May CPI continued to be all about shelter – by New Deal democrat Consumer prices in May showed no inflation at all, as a decline in gas prices helped the headline number come in unchanged. YoY inflation decelerated -0.1% to 3.3% – continuing in the narrow 3.0%-3.4% range it has been in for the last year. The bottom line remains that almost the entire inflation “problem” is with shelter, which increased 0.4% again, while the YoY rate continued its snail pace of deceleration, down -0.1% to 5.4% – still the lowest increase in 2 years. For the record, here is the month over month change in headline inflation (blue) vs. “core” inflation less food and energy: More importantly, all items except shelter were unchanged for the month, and

Topics:

NewDealdemocrat considers the following as important: Home Sales, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

May CPI continued to be all about shelter

– by New Deal democrat

Consumer prices in May showed no inflation at all, as a decline in gas prices helped the headline number come in unchanged. YoY inflation decelerated -0.1% to 3.3% – continuing in the narrow 3.0%-3.4% range it has been in for the last year.

The bottom line remains that almost the entire inflation “problem” is with shelter, which increased 0.4% again, while the YoY rate continued its snail pace of deceleration, down -0.1% to 5.4% – still the lowest increase in 2 years.

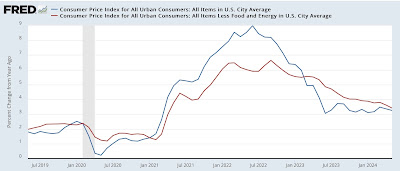

For the record, here is the month over month change in headline inflation (blue) vs. “core” inflation less food and energy:

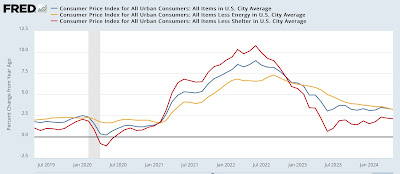

More importantly, all items except shelter were unchanged for the month, and are only up 2.1% YoY – the 13th month in a row they have been up less than 2.5% YoY. Meanwhile, with the -2.0% decline in energy costs in May, CPI less energy was up less than 0.2% for the month – the lowest increase in over 3 years – and up 3.2% YoY:

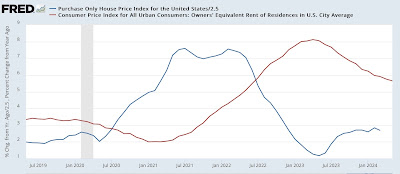

Focusing on shelter, it has continued to behave as I expected. Here is an update to the 12-18 month leading relationship between house prices (as measured by the FHFA) and Owners’ Equivalent Rent in the CPI:

House prices are currently increasing a little higher than their average pre-pandemic rate (because, ironically, the Fed’s rate hikes have exacerbated a shortage in housing supply, thereby driving up its price), which has translated to OER and the other measures of shelter inflation to continue to decelerate YoY, but at a much slower pace than their initial rapid decline. I expect this trend to continue in the coming months.

Turning to our recent and former problem children; first, although I won’t bother with a graph, new and used vehicle prices continued to indicate that they have reached a new equilibrium. Used car prices rose 0.6% in May, but have declined -9.3%YoY. New car prices declined -0.5% in May, and are down -0.8% YoY.

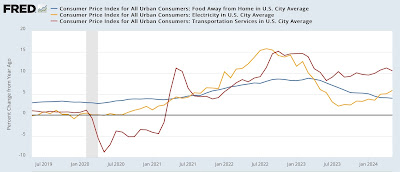

Here’s what happened with the remaining problem areas of inflation:

(1) food away from home (fading), which peaked at 8.8% YoY over one year ago, increased 0.4% in May, but decelerated -0.1% ona YoY basis to a 4.0% increase, gradually getting closer to its pre-pandemic average of 2.5%-3.0%;

(2) electricity, which has followed gas prices higher, was unchanged for the month, but has risen from 2.2% YoY last August to an 11 month high of 5.9% in May; and

(3) transportation services – mainly car repairs (up 0.3% for the month, but down from 7.6% YoY in April to 7.2%) and insurance (down -0.1% for the month and up 20.3% YoY – still down from last month’s 22.6% YoY gain) – declined -0.5% for the month. It had rocketed from its pre-pandemic range of 2.5%-5.0% to as high as 15.2% in October 2022, and is now still up 10.5% YoY, a -0.7% deceleration from April.

Based on the past inflationary period of 1966-82, it is clear that transportation services lags increases in vehicle prices by 1-2 years and even more, sometimes increasing right through recessions

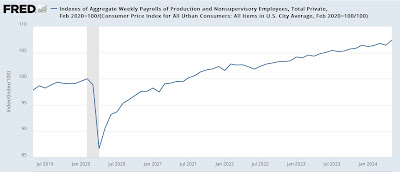

Finally, the CPI report enables us to update real aggregate nonsupervisory payrolls. Last Friday we saw that nominally they rose 0.9%, which with today’s unchanged prices, is their “real” gain as well:

This made a new high, showing that average American working families had significantly more to spend in May, and negativing any recession for the next few months.

To summarize: if we exclude the well-documented historically lagging sectors of shelter prices (and motor vehicle insurance), consumer inflation continues to be well behaved, up only 2.1% YoY. If gas prices continue to be well-behaved, headline inflation should go below 3%

The Bonddad Blog

Repeat home sales indexes renew favorable YoY comparisons, suggest slow deceleration in shelter CPI to continue, Angry Bear by New Deal democrat