Why home insurance rates are rising so fast across the US. Climate change plays a big role, The Conversation Millions of Americans have been watching with growing alarm as their homeowner insurance premiums rise and their coverage shrinks. Nationwide, premiums rose 34% between 2017 and 2023, and they continued to rise in 2024 across much of the country. To add insult to injury, those rates go even higher if you make a claim – as much as 25% if you claim a total loss of your home. Why is this happening? There are a few reasons, but a common thread: Climate change is fueling more severe weather, and insurers are responding to rising damage claims. The losses are exacerbated by more frequent extreme weather disasters striking densely

Topics:

Angry Bear considers the following as important: Home Owners Insurance, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Why home insurance rates are rising so fast across the US. Climate change plays a big role, The Conversation

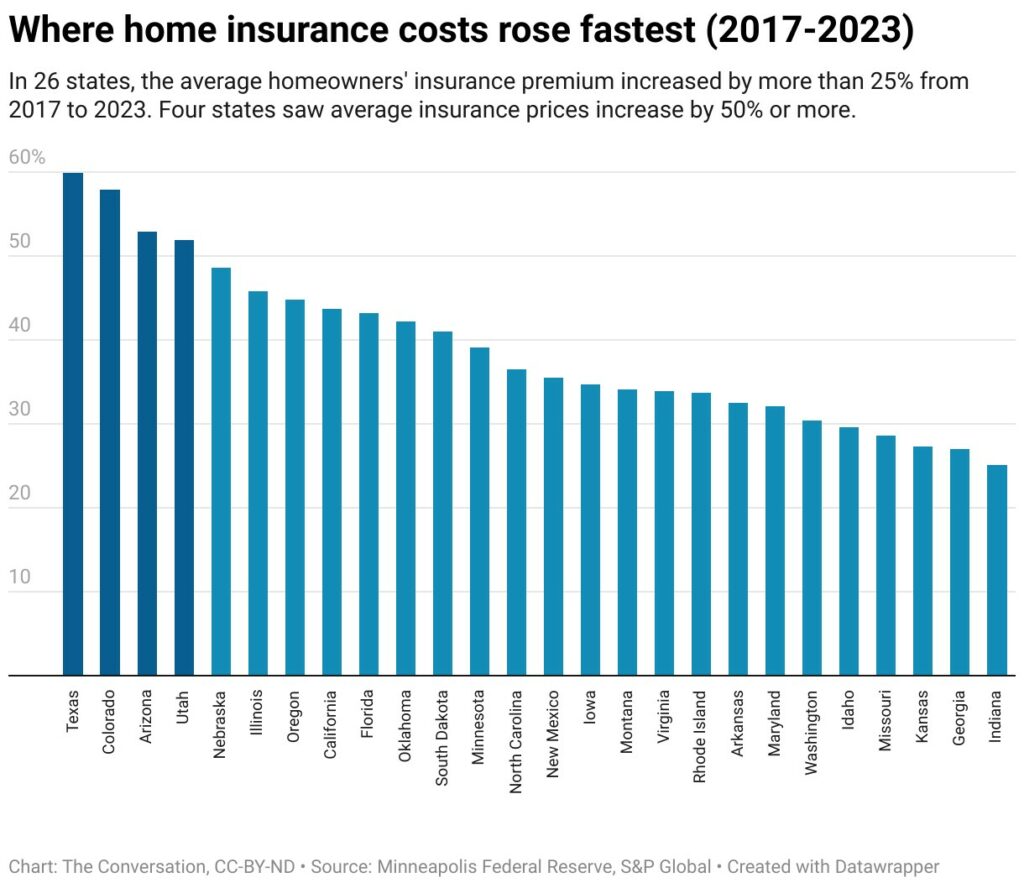

Millions of Americans have been watching with growing alarm as their homeowner insurance premiums rise and their coverage shrinks. Nationwide, premiums rose 34% between 2017 and 2023, and they continued to rise in 2024 across much of the country.

To add insult to injury, those rates go even higher if you make a claim – as much as 25% if you claim a total loss of your home.

Why is this happening?

There are a few reasons, but a common thread: Climate change is fueling more severe weather, and insurers are responding to rising damage claims. The losses are exacerbated by more frequent extreme weather disasters striking densely populated areas, rising construction costs and homeowners experiencing damage that was once rare.

Parts of the U.S. have been seeing larger and more damaging hail, higher storm surges, massive and widespread wildfires, and heat waves that kink metal and buckle asphalt. In Houston, what used to be a 100-year disaster, such as Hurricane Harvey in 2017, is now a 1-in-23-years event, estimates by risk assessors at First Street Foundation suggest. In addition, more people are moving into coastal and wildland areas at risk from storms and wildfires.

Just a decade ago, few insurance companies had a comprehensive strategy for addressing climate risk as a core business issue. Today, insurance companies have no choice but to factor climate change into their policy models.

Rising damage costs, higher premiums

There’s a saying that to get someone to pay attention to climate change, put a price on it. Rising insurance costs are doing just that.

Increasing global temperatures lead to more extreme weather, and that means insurance companies have had to make higher payouts. In turn, they have been raising their prices and changing their coverage in order to remain solvent. That raises the costs for homeowners and for everyone else.

The importance of insurance to the economy cannot be understated. You generally cannot get a mortgage or even drive a car, build an office building or enter into contracts without insurance to protect against the inherent risks. Because insurance is so tightly woven into economies, state agencies review insurance companies’ proposals to increase premiums or reduce coverage.

The insurance companies are not making political statements with the increases. They are looking at the numbers, calculating risk and pricing it accordingly. And the numbers are concerning.

The arithmetic of climate risk

Insurance companies use data from past disasters and complex models to calculate expected future payouts. Then they price their policies to cover those expected costs. In doing so, they have to balance three concerns: keeping rates low enough to remain competitive, setting rates high enough to cover payouts and not running afoul of insurance regulators.

But climate change is disrupting those risk models. As global temperatures rise, driven by greenhouse gases from fossil fuel use and other human activities, past is no longer prologue: What happened over the past 10 to 20 years is less predictive of what will happen in the next 10 to 20 years.

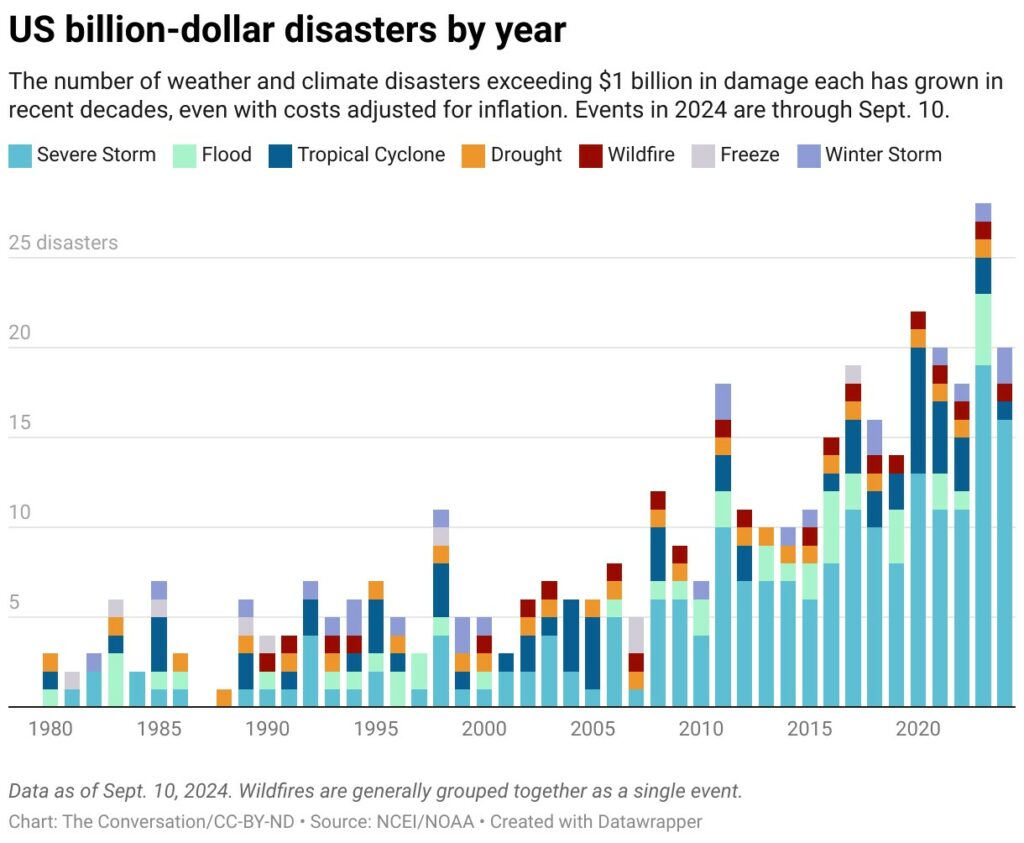

The number of billion-dollar disasters in the U.S. each year offers a clear example. The average rose from 3.3 per year in the 1980s to 18.3 per year in the 10-year period ending in 2024, with all years adjusted for inflation.

With that more than fivefold increase in billion-dollar disasters came rising insurance costs in the Southeast because of hurricanes and extreme rainfall, in the West because of wildfires, and in the Midwest because of wind, hail and flood damage.

Hurricanes tend to be the most damaging single events. They caused more than US$692 billion in property damage in the U.S. between 2014 and 2023. But severe hail and windstorms, including tornadoes, are also costly; together, those on the billion-dollar disaster list did more than $246 billion in property damage over the same period.

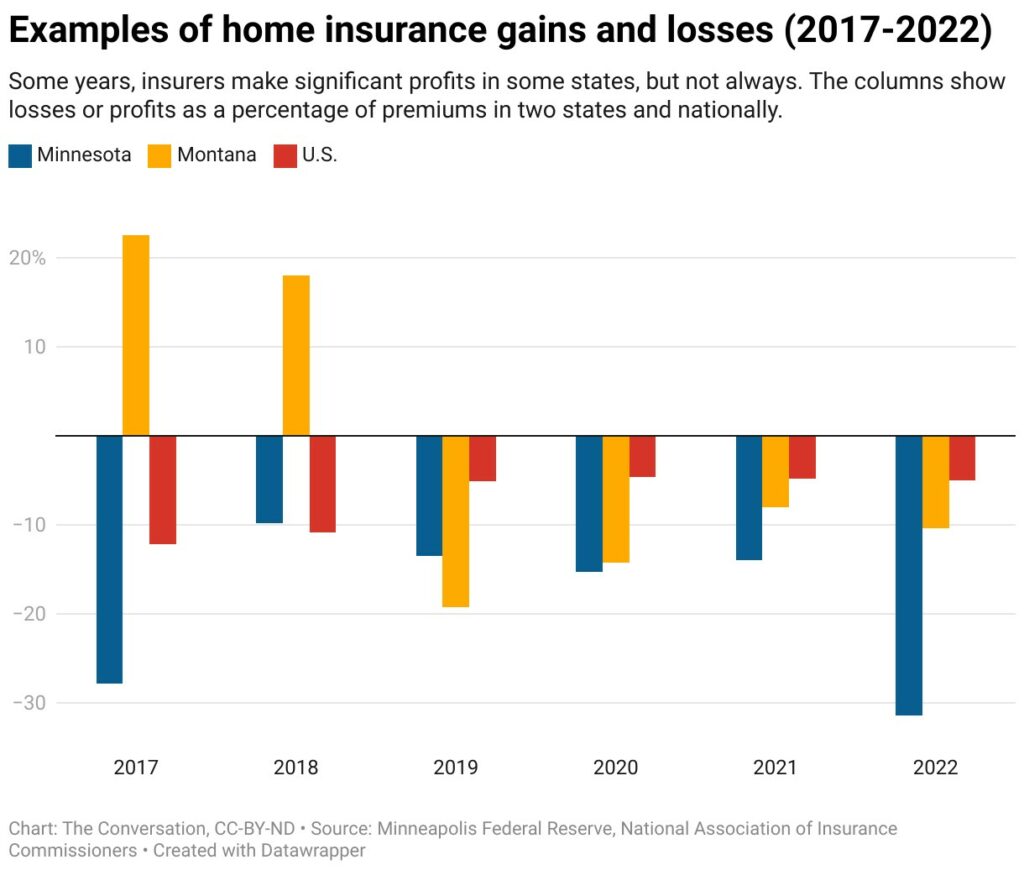

As insurance companies adjust to the uncertainty, they may run a loss in one segment, such as homeowners insurance, but recoup their losses in other segments, such as auto or commercial insurance. But that cannot be sustained over the long term, and companies can be caught by unexpected events. California’s unprecedented wildfires in 2017 and 2018 wiped out nearly 25 years’ worth of profits for insurance companies in that state.

To balance their risk, insurance companies often turn to reinsurance companies; in effect, insurance companies that insure insurance companies. But reinsurers have also been raising their prices to cover their costs. Property reinsurance alone increased by 35% in 2023. Insurers are passing those costs to their policyholders.

What this means for your homeowners policy

Not only are homeowners insurance premiums going up, coverage is shrinking. In some cases, insurers are reducing or dropping coverage for items such as metal trim, doors and roof repair, increasing deductibles for risks such as hail and fire damage, or refusing to pay full replacement costs for things such as older roofs.

Some insurances companies are simply withdrawing from markets altogether, canceling existing policies or refusing to write new ones when risks become too uncertain or regulators do not approve their rate increases to cover costs. In recent years, State Farm and Allstate pulled back from California’s homeowner market, and Farmers, Progressive and AAA pulled back from the Florida market, which is seeing some of the highest insurance rates in the country.

State-run “insurers of last resort,” which can provide coverage for people who can’t get coverage from private companies, are struggling too. Taxpayers in states such as California and Florida have been forced to bail out their state insurers. And the National Flood Insurance Program has raised its premiums, leading 10 states to sue to stop them.

About 7.4% of U.S. homeowners have given up on insurance altogether, leaving an estimated $1.6 trillion in property value at risk, including in high-risk states such as Florida.

No, insurance costs aren’t done rising

According to NOAA data, 2023 was the hottest year on record “by far.” And 2024 could be even hotter. This general warming trend and the rise in extreme weather is expected to continue until greenhouse gas concentrations in the atmosphere are abated.

In the face of such worrying analyses, U.S. homeowners insurance will continue to get more expensive and cover less. And yet, Jacques de Vaucleroy, chairman of the board of reinsurance giant Swiss Re, believes U.S. insurance is still priced too low to fully cover the risk from climate change.