– by New Deal democrat The Bonddad Blog [NOTE: After traveling all day yesterday, I decided to put off any comments on the CPI upside surprise until later today. Short version is that shelter continues its slow decent, gasoline picked up, and services are accelerating as one might expect in a strong economy with the supply chain tailwind having dissipated.] Initial claims continued to be rangebound this week, declining -11,000 to 211,000. The four week moving average declined -250 to 214,250. With the usual one week delay, continuing claims increased 28,000 to 1.817 million: On the YoY% basis more important for forecasting purposes, weekly claims were down -4.1%, the four week average down -4.4%, and continuing claims up from last

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

[NOTE: After traveling all day yesterday, I decided to put off any comments on the CPI upside surprise until later today. Short version is that shelter continues its slow decent, gasoline picked up, and services are accelerating as one might expect in a strong economy with the supply chain tailwind having dissipated.]

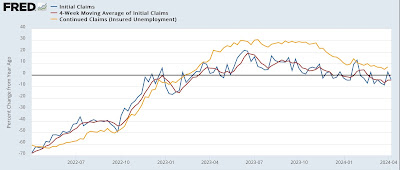

Initial claims continued to be rangebound this week, declining -11,000 to 211,000. The four week moving average declined -250 to 214,250. With the usual one week delay, continuing claims increased 28,000 to 1.817 million:

On the YoY% basis more important for forecasting purposes, weekly claims were down -4.1%, the four week average down -4.4%, and continuing claims up from last week’s 12 month low to 7.1%:

While continuing claims are a negative, they are much less so than they were during the last nine months of 2023. The more leading initial claims remain firmly positive.

One week of data doesn’t give me enough information to make it worth updating the Sahm rule forecast, but here is the YoY% comparison through the end of March:

For the month, initial claims were down -5.9% YoY, while the unemployment rate was up 5.6% (note this is a ‘percent of a percent’). Because the YoY comparisons in both initial and continuing claims have improved since late last year, I expect the YoY comparison in the unemployment rate to follow suit, meaning a slight decline in that rate is more likely than a return to its recent peak of 3.9%.

“Initial claims remain somnolent, while continuing claims pop slightly,” Angry Bear, by New Deal democrat