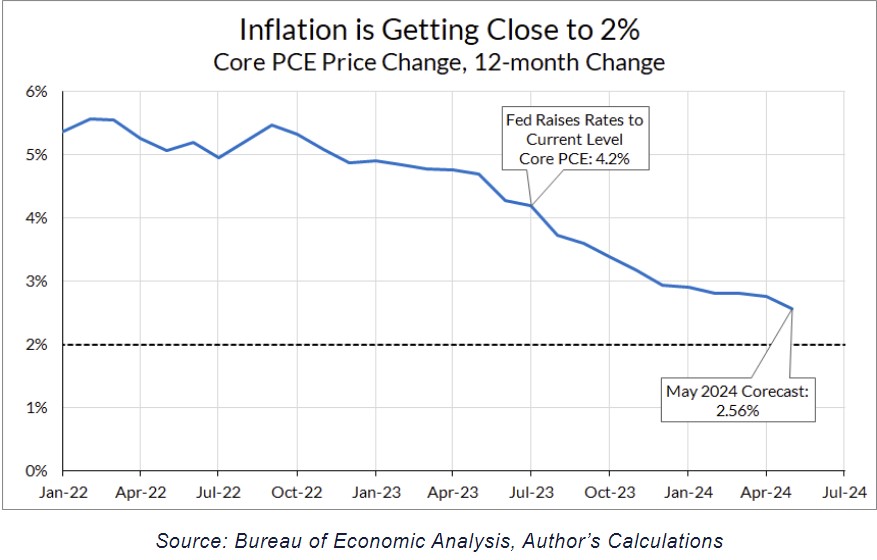

Post-June FOMC: By Overreacting Hawkishly, the Fed Risks Being Behind the Ball by Preston Mui employ america org The simple fact as seen in a longer-run view, inflation has fallen greatly. Whether you start from its peak at 5.6% in February 2022 or 4.2% when the Fed raised rates to the current level, core PCE inflation—which is on track to deliver a 2.6% year-on-year read for May 2024—is most of the way back to 2%. The inflation outlook is pointing towards further cooling. Rent and owner’s equivalent rent now accounts for nearly two-thirds of the excess of core PCE inflation above 2%, which should mechanically follow the much softer new tenant rent indices. The uncertainty there is about when exactly that softening will trickle through

Topics:

Angry Bear considers the following as important: inflation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Post-June FOMC: By Overreacting Hawkishly, the Fed Risks Being Behind the Ball

by Preston Mui

employ america org

The simple fact as seen in a longer-run view, inflation has fallen greatly. Whether you start from its peak at 5.6% in February 2022 or 4.2% when the Fed raised rates to the current level, core PCE inflation—which is on track to deliver a 2.6% year-on-year read for May 2024—is most of the way back to 2%.

The inflation outlook is pointing towards further cooling. Rent and owner’s equivalent rent now accounts for nearly two-thirds of the excess of core PCE inflation above 2%, which should mechanically follow the much softer new tenant rent indices. The uncertainty there is about when exactly that softening will trickle through to measured inflation, not about the underlying dynamic. Auto prices, which were actually firm in May, are likely to contribute more to disinflation in the coming months given trends in private data on car prices.

Obviously, inflation is not at 2 percent, but the steady and significant progress in core PCE inflation should be enough for the Fed to start backing away. As Powell and other Committee members have repeatedly said, the Fed should not wait until inflation is literally at 2% to cut. The threshold for cuts over the next few months should not be very high. As Powell said in his interview with 60 minutes earlier this year:

“We just want to see more good data along those lines. It doesn’t need to be better than what we’ve seen [in the latter half of 2023], or even as good. It just needs to be good. And so, we do expect to see that.”

Other Points Supporting the Easing of the Economic Brakes . . .

- Labor Market is softening

- Wage Growth has been Falling

It is entirely possible that year-on-year core PCE inflation readings stall out or even rise slightly over the next few months, even with good month over month prints (as the Fed’s new inflation projections would imply) due to the base effects from low inflation prints in the back half of last year. It would be a small increase in the longer-run context of inflation, and in the greater context of the inflation trajectory, this should not spook the Fed. Moreover, to the extent that rising year-on-year measures reflect base effects from low inflation prints last year, the Fed should not overreact to those months’ base effects (after all, they promised not to overreact when we got those months’ low inflation prints).