CNN Tells Us, Young People can’t Afford Homes Even Though more Young People have Homes now than when Trump was in the White House, CEPR, Dean Baker Major media outlets continually push the theme that young people can’t buy homes even though a larger share of households headed by someone under age 35 own homes today than when Donald Trump was in the White House. CNN pushed its entry into the contest for the best “Death of the American Dream” piece last week, with an article headlined “What Broke the American Dream for Millennials.” CNN hoped to get extra credit for this segment about student loan debt burdens: “I think a lot of Millennials were forced into saying, ‘you need a four-year degree in order to be successful,’” says Rachael, who is

Topics:

Angry Bear considers the following as important: Education, housing, Interest rates, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

CNN Tells Us, Young People can’t Afford Homes Even Though more Young People have Homes now than when Trump was in the White House, CEPR, Dean Baker

Major media outlets continually push the theme that young people can’t buy homes even though a larger share of households headed by someone under age 35 own homes today than when Donald Trump was in the White House. CNN pushed its entry into the contest for the best “Death of the American Dream” piece last week, with an article headlined “What Broke the American Dream for Millennials.”

CNN hoped to get extra credit for this segment about student loan debt burdens:

“I think a lot of Millennials were forced into saying, ‘you need a four-year degree in order to be successful,’” says Rachael, who is 33. “At 18, you’re signing up to be $100,000 in debt before you even really know how to make the best decisions for yourself. I think we need to change that narrative.”

This quote was really impressive for two reasons. First, almost no one borrows $100,000 to get a bachelors degree. The average amount borrowed to get four-year degree at a public university was $32,637, so CNN’s authority here is giving readers a number that is more than three times the average.

AB: Dean does not make a differentiation between private and public colleges. Best bet, go public. After a decade, it will make no or little difference once you prove yourself. Dean is right on in interest rate impact.

The other reason the quote is impressive is that they are telling us that “we need to change that narrative” [on student loan debt.] This is impressive because we actually did change the narrative, which CNN’s reporters would know if they had access to government web sites.

Under President Biden’s income-driven repayment plan, a single person earning less than $32,800 a year would pay nothing towards their loan. If their income rose to $40,000, they would pay $60 a month and at $50,000 a year they would pay $143 a month. Many borrowers would have their loans forgiven after being in the program for ten years.

CNN’s competitors for the award include the Washington Post’s entry “Millennials have found a way to buy houses: Living with mom and dad,” the New York Times entry “American Dream Deferred: Why Housing Prices May Pose a Problem for Biden,” as well as two earlier entries from the NYT: ‘It’s Never Our Time’: First-Time Home Buyers Face a Brutal Market,” and “Older, White and Wealthy Home Buyers Are Pushing Others Out of the Market.”

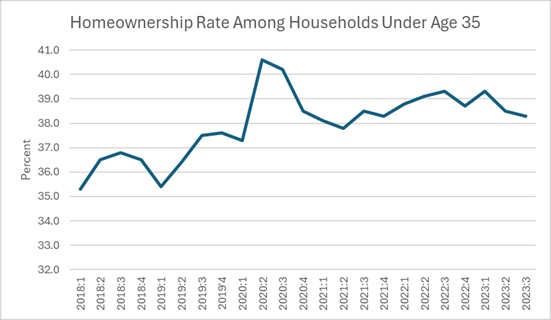

For those interested in the realities of the housing market, homeownership rates for people under age 35 are actually above their pre-pandemic level as shown below.

Source: Census Bureau, Table 6

Homeownership rates are also higher for Blacks, Hispanics, and households with less than the median income. But you would have to have access to the Census Bureau’s website to have this information.

To be clear, if interest rates stay high, the homeownership rate for the young and other disadvantaged groups is likely to fall, but few are expecting that we will continue to see high mortgage rates.

What broke the American Dream for Millennials, CNN Business, Allison Morrow