I did some rewriting on this particular commentary and added two charts from another commentary (at the bottom). The point being to give graphical depiction of the impact of the Tax Cuts and Jobs Act (TCJA) and who it benefited the most. You can see (for whatever reason) why the Republican Party is pushing for this and taking it from Medicaid. You can also wonder why less wealthy Republicans making far less than the major beneficiaries are not up in arms. The charts are very telling amongst Park’s verbiage. GOP Pushes to Make Trump Tax Cuts Permanent Makes Medicaid Top Target for Draconian Cuts. by Edwin Park Center For Children and Families, Edwin Park has been writing about the many conservative and Congressional Republican plans and

Topics:

Angry Bear considers the following as important: Medicaid, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

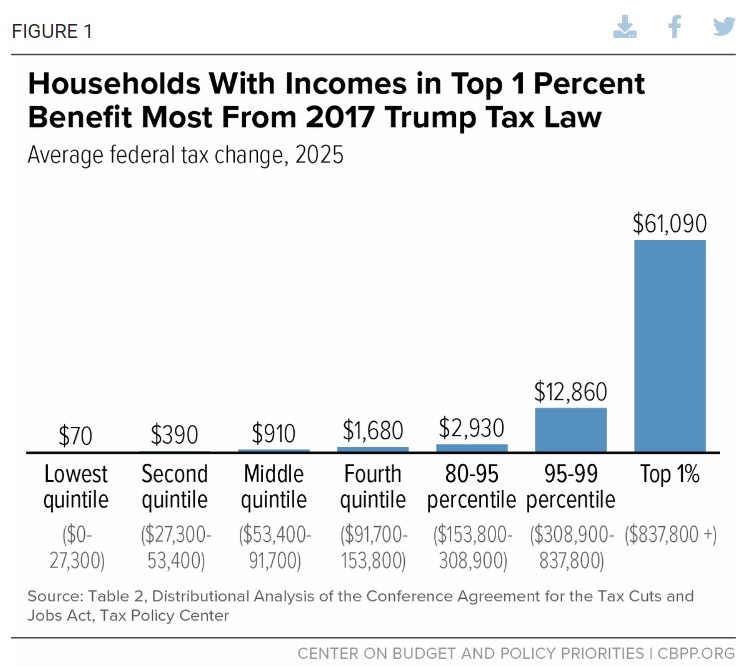

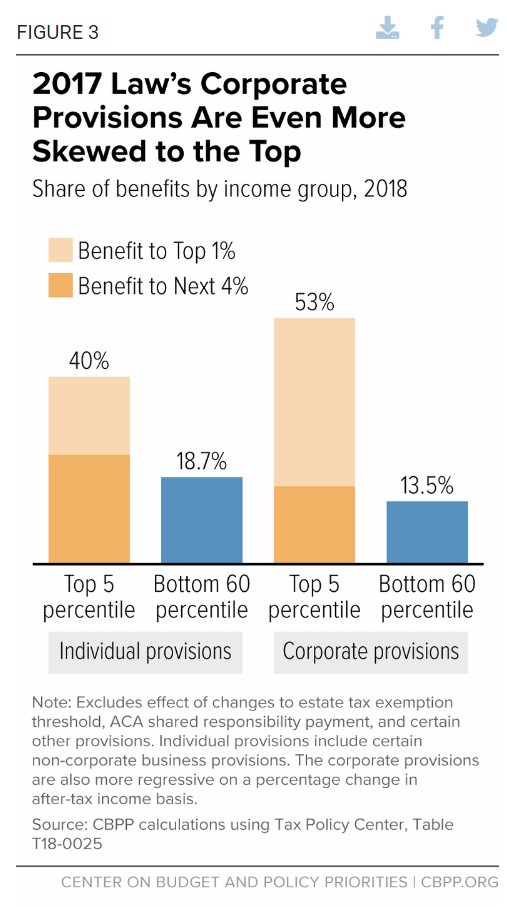

I did some rewriting on this particular commentary and added two charts from another commentary (at the bottom). The point being to give graphical depiction of the impact of the Tax Cuts and Jobs Act (TCJA) and who it benefited the most. You can see (for whatever reason) why the Republican Party is pushing for this and taking it from Medicaid. You can also wonder why less wealthy Republicans making far less than the major beneficiaries are not up in arms. The charts are very telling amongst Park’s verbiage.

GOP Pushes to Make Trump Tax Cuts Permanent Makes Medicaid Top Target for Draconian Cuts.

by Edwin Park

Edwin Park has been writing about the many conservative and Congressional Republican plans and proposals to make draconian cuts to Medicaid. Several prominent plans are targeted in the Project 2025 (Republican Study Committee fiscal year 2025 [RSC] budget) and the fiscal year 2025 House GOP budget. The plan is to cap and deeply cut federal Medicaid funding through block grants and/or per capita caps.

As the author has written, they signal for radically restructuring Medicaid, as well as making other damaging Medicaid cuts, would be a very high priority. That is if there is a second term of the Trump Administration and if Congressional Republicans win majorities in the House and Senate in 2025.

There is another crucial reason why Medicaid would likely be a primary target for draconian cuts next year under that election outcome. The expiration of many of the “Trump tax cuts” enacted by the Tax Cuts and Jobs Act (TCJA) in 2017.

As the Center on Budget and Policy Priorities (CBPP), CEPR, and other organizations will point out, the TCJA cuts were heavily skewed to the high-income households (Figure 1) and corporations, with the top 5 percent of households receiving 40 percent (Figure 3) of the individual tax cuts. Included were more than half of the corporate and other tax cuts in 2018.

While the corporate tax cuts were largely made permanent, the individual income and estate tax cuts were temporary and expire at the end of tax year 2025. Based on Congressional Budget Office (CBO) estimates, both CBPP and the Center for American Progress expect that making the expiring individual and estate tax TCJA tax cuts permanent would cost roughly $4 trillion over the next ten years. Notably, the RSC budget and the House GOP budget resolution, as well as the GOP platform, all propose to make the expiring TCJA tax cuts permanent.

Why is this important for Medicaid? It’s because of the rules related to budget reconciliation. As CBPP explains, budget reconciliation bills are not subject to the filibuster in the Senate and thus have been used to advance major spending and revenue priorities when one party controls both Congress and the White House. For example, during the Trump Administration, reconciliation was used in 2017 for both the failed effort to repeal and replace the Affordable Care Act and for successfully enacting the TCJA. Budget reconciliation can be used to increase the deficit during the budget window, as was the case with the TCJA. But as CBPP states, the “Byrd Rule,” which applies to budget reconciliation, can effectively bar any provision that “raises deficits in any year after the period covered by the reconciliation instructions unless other provisions included in the same title of the bill fully offset those ‘outside-the-window’ costs….” (A Byrd Rule violation raised in a point of order by a Senator can be waived but only with a three-fifths vote.) That is why the corporate tax cuts could be made permanent but not the individual income and estate tax cuts.

To make as much of the expiring TCJA tax cuts permanent as possible without adding to the deficits in future decades — and thus avoid a Byrd Rule violation — would require a reconciliation bill that includes massive mandatory spending cuts that offset the cost of making the Trump tax cuts permanent. Medicaid would clearly be a top target for such spending cuts, even if it is very doubtful that a second term of a Trump Administration would hold to statements that it would not also cut Medicare. This is one crucial reason why the RSC budget would slash Medicaid, CHIP and the Affordable Care Act’s marketplace subsidies by $4.5 trillion over ten years and the House GOP budget resolution would cut Medicaid by $2.2. trillion over the next decade — although as noted above, radically restructuring Medicaid and making other deeply damaging Medicaid cuts is clearly a high priority for conservatives and Congressional GOP leaders in and of itself. As a result, the outcome of this fall’s elections will determine whether Medicaid faces an existential threat in 2025, with the risk significantly magnified by the pending expiration of the TCJA tax cuts at the end of next year.

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises, Center on Budget and Policy Priorities