– by New Deal democrat The effects of Hurricane Beryl had just enough of an effect on home building in July to cause me not to hoist a yellow recession caution flag in this important leading sector. While the hurricane had no significant effect on permits, it likely did have an effect on starts and on units under construction, as I’ll go into further below. Let’s start with the overall view. Starts (blue in the graph below), which are noisier and slightly lag permits, declined -6.8% in July, while total permits (gold) declined -4.0%. by contrast, the least noisy, most leading single family permits (red, right scale) declined a mere -0.1%: Comparing single family with multi family permits, the former as above declined -1,000, while the

Topics:

NewDealdemocrat considers the following as important: climate change, housing construction, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

The effects of Hurricane Beryl had just enough of an effect on home building in July to cause me not to hoist a yellow recession caution flag in this important leading sector. While the hurricane had no significant effect on permits, it likely did have an effect on starts and on units under construction, as I’ll go into further below.

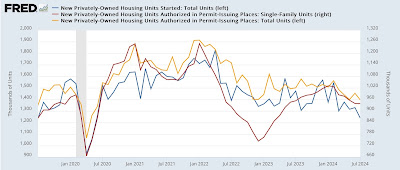

Let’s start with the overall view. Starts (blue in the graph below), which are noisier and slightly lag permits, declined -6.8% in July, while total permits (gold) declined -4.0%. by contrast, the least noisy, most leading single family permits (red, right scale) declined a mere -0.1%:

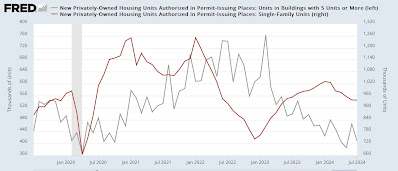

Comparing single family with multi family permits, the former as above declined -1,000, while the latter (gray), which is much noisier, declined -58,000:

Still, multi-family permits show signs of stabilization, as the current reading is higher than both April’s and May’s, and the three-month average rose very slightly (+333 units).

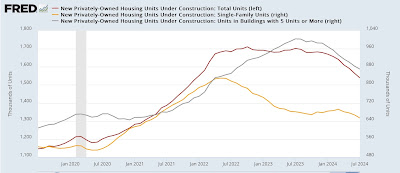

But units under construction is the measure of real economic activity in this sector. While it is not so leading as permits and starts, it has always turned down, typically by more than -10% (often -30% or more) before a recession begins. I’ll spare you the long-term graph this month, but here is the graph of the last five years comparing total permits (blue, right scale) with housing units under construction (red):

There had been a long time after single family construction turned down while multi-unit construction continued to increase and then plateaued. But this year both have declined:

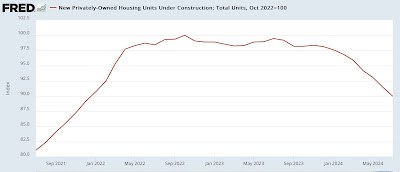

Indeed, the total decline in housing units under construction this month surpassed the -10% cutoff level necessary for a yellow caution flag as to recession, as they are now down -10.1%:

But as I wrote at the outset, Hurricane Beryl apparently did affect these numbers. We can estimate its impact by deducting the number of permits, starts, and units under construction in the South Census Region from the nationwide total. Here’s what we get when we do so. In the chart below, the first number is the nation total as above, and the number in parentheses is the number excluding the South Census Region:

Permits: -4.0%. (-3.7%)

Starts: -6.8%. (+1.7%)

Under construction: -1.6%. (-1.0%)

While Beryl likely had little effect on permits, it most likely did have a sizeable impact on housing starts and also to some extent units under construction.

Had housing units under construction declined only -1.0% instead of -1.6% for the month, the total decline from peak would have been -9.5% rather than -10.1%.

In other words, except for Beryl, there is a very good chance that the -10% threshold would not have been crossed.

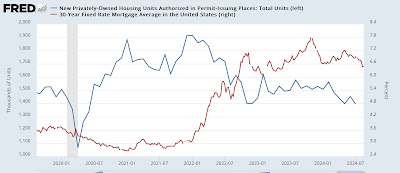

Further, because mortgage rates in the last two weeks have been at 12-month lows, and close to their lowest levels in two years:

We can expect permits to rise in the next several months, followed by starts.

That the most leading metric, single family permits, as well as multi-family permits, appear to be stabilizing, plus the likely effect of lower mortgage rates, plus the probable effect of Beryl on units under construction, together cause me to believe that raising the yellow caution flag for housing would be premature based on this month’s report. It’s very close, but I don’t think we’ve crossed the threshold yet, and there are still good reasons to believe we may not cross it at all.

The Bonddad Blog

Housing permits and starts stabilizing, but construction? Angry Bear, by New Deal democrat