communications between Teva and other generic drug firms from 2013 to 2015, they have many of the actual messages. This doesn’t look like a relatively subtle anticompetition case, like the one about how Amazon charges fees to firms selling on its website. It sure looks like good old-fashioned price fixing.

The final obvious question is: When prices for one group of generic drugs rose so substantially, why didn’t other manufacturers of generic drugs from outside the Teva-organized network enter the market? In the research mentioned above, Starc and Wollman find that some entry does occur. But entry isn’t simple. For example, because the regulatory process in the market generic drugs (even though the drugs are chemically identical!), it takes 2-4 years for a manufacturer of generic drugs to start producing a new product. Also, if a potential entrant gears up and invests to manufacture a new drug, the existing firms could then cut their prices, so that the funds spent on entering the market don’t pay off. Entering a new market is considerably easier in an economics textbook model than in the real world.