Core capital goods orders, three month average of manufacturers’ new orders both make new all-time highs – by New Deal democrat Before I update this morning’s personal income and spending data, I wanted to briefly note some significant news in yesterday’s report on manufacturers new orders. (I’ll discuss the important leading metrics from the GDP report next week.) New orders are one of the long-time components of the index of leading indicators. Typically (but not always!) they peak 3 to 9 months before a recession: Because they are noisy, I usually don’t pay a lot of attention. But yesterday was significant, because the manufacturing sector of the economy has been flat to mildly recessionary for over a year. For example (not

Topics:

NewDealdemocrat considers the following as important: core capital goods, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Core capital goods orders, three month average of manufacturers’ new orders both make new all-time highs

– by New Deal democrat

Before I update this morning’s personal income and spending data, I wanted to briefly note some significant news in yesterday’s report on manufacturers new orders. (I’ll discuss the important leading metrics from the GDP report next week.)

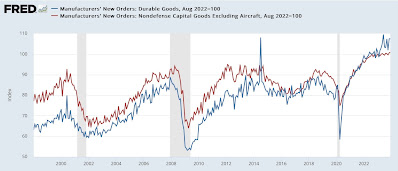

New orders are one of the long-time components of the index of leading indicators. Typically (but not always!) they peak 3 to 9 months before a recession:

Because they are noisy, I usually don’t pay a lot of attention.

But yesterday was significant, because the manufacturing sector of the economy has been flat to mildly recessionary for over a year. For example (not shown), industrial production has not made a new high in 16 months, and the ISM manufacturing index has shown contraction for over a year as well.

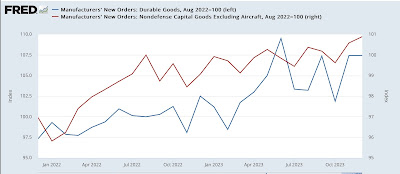

But yesterday core capital goods orders (red in the graph below) made a new all-time high. Total new orders were flat for the month, but were one of the three highest readings ever, and the three-month average (not shown) also made a new all-time high:

One of the big issues for this year is whether, with the resolution of supply chain disruptions in the rear-view mirror, the effects of higher interest rates for the past 2 years finally bite manufacturing, construction, and general goods consumption at the same time. Yesterday’s report on new orders suggests that the impact on manufacturing may be abating. If so, this is very good news.

Durable goods orders: more deceleration, still no recession, Angry Bear by New Deal democrat