These guys are ahead of us. What Scared Ford’s CEO in China, WSJ Jim Farley had just returned from China. What the Ford Motor chief executive found during the May visit made him anxious: The local automakers were pulling away in the electric-vehicle race. In an early-morning call with fellow board member John Thornton, an exasperated Farley unloaded. The Chinese carmakers are moving at light speed, he told Thornton, a former Goldman Sachs executive who spent years as a senior banker in China. They are using artificial intelligence and other tech in cars that is unlike anything available in the U.S. These Chinese EV makers are using a low-cost supply base to undercut the competition on price, offering slick digital features and

Topics:

Angry Bear considers the following as important: US/Global Economics, WSJ

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

These guys are ahead of us.

What Scared Ford’s CEO in China, WSJ

Jim Farley had just returned from China. What the Ford Motor chief executive found during the May visit made him anxious: The local automakers were pulling away in the electric-vehicle race.

In an early-morning call with fellow board member John Thornton, an exasperated Farley unloaded.

The Chinese carmakers are moving at light speed, he told Thornton, a former Goldman Sachs executive who spent years as a senior banker in China. They are using artificial intelligence and other tech in cars that is unlike anything available in the U.S. These Chinese EV makers are using a low-cost supply base to undercut the competition on price, offering slick digital features and aggressively expanding to overseas markets.

Farley . . .

“John, this is an existential threat.”

For years, Tesla was the main source of consternation for auto CEOs trying to tackle a transition to electric vehicles. Now, it is the rapid rise of nimble automakers in China that have rattled executives from Detroit to Germany and Japan. Even Tesla’s Elon Musk recently called the Chinese the “most competitive” car makers in the world.

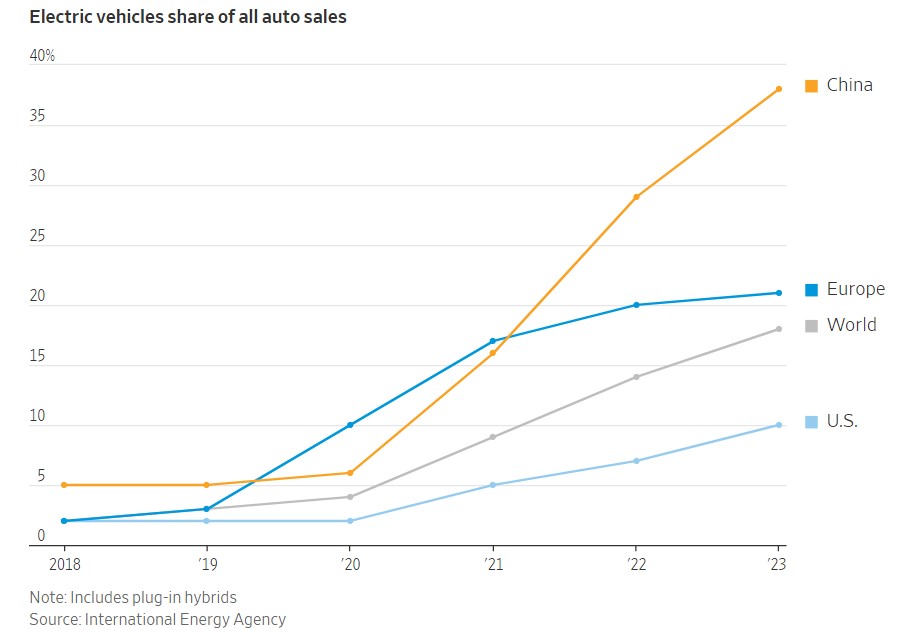

In the span of a few years, Chinese EV maker BYD, backed by Warren Buffett, and other domestic brands have clawed away gobs of market share in China from once-dominant foreign rivals, through a combination of lower prices, high-tech interiors and rapid vehicle updates. Today, they are quickly expanding in Europe, the Middle East and other Asian markets.

In the U.S., carmakers see EVs as their future, but for now, EV sales growth has slowed, as high prices and charging hassles turn off some shoppers.

Shortly after the trip, Farley arranged to have Chinese EVs shipped to Michigan for executives and directors to check out and sit in. The models were displayed in a Ford conference center near its headquarters. During board-meeting coffee breaks, directors took turns fiddling with cars.

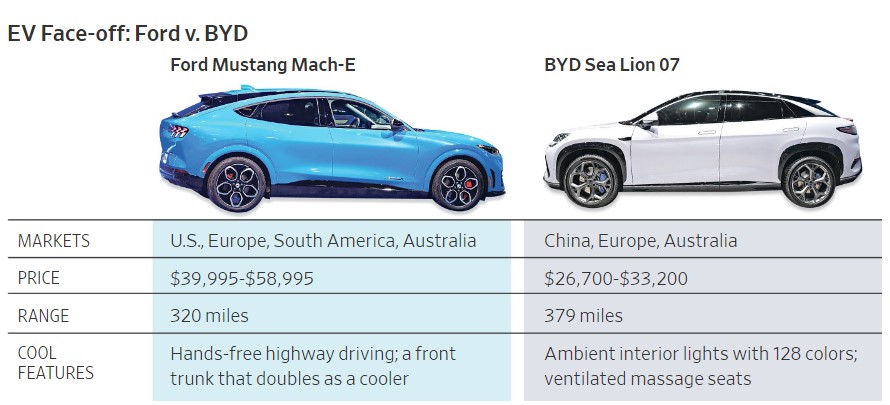

One was the first EV from smartphone giant Xiaomi, which has drawn comparisons to a Porsche and sells for $30,000 to $40,000, below Ford’s similarly sized Mustang Mach-E SUV. The Xiaomi has a fragrance diffuser and an infotainment system that can connect to devices inside the home when the car approaches—turning on the home lights or air conditioner, for example.

There was also a $77,000 futuristic-looking electric minivan from Li Auto. The plush seats in the rear rows have heated arm and leg rests, and massive multimedia screens controlled by hand gestures. Ford brass compared the setup to business-class air travel or a home theater.

“Executing to a Chinese standard is going to be the most important priority,” Farley said.

Humbling trips

Chinese brands have so far been kept out of the U.S. by steep tariffs, geopolitical tensions and regulatory hurdles. But some have established a toehold in Mexico, where China-built vehicles—both EVs and combustion-engine vehicles—now account for about 20% of sales.

Governments around the world are worried about China’s EV expansion, citing everything from potential job losses to data-security concerns. In the European Union, where Chinese imports make up about one-fifth of electric sales, regulators recently disclosed plans for tariffs up to nearly 50%. The Biden administration went further with a roughly 100% tariff.

Farley, a 62-year-old, blunt-talking car fanatic who spent the early part of his career in marketing at Toyota Motor, sees Chinese EVs as an immediate threat in Europe and other overseas markets, and a long-term risk in Ford’s profit engine of North America, regardless of protectionist measures.

Farley often reminds his executive team of how Toyota and other Japanese car companies grabbed market share from the U.S. automakers in the 1980s and 1990s, followed in recent decades by Korea’s Hyundai and Kia, which have found success with EVs.

“I’ve seen this movie before,” said Farley, who has been Ford’s CEO for four years.

A few humbling trips to China in the past 18 months prompted Farley to alter his EV strategy.

On a visit to China last year, he watched engineers dissect an electric car from Chinese juggernaut BYD to reveal elegant, low-cost engineering. A spin around a test track in another China-branded EV left him blown away by the car’s ride quality and high-tech features.

Those experiences persuaded Farley to narrow Ford’s focus in China to commercial vehicles, rather than trying to compete with local manufacturers in its consumer market. Now, he is racing to fend off the threat of Chinese EVs elsewhere—in part by borrowing from them.

The CEO has a team exploring ways to contract with some of the same low-cost parts suppliers that have given Chinese EV makers such a big edge. He has pivoted Ford’s strategy toward smaller EVs, because for now the huge batteries needed for big pickups and SUVs are too expensive. That strategic shift resulted in the recent, high-profile cancellation of a future Ford Explorer-size electric SUV.

‘These guys are ahead’

For decades, Ford and other global carmakers did not view Chinese automakers as much of a threat.

China opened its auto market to foreign companies in the 1980s under the condition that they enter joint ventures with fledgling state-owned carmakers. The local manufacturers mostly played little-sibling roles to their foreign JV partners, helping them to navigate red tape and providing some capital to build factories.

Meanwhile, Beijing was methodically investing in a plan to leapfrog global carmakers through a move to electric cars. The government offered generous subsidies for car companies to build EVs, and for consumers to buy them. Huge investment into car chargers also nurtured the EV market.

By early this decade, those once-shaky Chinese companies—joined by a few hundred startups—had begun churning out stylish, affordable EVs. BYD in particular pulled away from the pack, selling more than three million electric and plug-in-hybrid cars last year, nearly seven times higher than in 2019.

BYD’s cheapest EV, the Seagull, starts around $10,000 and features a fashionable cabin; a rotating, iPad-like touch screen; and more than 300 miles of driving range, comparable to EVs from legacy automakers that are priced three times higher. It is currently for sale in China and Latin America and BYD plans to start selling it in Europe next year for around $20,000.

In early 2023, Farley made his first trip to China since it reopened after years of pandemic restrictions. He sat in the driver seat of an electric SUV from Ford’s longtime joint-venture partner, Changan Automobile, which for years had been a middling player in China, its market share hovering around 5%.

Farley, who races vintage cars and has an encyclopedic knowledge of car models, thrashed the EV around Changan’s sprawling test track in central China, as Ford Chief Financial Officer John Lawler rode shotgun. Afterward the executives sat silently, stunned at the progress Changan had made. The ride was smooth and quiet and the cabin upscale, with easy-to-use technology. Lawler told Farley after the drive.

“Jim, this is nothing like before.

These guys are ahead of us.”