– by New Deal democrat The Bonddad Blog About 10 years ago, I went looking for what I called “mid cycle indicators.” In other words, I wanted to go beyond leading or lagging indicators to find at least a few that tend to peak somewhere near the middle of an expansion. That synapse was jangled when I read the title of a recent update by financial analyst Cam Hui, “Relax, it’s just a mid-cycle expansion.” Since I hadn’t looked at the mid-cycle indicators I identified last cycle* during this one, I thought I’d take a look. So here we are. (*incidentally, those peaked in 2014, about 5 years after the expansion’s start, suggesting the next recession would occur in about 2019 or so…Hmmm, I don’t think they foretold a pandemic, but still ….)

Topics:

NewDealdemocrat considers the following as important: Education, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

The Bonddad Blog

About 10 years ago, I went looking for what I called “mid cycle indicators.” In other words, I wanted to go beyond leading or lagging indicators to find at least a few that tend to peak somewhere near the middle of an expansion.

That synapse was jangled when I read the title of a recent update by financial analyst Cam Hui, “Relax, it’s just a mid-cycle expansion.”

Since I hadn’t looked at the mid-cycle indicators I identified last cycle* during this one, I thought I’d take a look. So here we are. (*incidentally, those peaked in 2014, about 5 years after the expansion’s start, suggesting the next recession would occur in about 2019 or so…Hmmm, I don’t think they foretold a pandemic, but still ….)

Anyway, there were 4 such mid-cycle indicators I identified back then, some with more noise than others. They were:

– YoY% jobs growth

– YoY% growth in nominal wages

– YoY% growth in real retail sales vs. real personal consumption expenditures

– a sharp decline in the personal saving rate adjusted for inflation

Let’s take a look at each in turn.

YoY% jobs growth

HIstorically his series has tended to be quite smooth and to peak near the midpoint of economic expansions, except in those cases like the 1980s and 1990s, when the Fed goes through two loosening and tightening cycles:

In this expansion, YoY employment growth peaked in March 2021 (one year after the sudden lockdowns due to the pandemic). It’s pretty clear that is a false positive. But if we look further out, after virtually all laid off employees were recalled to work, YoY payrolls growth peaked in February 2022:

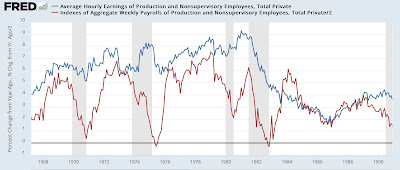

YoY% growth in nominal wages

This indicator (blue in the graphs below) was a lot noisier, and might be thought of more as a long leading indicator, because it often has peaked about 3/4’s of the way through an expansion, but it was useful enough to group with the series. Here’s the historical look:

Because in the past several years I have discovered that real aggregate nonsupervisory payrolls have been an event better indicator, I’ve included their nominal YoY% growth (red) as well.

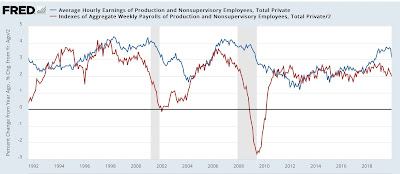

Here’s what the current expansion looks like:

Again, both of these appear to have peaked in early 2022.

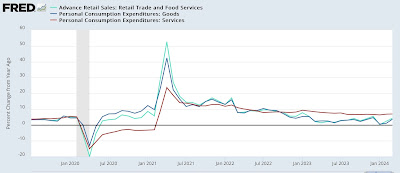

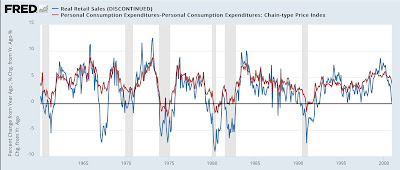

YoY% growth in real retail sales vs. real personal consumption expenditures

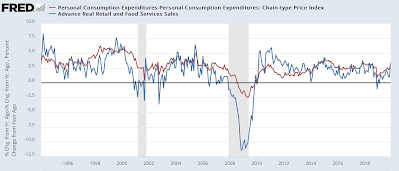

Ten years ago I identified a consistent pattern whereby retail sales grew faster than the broader category of personal consumption expenditures early in an expansion, but slower later in an expansion. Retail sales constitute about 50% of PCE’s and are more volatile, but as the graph below comparing the YoY% growth in the two, they vary in a very specific and non-random way:

Real retail sales are always decelerating, and lower than YoY PCE’s before the economy ever tips into recession. That’s 11 of 11 times in over 50 years. Further, in 10 of those 11 times (1957 being the noteworthy exception), the number was not just negative, but was continuing to decline for a significant period before we tipped into recession.

Essentially these graphs tell us that, in the later part of a business cycle, consumers cut back on discretionary purchases of goods to preserve other recurring spending on services.

Here’s what the current expansion looks like:

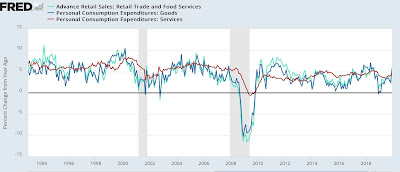

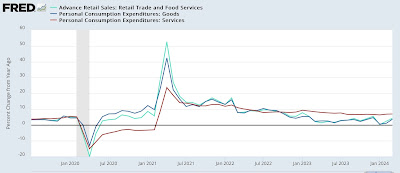

In the past 10 years, I’ve refined my analysis somewhat, because real retail sales and real personal consumption on goods tend to follow nearly identical trajectories. Thus the big difference is spending on goods vs. services. Here’s what that historical graph looks like:

And here is the current expansion:

Once again, the dividing line appears to be in 2022, in this case summer of 2022.

The real personal savings rate

This is essentially a measure of economic confidence. How much of their paychecks do consumers feel they need to save over and above the rate of inflation? This has also been a noisier and less reliable indicator.

Here is the historical look:

Note that in every single economic expansion prior to the last one, except the 1980-81 double-dip, at some point from about the middle to 3/4 mark, there is a steep decline in the real personal savings rate from its peak of about 5%. Further note that in every single recession, the real personal savings rate increases as consumers seek to buttress their balance sheets. Generally speaking, as an economic expansion goes on, consumers expose themselves to too much risk, either due to overconfidence, or the need to stretch their finances to keep up. In the last expansion, there was no clear signal before the pandemic hit.

Here is the current expansion:

There was a big dip in the real savings rate in 2022, followed by a rebound and recently a renewed fade. The point is, that consumers are much more vulnerable to an economic shock now than they were in either 2021 or 2023.

IN CONCLUSION, our mid-cycle indicators seem to be unanimous in picking out 2022 as the most likely midpoint of this expansion. That would suggest that the next recession is probably pretty near at hand.

Given the distortions introduced by fiscal and monetary stimulus to counter the effects of the pandemic, and the clogging and un-kinking of supply lines that took place over 2020-23, all of this has to be treated with several extra helpings of salt.

But there they are.

2018 Midterm election economic forecast: a struggling expansion that may amplify a wave, Angry Bear, by New Deal democrat