By Les Leopold Chelsea Green Publishing Interesting book I just started to touch upon. Book review by Paul Prescod. Last section touches upon why layoffs may happen . . . Stock Buybacks and Deregulation. Across the political spectrum, it seems as if the right to decent employment has disappeared from the agenda. Wars, natural disasters, and Donald Trump’s antics grab headlines while the closing of a major factory doesn’t register a blip. Even on the Left, a fatalistic acceptance of layoffs has numbed us to the human misery caused by contemporary capitalism’s widespread job insecurity. Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It, a new book by labor educator Les

Topics:

Angry Bear considers the following as important: Journalism, Taxes/regulation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

By Les Leopold

Interesting book I just started to touch upon. Book review by Paul Prescod. Last section touches upon why layoffs may happen . . . Stock Buybacks and Deregulation.

Across the political spectrum, it seems as if the right to decent employment has disappeared from the agenda. Wars, natural disasters, and Donald Trump’s antics grab headlines while the closing of a major factory doesn’t register a blip. Even on the Left, a fatalistic acceptance of layoffs has numbed us to the human misery caused by contemporary capitalism’s widespread job insecurity.

Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It, a new book by labor educator Les Leopold, seeks to lay out the root causes of mass layoffs in our economy today and demonstrate that we need not accept them as inevitable.

Leopold cofounded the Labor Institute for popular worker education and authored the Runaway Inequality guide used by unions to train workers on combating wealth inequality. Leopold’s latest book carries on the same tradition of taking on big-picture issues of political economy in a straightforward way that most working people can understand.

The book traces the root cause of mass layoffs to a pervasive corporate culture that prioritizes stock buybacks and enriching shareholders. He clearly demonstrates that not only are mass layoffs devastating for working-class communities, but they are also destroying worker loyalty to the Democratic Party while opening up huge political opportunities for the far right.

Leopold also marshals empirical data to show that the “white working class” is not full of hopelessly racist bigots, contrary to popular liberal thought and rhetoric. In his view, the Left must reach this constituency by acknowledging their genuine suffering and finding common ground, or else bad actors with worse agendas will get to them first.

While the Biden administration loves to tout strong economic numbers, the reality is that mass layoffs and economic dislocation are not likely to go away anytime soon. Wall Street’s War on Workers should be read by all those interested in building a movement to secure quality employment for all working people.

Stock Buybacks and Deregulation

It’s in capitalists’ nature to exploit workers for the maximization of profit. However, the growth of a powerful labor movement and the New Deal regulatory state in the ’30s and ’40s temporarily put a check on corporate power in the United States. The dominant sectors of the economy conformed to a business model that, at least to a degree, viewed product quality and worker retention as the ingredients for company profitability.

But now, this business model has unraveled. CEOs and shareholders maximize profit by buying back their own stock and giving themselves bonuses. Leopold provides a detailed but accessible account of how hedge funds also drive this process through buying up corporations, loading them with debt, and stripping their profitable assets. The dual pressure for money to facilitate stock buybacks and to pay back the debt further fuels layoffs and cost-cutting.

Readers will get a clear historical account of how and why this financialization of the economy takes place. Under the New Deal regulatory state, stock buybacks were rare because the Securities Exchange Commission (SEC) interpreted them as stock manipulation. But with the crisis of stagflation during the 1970s came the beginnings of the deregulatory wave, which was kicked off by Democratic president Jimmy Carter.

Under Ronald Reagan in the 1980s, stock buybacks were encouraged again when the SEC created Rule 10c-18 that allowed corporations to put profits back into their own stocks. One graph featured in the book shows that in 1981, only 2 percent of corporate profits went to stock buybacks. By 2016, it was 68 percent.

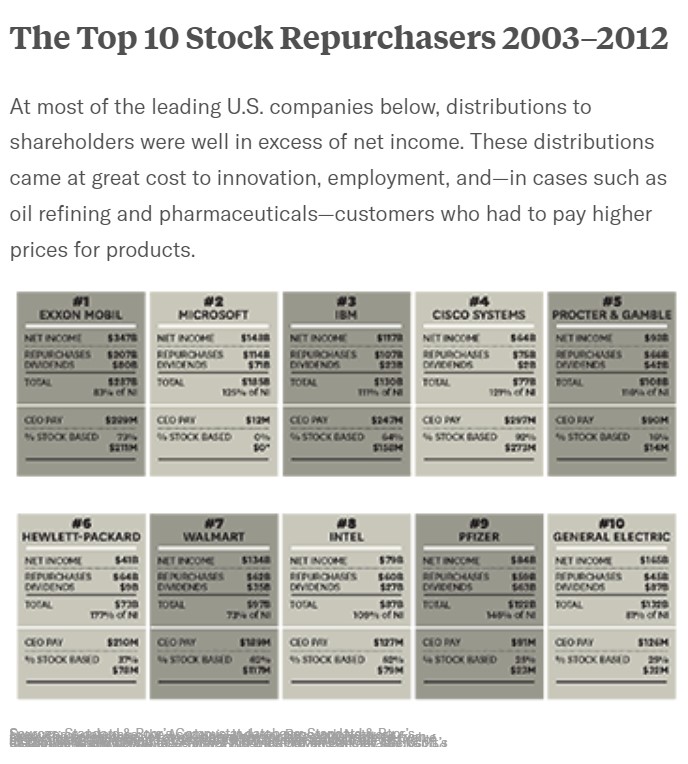

Consider the 10 largest repurchasers, which spent a combined $859 billion on buybacks, an amount equal to 68% of their combined net income, from 2003 through 2012.

From 2010-2019 alone, an astonishing $6.5 trillion has gone into stock buybacks. The money going into stock buybacks is money that doesn’t go toward increasing workers’ pay and benefits, or research and development for better quality products.

Three initiatives could rein in Stock Buybacks . . .

- Put an end to open-market buybacks. “It is not appropriate for the safe harbor to be available when the issuer has a heightened incentive to manipulate its share price.” In practice, though, the stock-based pay of the executives who decide to do repurchases provides just this “heightened incentive.” To correct this glaring problem, the SEC should rescind the safe harbor.

- Rein in stock-based pay. The SEC should stop allowing executives to sell stock immediately after options are exercised. Such a rule could help launch a much-needed discussion of meaningful reform that goes beyond the 2010 Dodd-Frank Act’s “Say on Pay”—an ineffectual law that gives shareholders the right to make nonbinding recommendations to the board on compensation issues.

- Transform the boards that determine executive compensation. Taxpayers and workers should have seats on boards. Their representatives would have the insights and incentives to ensure that executives allocate resources to investments in capabilities most likely to generate innovations and value.

Profits Without Prosperity, Harvard Business Review, William Lazonick

Flipping back to the book, Wall Street’s War on Workers is full of examples of major corporations engaging in massive stock buybacks before announcing waves of layoffs. Leopold emphasizes that this kind of financialization lies at heart of layoffs — even more so than automation, which tends to dominate contemporary discussions about unemployment.

Meta/Facebook, Alphabet/Google, and Microsoft have announced tens of thousands of layoffs. While many commentators have cited the automation of white-collar work as the culprit, Leopold highlights that in just one quarter of 2022 these firms conducted $28 billion in stock buybacks.

While many on the Left are now aware that stock buybacks are on the rise, we should all strive for a more nuanced understanding of this process and its links to job loss.

Wall Street’s War on Workers Can Be Stopped, jacobin.com, Paul Prescod