The bottoming process in existing home sales continues, as YoY price comparisons increase – by New Deal democrat The bifurcation of the housing market between new and existing home components continues, as existing home sales continue near their bottom, but with a little improvement. Specifically, in January sales increased 120,000 on an annualized basis from an upwardly revised (by 80,000) 3.88 million to 4.00 million. This is the seventh month in a row that the annualized rate has varied between 3.85 million and 4.11 million: Because of the low inventory, the non-seasonally adjusted median price for an existing home increased to up 5.1% YoY, the highest YoY comparison since 2022: The YoY improvement is consistent with what we

Topics:

NewDealdemocrat considers the following as important: existing home sales, Hot Topics, January 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

The bottoming process in existing home sales continues, as YoY price comparisons increase

– by New Deal democrat

The bifurcation of the housing market between new and existing home components continues, as existing home sales continue near their bottom, but with a little improvement.

Specifically, in January sales increased 120,000 on an annualized basis from an upwardly revised (by 80,000) 3.88 million to 4.00 million. This is the seventh month in a row that the annualized rate has varied between 3.85 million and 4.11 million:

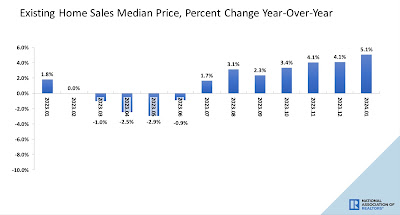

Because of the low inventory, the non-seasonally adjusted median price for an existing home increased to up 5.1% YoY, the highest YoY comparison since 2022:

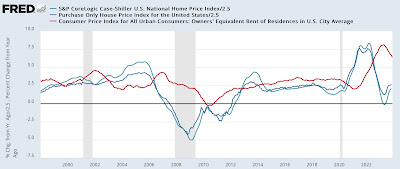

The YoY improvement is consistent with what we have recently seen in the FHFA and Case Shiller repeat sales house price indexes:

It is also consistent with the slight improvement (to “less negative”) in the YoY comparisons in new apartment leases, as reported in the National Rent Index earlier this week:

The monthly non-seasonally adjustment in rentals better shows the bottoming process there:

Because of the all-time high in new apartment and condo completions, there has been more downward pressure on rents than on single family houses. The present situation remains that very few people are interested in trading in 3% mortgages for 7% mortgages, so existing home sales are somewhat frozen, while developers can adjust the footprint, amenities, mortgage rebates, and prices in new houses to generate more demand.

Briefly noted: existing home sales appear to be bottoming near 30 year lows as prices continue to firm, Angry Bear, by New Deal democrat